Solana ETFs Spur Inflows as Bitcoin, Ether Funds Outflow

Solana ETFs are gaining traction in the crypto investment landscape, showing strong momentum as Bitcoin and Ether funds face notable outflows. The surge in Solana-based exchange-traded funds reflects a shift in investor sentiment, with capital rotating toward alternative assets offering fresh narratives and potential yields.

According to data from SoSoValue, Solana ETFs recorded an inflow of about 44.48 million dollars on Friday, their fourth consecutive day of gains. This brought cumulative inflows to around 199.2 million dollars, while total assets under management reached approximately 502 million dollars. The performance of these products has caught market attention as other leading crypto funds experience a pullback.

In contrast, Bitcoin spot ETFs recorded outflows of roughly 191.6 million dollars on the same day, while Ether spot ETFs saw around 98.2 million dollars leave the market. The pattern of inflows into Solana products alongside outflows from Bitcoin and Ether suggests that investors may be reallocating capital rather than withdrawing entirely from crypto exposure.

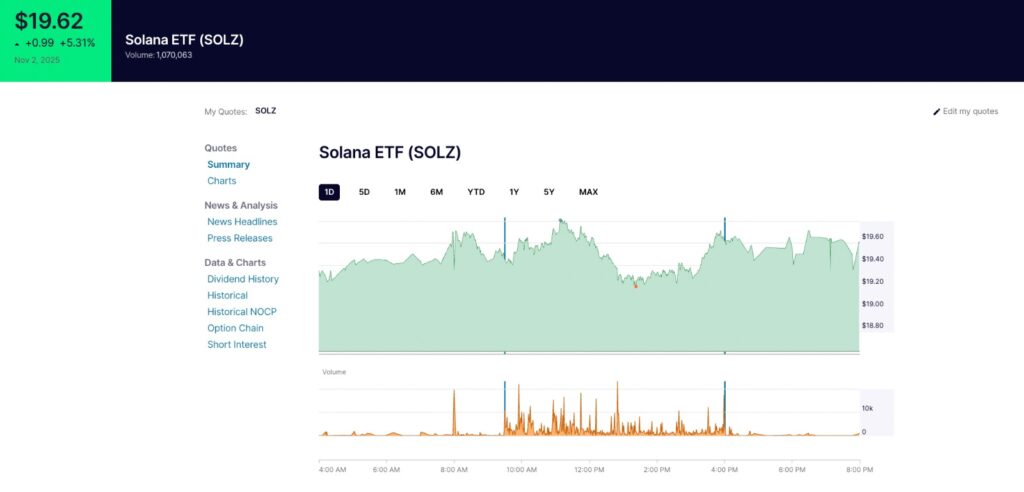

As shown in the latest Nasdaq data, the Solana ETF (SOLZ) closed at $19.62 on November 2, 2025, marking a 5.31% increase for the day with a trading volume of 1,070,063 shares. The intraday chart indicates steady upward momentum through most of the trading session, reflecting continued investor confidence in Solana-based funds. This price movement aligns with the broader inflow trend seen across Solana ETFs, reinforcing their growing position in the digital asset investment market.

Why the shift toward Solana ETFs? Analysts point to several driving forces.

First, new opportunities for yield generation within Solana’s ecosystem are attracting capital. Solana allows staking, which can offer investors additional returns beyond price appreciation. In an environment where risk appetite remains moderate, yield potential becomes an appealing factor. Vincent Liu, Chief Investment Officer at Kronos Research, noted that Solana ETFs are benefiting from “fresh catalysts and capital rotation, as Bitcoin and Ether experience profit-taking after strong rallies.”

Second, the introduction of new products has provided institutional investors with more ways to gain exposure to Solana. The Bitwise Solana Staking ETF (ticker BSOL) recently launched with assets exceeding 222.8 million dollars. This product includes an estimated staking yield of about 7 percent, making it one of the most attractive yield-bearing ETF options in the crypto sector.

Beyond the United States, regulatory and market developments in regions like Hong Kong have added momentum. Hong Kong recently approved its first spot Solana ETF, expanding institutional access and global visibility for the asset. These developments have strengthened investor confidence that Solana can secure a place alongside Bitcoin and Ether in institutional portfolios.

Comparing Solana ETFs to Bitcoin and Ether funds helps clarify the market rotation. Solana products have maintained four consecutive days of net inflows, while Bitcoin and Ether funds have faced a string of outflows. For example, Bitcoin spot ETFs saw nearly 488 million dollars in outflows on Thursday and around 470 million on Wednesday. Ether spot ETFs also recorded 184 million and 81 million dollars in outflows on the same days.

However, Ether ETFs still hold cumulative inflows of over 14.3 billion dollars, showing that while there is short-term rebalancing, long-term investor positioning remains strong for major assets. The current flows simply highlight that some investors are diversifying their crypto exposure.

This rotation toward Solana ETFs may signal a temporary reallocation rather than a permanent shift. Market observers suggest that investors are seeking diversification while locking in profits from Bitcoin and Ether after strong price runs earlier in the quarter.

For the broader crypto market, this trend has several implications. It demonstrates that the rise of new blockchain ecosystems can attract institutional participation, especially when supported by liquid and regulated investment vehicles like ETFs. It also highlights how investor behavior in crypto increasingly mirrors that of traditional finance, where capital rotates among sectors based on performance and opportunity.

The continued inflows into Solana ETFs suggest growing confidence in the network’s fundamentals. Solana’s fast transaction speeds, low costs, and expanding decentralized finance and NFT ecosystems have strengthened its narrative as a strong alternative layer-one blockchain.

Still, analysts warn that this enthusiasm should be tempered with caution. Macro factors such as inflation data, interest rate changes, and risk sentiment could reverse the current pattern quickly. If markets experience higher volatility or a shift toward risk aversion, funds may flow back into Bitcoin and Ether ETFs, which are viewed as safer large-cap assets within the crypto space.

Vincent Liu commented that Solana’s momentum could extend into the coming week “as long as the majors consolidate and macro conditions remain stable.” However, he added that any surge in volatility could lead to rapid capital rotation once again.

Looking ahead, several indicators will determine whether this trend holds. First, the persistence of net inflows into Solana ETFs will show if the move represents a genuine shift or a short-term trade. Second, Bitcoin and Ether ETF flow data will indicate whether investors are simply rebalancing or fundamentally changing allocation strategies. Third, performance within the Solana ecosystem, including staking rewards, developer activity, and network reliability, will shape long-term sentiment.

If the inflows continue, Solana could secure a growing share of total crypto ETF assets, signaling that investors are willing to explore new blockchain opportunities beyond the top two cryptocurrencies. The approval and success of Solana-based ETFs also encourage further diversification within the crypto ETF landscape, paving the way for future funds tied to other ecosystems.

In summary, Solana ETFs have quickly become one of the most discussed topics in digital-asset investment circles. With over 199 million dollars in cumulative inflows and more than 502 million in total assets, these products are showing that investor demand for alternatives is real. Bitcoin and Ether ETFs, while still dominant, are currently experiencing outflows as capital rotates.

Whether this trend continues will depend on market stability, yield sustainability, and investor appetite for risk. For now, the spotlight clearly belongs to Solana ETFs, which are enjoying their strongest wave of institutional inflows yet while traditional crypto heavyweights take a brief pause.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe