Tether FUD CEO Rejects S&P Downgrade

Tether FUD is once again dominating conversations in the crypto world after Tether Limited’s CEO, Paolo Ardoino, forcefully rejected S&P Global Ratings’ recent downgrade of USDT’s peg stability. The downgrade placed the stablecoin at the lowest rating tier for maintaining its dollar peg, prompting Ardoino to publicly dispute the assessment. His response has reignited debate around the strength, transparency, and risk profile of the world’s largest stablecoin. According to Ardoino, Tether’s balance sheet demonstrates far greater resilience than critics claim, and the firm’s earnings and excess equity contradict the concerns raised by the rating agency.

Understanding the New Tether FUD Wave

The latest controversy began when S&P lowered its stability score for USDT, describing the peg as weak. The agency cited Tether’s growing exposure to assets such as gold and Bitcoin, arguing that their volatility could pose a threat if market conditions turned sharply downward. Because USDT is used so widely for trading, lending, and liquidity across exchanges, any suggestion of undercollateralization naturally attracts heightened attention. This created a new surge of Tether FUD as analysts and market watchers debated whether the rating signaled deeper risks.

S&P’s central concern was that the presence of more volatile assets in Tether’s reserves could, in extreme circumstances, affect the company’s ability to redeem tokens at one dollar. This risk-based framing quickly circulated online, generating discussions and resurfacing long-standing questions about transparency and reserve composition. This environment set the stage for Ardoino’s strong rebuttal.

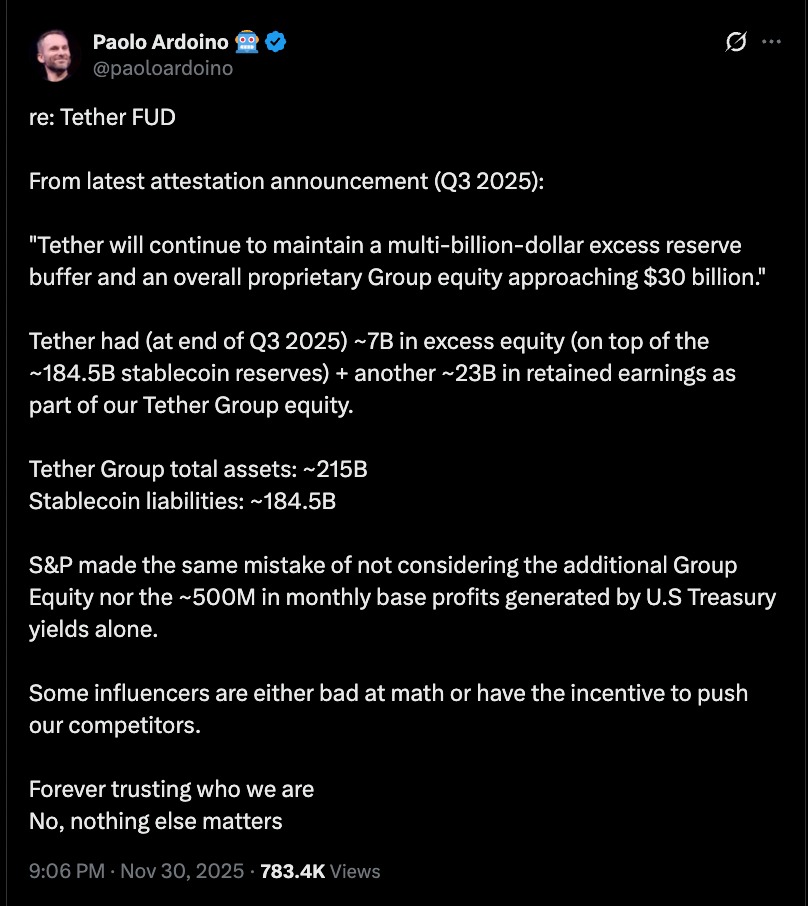

Tether FUD and the CEO’s Detailed Rejection

Tether’s CEO publicly addressed the situation in this statement, outlining what he described as significant financial strength that S&P failed to factor into its downgrade. In the message, he highlighted billions in excess equity, tens of billions in retained earnings, and substantial monthly profits from U.S. Treasury yields. According to him, these figures demonstrate that Tether maintains a wide financial buffer beyond its stablecoin liabilities. His comments were also aimed at critics who, in his view, misunderstand the company’s financial structure or overlook the broader context behind its reserve strategy.

Emphasizing Equity and Earnings

In response to the downgrade, Ardoino argued that S&P overlooked critical data from Tether’s most recent attestation reports. According to these reports, the company holds well over $200 billion in assets against roughly $185 billion in liabilities. This difference, he emphasized, represents billions of dollars in excess equity that serve as an important buffer during market fluctuations. Ardoino also highlighted that Tether has accumulated tens of billions in retained earnings, which further reinforces financial stability.

Additionally, Tether earns significant income from its large holdings of U.S. Treasuries. These earnings reportedly amount to substantial monthly profits, which Ardoino used to argue that Tether is not only stable but highly profitable. He portrayed the company as one with a robust financial foundation that traditional rating metrics failed to fully capture.

Challenging Traditional Assessment Models

A central argument in Ardoino’s pushback is that established rating agencies evaluate stablecoins through frameworks designed for legacy institutions. He suggested that these traditional approaches do not accurately reflect the mechanics of a digital-asset company that operates with a lean structure and real-time liquidity requirements. By treating Tether similarly to a conventional bank, he believes S&P missed key features that define stablecoin economics.

Ardoino insisted that Tether’s reserve strategy, diversification, and profit generation demonstrate an innovative model rather than a risky one. In his view, critics misunderstand how modern stablecoin companies manage liquidity and maintain solvency in fast-moving global markets. This clash between traditional finance and crypto-native operations sits at the heart of much of the current Tether FUD.

Industry Concerns and Ongoing Debate

Supporters and Skeptics Speak Out

While Ardoino defended the company’s position vigorously, responses from industry participants have been mixed. Supporters argue that Tether remains better collateralized than many traditional financial institutions. They also note that Tether’s ability to generate large profits with a relatively small staff shows operational efficiency rather than weakness.

On the other hand, some prominent figures believe the concerns raised by S&P warrant attention. They argue that exposure to volatile assets could create vulnerabilities during severe downturns. According to these skeptics, even with excess equity, sudden shocks in gold or Bitcoin markets could temporarily affect Tether’s buffer levels. This potential risk keeps the discussion alive and ensures Tether FUD continues to surface during moments of uncertainty.

Why the Debate Matters

The controversy extends far beyond Tether itself. USDT plays a crucial role across the digital-asset economy. It is one of the most traded tokens in the world and acts as a core liquidity source for countless platforms. When questions arise about its backing, the effects ripple widely. Traders may shift liquidity, exchanges may reduce exposure, and regulators may step up scrutiny.

For this reason, disputes about Tether’s stability often gain outsized attention, and any rating change becomes a headline. The divide between crypto innovators and traditional evaluators highlights deeper questions about how stablecoins should be measured, monitored, and integrated into mainstream financial oversight.

What This Means for the Future of Stablecoins

Shifting Regulatory Landscape

The clash over USDT’s rating arrives during a period of increasing regulatory focus on stablecoins. Policymakers in multiple regions are exploring frameworks that address reserve standards, risk management, and transparency. As regulators examine how stablecoins interact with global markets, the approach taken toward Tether could set meaningful precedents.

If stablecoin issuers are assessed strictly under traditional models, companies may need to adjust reserve strategies or reporting methods. Conversely, recognition of crypto-native models could influence the creation of more tailored regulatory structures.

Tether’s Challenge Moving Forward

Tether must now navigate a landscape where both critics and supporters expect more data, more transparency, and sustained performance under pressure. Defending USDT’s peg will require not only maintaining strong reserves but also demonstrating that the company can operate successfully despite evolving regulatory and market conditions.

Conclusion

Tether FUD continues to highlight the tension between old financial frameworks and new digital-asset realities. S&P’s downgrade sparked another round of questions about reserve composition and risk, while Tether’s leadership insists the company is stronger than critics suggest. Whether Tether’s rebuttal will shift sentiment remains to be seen, but the debate will likely influence how stablecoins are evaluated and regulated in the years ahead.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL