Crypto ETFs Gain Ground with Bond Investors

Crypto ETFs are fast becoming a core part of investor portfolios, according to a new survey from Charles Schwab Corporation. The firm’s latest “ETFs and Beyond” report shows that investor interest in crypto exchange-traded funds (ETFs) has grown so strongly that it now matches the level of interest in bond ETFs. This marks a significant milestone in how investors view digital assets within traditional finance.

Rising investor demand for Crypto ETFs

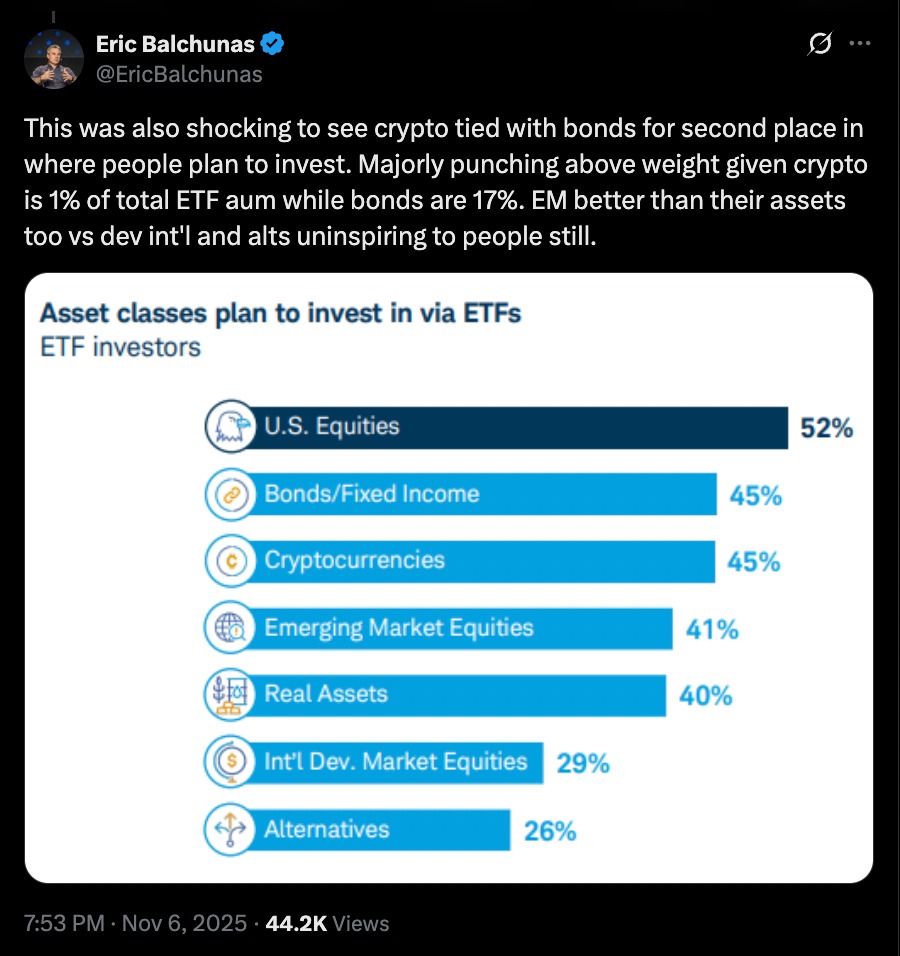

The Schwab report surveyed 2,000 U.S. investors between the ages of 25 and 75, each with at least $25,000 in investable assets. The results revealed that 45 percent of respondents plan to invest in crypto ETFs. The same percentage said they plan to invest in U.S. bond ETFs, putting both asset types on equal footing.

In comparison, 52 percent of investors said they plan to buy U.S. equity ETFs, meaning that stocks remain slightly ahead but not by much. The finding that crypto ETFs now stand level with bond ETFs in investor intentions is striking. Bonds account for around 17 percent of total ETF assets under management, while crypto ETFs make up only about 1 percent. Despite this large difference in market size, investor enthusiasm for crypto exposure continues to grow rapidly.

Industry analysts echoed these findings on social media. Bloomberg ETF analyst Eric Balchunas highlighted on X (formerly Twitter) that it was “shocking to see crypto tied with bonds for second place” among investment plans. He noted that while cryptocurrencies represent only about 1% of total ETF assets under management compared with 17% for bonds, investor enthusiasm shows crypto is “punching above its weight.” The accompanying chart from Schwab’s survey illustrates how 45% of respondents plan to invest in both bonds and crypto ETFs, compared with 52% in U.S. equities, confirming that digital assets have entered the mainstream investment conversation.

Why investors are turning to Crypto ETFs

Accessibility and cost advantages

One reason behind the growing appeal of crypto ETFs is accessibility. For many individuals, buying cryptocurrency directly can be complicated and risky, involving private wallets, exchanges, and security concerns. A crypto ETF allows investors to gain exposure to digital assets through a traditional, regulated vehicle without needing to manage crypto directly.

Schwab’s data shows that 94 percent of respondents view ETFs as a low-cost way to invest. Nearly half said ETFs allow them to explore specialized asset classes or strategies that go beyond their main portfolios. In this sense, crypto ETFs open doors to a new asset category that was once difficult for ordinary investors to reach.

The generational divide in crypto investing

The Schwab survey also revealed clear differences between generations. Millennials, those born between 1981 and 1996, lead the charge, with 57 percent planning to invest in crypto ETFs. Gen X investors, born between 1965 and 1980, came next at 41 percent, while only 15 percent of Baby Boomers (born 1946–1964) showed interest.

This generational pattern makes sense. Younger investors tend to be more comfortable with technology and digital finance. They are also more open to taking higher risks in exchange for potential long-term growth. Older investors, by contrast, often prefer stability and predictable income, which bonds traditionally provide.

What the data means for portfolios

A new mix of assets

The fact that Crypto ETFs are now as popular as bond ETFs in investor planning could signal a shift in how portfolios are built. Traditionally, portfolios were divided between stocks and bonds for balance. Now, crypto ETFs may emerge as a third pillar for diversification.

While only a small share of total ETF assets currently sits in crypto products, investor intentions suggest that this could change over the coming years. As more crypto ETFs launch and the market matures, allocations could gradually rise.

The importance of risk awareness

Even as interest grows, the Schwab report highlights that risk remains a key concern. Crypto assets are still known for volatility and regulatory uncertainty. A crypto ETF might trade on a regulated exchange, but its value ultimately depends on an asset class that can fluctuate dramatically.

Investors and advisors therefore need to consider crypto ETFs as part of an overall diversified portfolio, not as a replacement for traditional holdings. They should also pay attention to product structure, whether the ETF holds actual cryptocurrencies, futures, or related equities, since these can affect risk and return differently.

The role of advisors and education

The report suggests that financial advisors may soon face more questions from clients about how to integrate crypto ETFs into portfolios. For advisors, this creates both opportunities and responsibilities. On one hand, it allows them to meet rising demand for digital-asset exposure. On the other, it requires them to educate clients about volatility, liquidity, and tax implications.

As more advisors become familiar with the space, crypto ETFs could shift from being niche options to standard offerings. Still, Schwab emphasizes that investors should be cautious, informed, and clear about their risk tolerance before committing capital.

Broader market implications

Mainstream adoption of digital assets

The growing interest in crypto ETFs reflects the broader trend of digital assets entering mainstream finance. The approval of several spot Bitcoin ETFs earlier this year opened the door for regulated exposure to the largest cryptocurrency. Many experts believe Ethereum and other blockchain-based ETFs could follow, further legitimizing the sector.

If current trends continue, crypto ETFs could become a common feature in both retail and institutional portfolios. This would not only diversify investment options but also increase transparency and oversight within the digital-asset ecosystem.

The future outlook for Crypto ETFs

While the total assets in crypto ETFs are still small, their growth potential is significant. Investor interest, especially among younger generations, points toward continued expansion. As regulatory clarity improves and more products launch, the share of ETF assets tied to crypto could increase substantially.

For now, the Schwab report shows that investor sentiment has clearly shifted. Crypto ETFs are no longer viewed as experimental products but as legitimate investment tools. Their equal footing with bonds in investor interest marks a major milestone for both the ETF industry and the digital-asset market.

Conclusion

Crypto ETFs are emerging as a bridge between traditional finance and the world of digital assets. The Schwab “ETFs and Beyond” report demonstrates that they have reached the same level of planned investment as bond ETFs, underscoring their growing role in modern portfolios.

As investors seek new ways to diversify, the appeal of crypto ETFs will likely continue to expand. Yet caution and education remain crucial. Understanding the risks and potential rewards will be key as more people explore the intersection of traditional and digital finance.

For advisors, fund managers, and retail investors alike, one message stands out: crypto ETFs are here to stay, and their rise marks a turning point in how investors build wealth in the twenty-first century.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL