Bitcoin Tether Risk Signals USDT Stability Concerns

Bitcoin Tether Risk has become a major discussion point after Arthur Hayes issued a stark warning about Tether’s growing exposure to volatile assets. His comments surfaced shortly after S&P Global Ratings downgraded USDT’s stability assessment, citing the company’s shifting reserve structure. With Tether now holding more Bitcoin and gold than ever before, analysts across the crypto landscape are reexamining whether the world’s largest stablecoin is as secure as it appears. The debate has intensified, highlighting the tension between Tether’s growing profits and the potential risks of depending on highly volatile reserves.

Understanding the Bitcoin Tether Risk After S&P’s Downgrade

Why the S&P Report Triggered Concern

S&P Global Ratings assigned USDT a negative “weak” rating, noting that Tether’s increased exposure to Bitcoin and gold elevates the risk profile of the stablecoin. Unlike traditional cash and cash-equivalent assets, Bitcoin and gold can swing sharply in value, which means that a sudden downturn could strain Tether’s ability to maintain full backing for USDT. This shift raised immediate red flags for many observers who view stablecoins as assets that should rely on the safest and most liquid reserves available.

Hayes’s Warning About a 30 Percent Drop

In response to the rating, former BitMEX CEO Arthur Hayes explained why Tether’s strategy introduces significant downside exposure. He argued that the company is attempting to front-run the potential rally that usually follows Federal Reserve interest rate cuts. In his view, Tether is effectively betting that Bitcoin and gold will rise in value once monetary conditions loosen. However, Hayes cautioned that this strategy could backfire. According to him, a drop of roughly 30 percent in the combined value of Tether’s Bitcoin and gold reserves would be enough to erase the company’s equity entirely. In this scenario, USDT would be “theoretically insolvent,” meaning its liabilities would not be fully covered by asset value.

Breaking Down Tether’s Reserve Structure

What Tether Claims to Hold

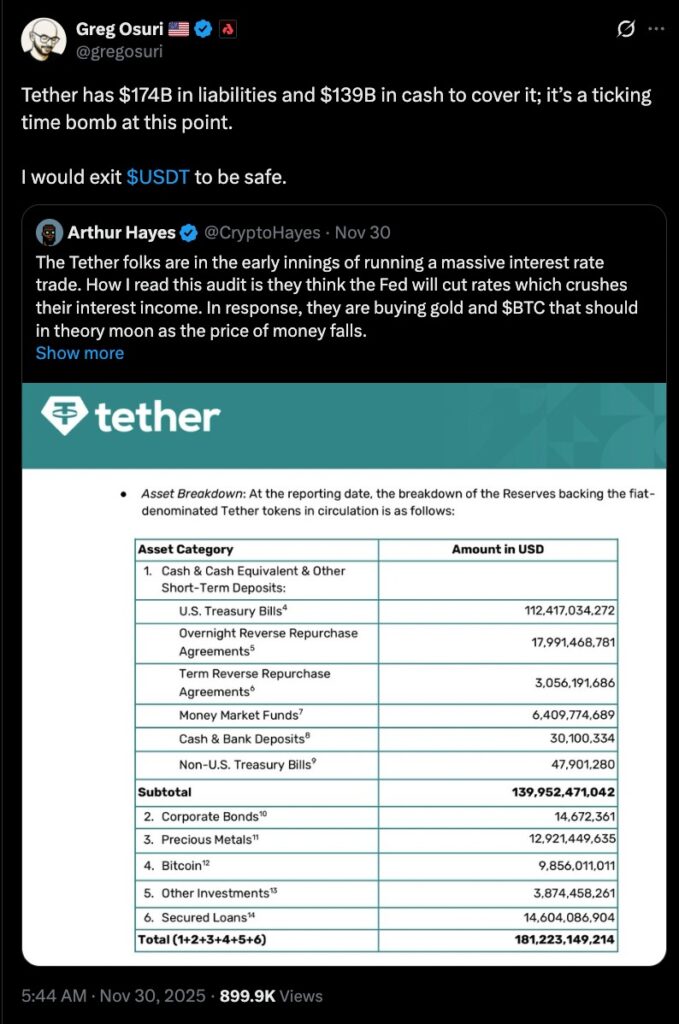

Tether’s Q3 report shows the company backing USDT with about 139 billion dollars in cash and cash equivalents. The remaining portion of its reserves consists of less liquid assets such as Bitcoin, gold, secured loans, and other instruments. While these assets contribute to Tether’s overall valuation, they are not easily or instantly converted into cash, especially during periods of high market volatility. This mix of liquid and illiquid holdings lies at the center of the current debate about Bitcoin Tether Risk.

Solvency on Paper, Liquidity in Practice

Tether’s disclosures show that it holds around 181 billion dollars in total assets against 174 billion dollars in liabilities. This means that on paper, the company is solvent. However, solvency does not automatically guarantee liquidity. If a sudden wave of USDT redemptions occurred, Tether would need to rapidly convert its illiquid assets into cash. With only about 140 billion dollars immediately available in cash and equivalents, the company could face a shortfall of roughly 34 billion dollars in a severe redemption event. This liquidity gap is one of the central concerns raised by analysts who see parallels between Tether’s structure and fractional-reserve banking.

Divided Opinions on the Bitcoin Tether Risk

Analysts Supporting Hayes’s View

Some analysts agree with Hayes’s assessment, arguing that Tether is taking on unnecessary risk by relying too heavily on volatile assets. Ryan Berckmans, a notable member of the Ethereum community, questioned why nearly 40 billion dollars in USDT is backed by reserves that carry significantly more risk than traditional safe assets. He argued that if a stablecoin operator keeps all the yield from its holdings, users should at least expect reserves to be fully risk-minimized. For him and others who share this view, the mismatch between liabilities and liquid assets is a worrying sign.

Akash Network founder Greg Osuri echoed these concerns, calling the liquidity gap a “ticking time bomb.” He suggested that while Tether remains solvent under normal circumstances, its vulnerability to a sharp market downturn creates systemic risk for the broader crypto ecosystem.

Voices Rejecting the Insolvency Scenario

Not everyone, however, agrees with Hayes’s warnings. Some argue that a mark-to-market decline does not automatically equal insolvency. One analyst pointed out that even after a 30 percent drop in Bitcoin and gold, Tether’s assets would still be close to its liabilities. According to this perspective, insolvency requires assets to fall below liabilities, not merely decrease in value temporarily.

Joseph Ayoub, a former crypto research lead at Citibank, dismissed the idea that Tether is on the brink of collapse. He suggested that Tether’s profitability and strong operational structure make it far more robust than critics assume. In his words, Tether effectively operates a “money printing machine,” generating large revenue streams from its holdings, particularly during periods of high interest rates.

Tether’s Expanding Bitcoin and Gold Holdings

A Growing Bet on Hard Assets

As of 2025, Tether has become one of the largest Bitcoin holders in the world, with approximately 87,000 BTC valued at around 8 billion dollars. The company has also increased its gold purchases dramatically, becoming the top buyer in Q3 of that year. This expansion highlights a clear strategy: Tether is positioning itself heavily in hard assets in anticipation of future macroeconomic trends. Supporters view this as savvy long-term planning, while critics argue that it compounds Bitcoin Tether Risk.

Final Thoughts on the Bitcoin Tether Risk Debate

Analysts remain deeply divided over the true stability of Tether’s USDT. While the company maintains that its reserves exceed its liabilities, the growing allocation to Bitcoin and gold has intensified scrutiny. Hayes’s warning about a 30 percent decline wiping out equity underscores how sensitive Tether’s position may be to market volatility. At the same time, defenders argue that Tether’s profitability, strong asset base, and operational efficiency give it resilience.

Ultimately, Bitcoin Tether Risk highlights the broader conversation about transparency, liquidity, and the evolving nature of stablecoin reserve management. As Tether continues to increase its exposure to volatile assets, the debate surrounding its stability is unlikely to fade anytime soon.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL