Bitcoin Supporters Boycott Targets JP Morgan

Bitcoin Supporters Boycott momentum has grown rapidly as the cryptocurrency community, along with supporters of the Bitcoin treasury firm Strategy, continues to react to what many see as a direct threat to crypto-focused companies. JP Morgan has become the central target of this backlash after sharing research about potential index changes that could significantly impact publicly traded firms holding large amounts of digital assets.

Why the Bitcoin Supporters Boycott Emerged

The controversy began when it became known that MSCI, a major global index provider, is preparing to exclude crypto treasury companies from its indexes starting in January 2026. MSCI sets the standards for which companies qualify for inclusion in various market indexes, and any change in its criteria can carry enormous financial consequences.

The situation intensified when JP Morgan circulated a research note highlighting MSCI’s intentions. This move was perceived by many in the Bitcoin community as the bank amplifying or supporting a policy shift that would disadvantage companies holding substantial crypto assets. The Bitcoin Supporters Boycott quickly gained traction as anger spread among investors, analysts, and crypto advocates who argued that the change could create far-reaching ripple effects throughout the market.

Real estate investor and prominent Bitcoin supporter Grant Cardone publicly voiced his frustration, claiming he pulled $20 million from JP Morgan’s Chase division and was pursuing legal action over what he described as credit card malfeasance. His response fueled the growing dissatisfaction and added momentum to the boycott movement.

Bitcoin advocate Max Keiser also issued a rallying call, encouraging supporters to “Crash JP Morgan and buy Strategy and BTC.” His message resonated with a wide portion of the crypto community that saw the index changes as an attack on companies embracing Bitcoin as part of their corporate treasury strategies.

How the Bitcoin Supporters Boycott Connects to Strategy

A major focus of the debate is Strategy, a Bitcoin treasury company that entered the Nasdaq 100 in December 2024. This inclusion allowed Strategy to benefit from passive capital inflows, since many institutional funds and investment vehicles are required to buy shares from companies listed in large-cap indexes. Being in the Nasdaq 100 boosted Strategy’s visibility, liquidity, and investor inflow.

However, MSCI’s proposed changes threaten this position. Under the new criteria, any treasury company holding 50 percent or more of its balance sheet in cryptocurrency would no longer qualify for index inclusion. For a company like Strategy, which is widely known for its heavy Bitcoin holdings, this would mean losing its index status and the passive fund flows associated with it.

Michael Saylor, the founder of Strategy, broke his silence shortly after the proposed changes surfaced. He clarified that Strategy is “not a fund, not a trust, and not a holding company.” Instead, he described the firm as a “Bitcoin-backed structured finance company.” According to Saylor, funds and trusts merely hold assets, while holding companies maintain investments. Strategy, he argued, actively creates, structures, issues, and operates financial products based on Bitcoin, making its business model fundamentally different.

These remarks formed part of a wider effort by Saylor and the Bitcoin community to push back against the idea that Strategy should be treated like a passive holding entity under index classification rules.

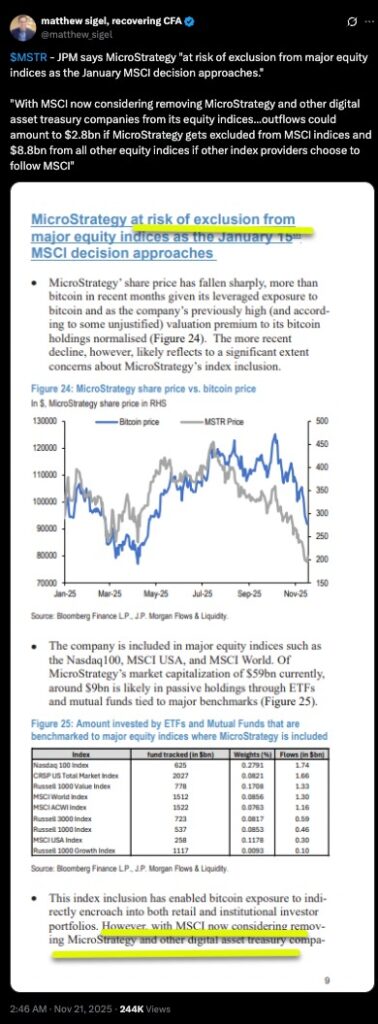

The tweet highlights how seriously market analysts are taking MSCI’s upcoming decision. The JP Morgan research note warns that MicroStrategy and other digital-asset treasury companies could face billions of dollars in potential outflows if they are removed from major equity indexes. The chart and data included in the note further illustrate how closely MicroStrategy’s share performance has tracked Bitcoin, reinforcing the concern that index exclusion may trigger significant selling pressure across both equities and crypto markets.

The Consequences Behind the Bitcoin Supporters Boycott

One of the most significant concerns surrounding MSCI’s proposed rule is the potential for broad market disruption. If crypto treasury companies are removed from indexes, asset managers and funds that track those indexes may be required to automatically sell their shares. Index-tracked funds typically have mandates that require exposure to only those companies inside approved indexes. A forced sell-off could cause a sharp decline in the share price of companies like Strategy.

This process could also spill over into the broader digital asset market. If major treasury companies were compelled to reduce their crypto holdings to stay below the threshold, or if they sold assets to offset market impacts, analysts warn that the resulting pressure could drive crypto prices downward. The Bitcoin Supporters Boycott underscores the fear that traditional financial systems could unintentionally or deliberately influence Bitcoin markets through index-based mechanisms.

Bitcoin Supporters Boycott and JP Morgan’s Role

JP Morgan’s involvement in distributing the research note placing attention on the MSCI changes positioned the bank at the center of the controversy. Many Bitcoin supporters believe the bank has a long-standing adversarial stance toward the cryptocurrency industry, and the release of the research note intensified those concerns. As a result, JP Morgan became a symbolic target for the boycott movement, regardless of whether the bank had any direct involvement in MSCI’s decision-making process.

Critics argue that traditional financial institutions may feel threatened by the rising prominence of Bitcoin and companies that embrace it as a core asset. Because of this perception, the Bitcoin Supporters Boycott portrays JP Morgan as part of a broader legacy financial system that stands in opposition to the growth of Bitcoin-centered corporations.

What the Bitcoin Supporters Boycott Suggests About the Future

The reaction to MSCI’s proposed changes highlights a fundamental tension between centralized financial governance and decentralized digital asset strategies. Treasury companies that rely heavily on Bitcoin may increasingly find themselves navigating a regulatory and structural environment built around traditional assets rather than digital ones.

If the changes take effect in 2026 as expected, affected companies may need to make a crucial choice: reduce their crypto exposure to meet index requirements, or accept exclusion and the loss of passive capital flows. Either option carries major implications for corporate strategy, investor behavior, and the overall structure of digital asset markets.

The Bitcoin Supporters Boycott represents more than just frustration with one bank. It signals a growing awareness of how traditional financial rules can impact companies that choose Bitcoin as a core treasury asset. As support for the boycott continues, discussions about fairness, innovation, and financial autonomy are likely to intensify.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe