Ethereum ICO Wallet Moves $120M Into Staking

Ethereum ICO Wallet pulled a dramatic move, staking 40,000 ETH worth roughly $120 million instead of cashing out. The wallet dates back to the initial network launch nearly ten years ago, when its ETH was purchased for around $12,000.

Why the Ethereum ICO Wallet Move Grabs Attention

The re-activation of a decade-old wallet often triggers market concern. Usually, such large transfers portend imminent selling pressure, as holders might be moving coins to exchanges. In many cases, that can cause price dips due to sudden supply flood.

However, in this unusual situation, the wallet’s owner chose staking over liquidation. Rather than offloading the coins for immediate profit, they locked them up to support the network. That decision suggests a long-term belief in the underlying blockchain, signaling faith rather than a fast exit.

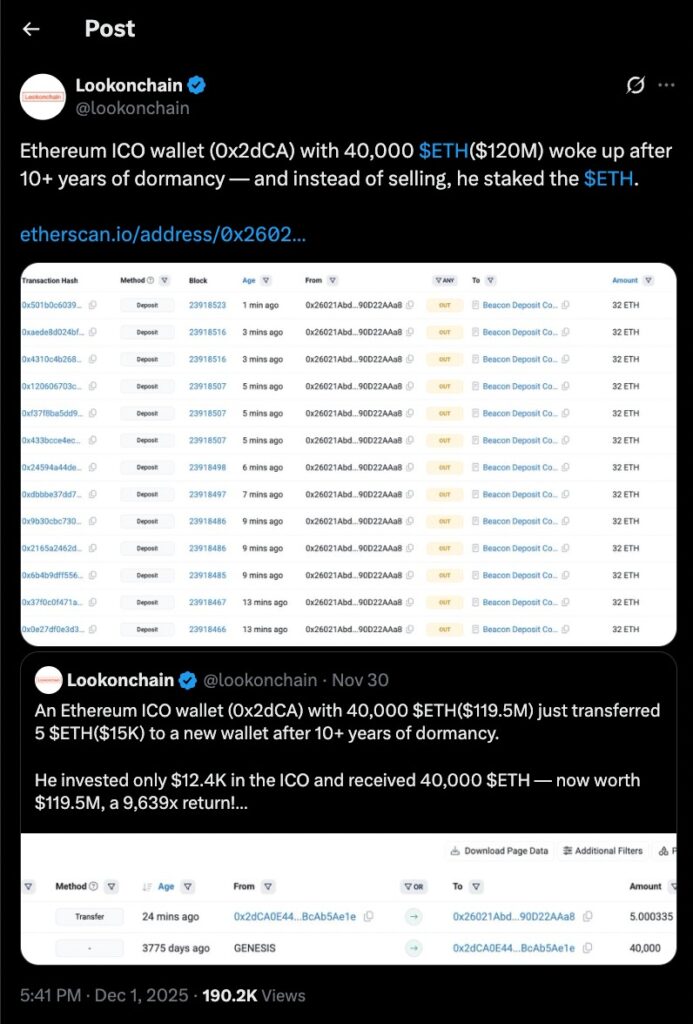

The tweet shown above from on-chain analytics account Lookonchain publicly verified the movement of funds from the decade-old wallet. The screenshots of the transactions confirm multiple 32-ETH deposits into the Beacon Deposit Contract, illustrating that the owner was intentionally staking the entire 40,000-ETH balance rather than preparing to sell. This independent on-chain evidence supports the overall narrative that the wallet’s reactivation reflects long-term confidence rather than profit-taking.

In the broader context of recent “whale” activity, this staking move stands out. Other large wallets, sometimes also dormant for years, have chosen to offload ETH, contributing to market volatility. Against that backdrop, a hold-and-stake decision provides a counter-narrative, one of commitment and confidence rather than cashing in.

From Genesis-Era Investment to $120 Million Stake

When the network launched in mid-2015, early backers could acquire Ether cheaply. This wallet reportedly bought 40,000 ETH for just around $12,000. Over time, as the value of ETH surged, that holding appreciated dramatically.

Now, roughly a decade later, that stash is worth about $120 million, a staggering return on the original investment. Instead of converting that windfall into fiat or alternative assets, the holder has committed those funds to staking. That indicates they view Ether not as a quick trade, but as a long-term asset with ongoing value.

By choosing to stake, the owner contributes to network security and decentralization. Rather than concentrating wealth or destabilizing supply via offloading, the wallet’s action reinforces the ethos behind the technology: shared long-term commitment.

Contrasting Strategies: Sell-offs vs. Stake-ins

Old Ether Holders Who Cashed Out

Not every legacy holder is playing the long game. For example, a wallet from the early days reportedly had around 254,908 ETH. That holder began selling on a recent date and continued until the holdings dwindled substantially. Another wallet from 2017, which held over 154,000 ETH, moved large portions to exchanges after partial sales.

These moves triggered noticeable downward pressure on prices and contributed to short-term volatility. For those holders, Ethereum became an opportunity to realize gains rather than a long-term project to back.

Genesis-Era Wallets Embracing Stake

By contrast, at least two wallets from the platform’s early era took a different path. One transferred 150,000 ETH into staking after years of inactivity. Now, this 40,000-ETH wallet has moved toward staking too.

These actions reflect a deliberate choice: stake and support the network, rather than liquidate for temporary gains. For observers, such moves may reflect broader confidence among early adopters in the technology’s future, and potentially reduced selling pressure from whales.

What the Bigger Picture Shows: Consolidation and Staking Growth

Despite periodic sell-offs, data suggests that top holders continue to accumulate and secure supply. The share of ETH held by the top 1% of addresses recently increased compared with a year ago. This indicates consolidation among large holders, potentially signalling tighter supply control.

On top of that, the total amount of staked ETH has grown significantly. The formal staking contract now holds a substantial portion of the network’s supply, with billions of dollars locked up. This shift emphasizes commitment to long-term stability and network security over short-term trading. Meanwhile, major institutional holders have also contributed large amounts to staking, showing that commitment extends beyond just early adopters.

Together, these factors point to an ecosystem increasingly driven by long-term holders and staked capital, rather than speculative trading.

What This Means for Market Sentiment and Network Health

- Confidence Instead of Cash-out: The decision by this long-idle wallet to stake instead of sell sends a clear message: ETH remains a long-term bet. Such actions may encourage similar behavior by other large holders.

- Reduced Sell Pressure: With more ETH locked in staking and held by top addresses, there may be less supply available for sale. That could help stabilize prices and reduce volatility triggered by large sell orders.

- Strengthened Network Security: Staking increases the amount of committed capital behind the network, improving overall security and decentralization. That could help build trust among users, investors, and institutions.

- Positive Long-Term Outlook: As institutional investors and early holders continue to stake rather than exit, it suggests faith in Ethereum’s future applications, ecosystem growth, and continued relevance in the broader crypto space.

Why This Move Stands Out

Over the years, stories about dormant wallets moving ETH often triggered alarm, people expected big sell-offs and price drops. But in this case, the opposite happened. The funds didn’t move toward exchanges; they moved deeper into the network as staking capital.

That distinction matters. It reflects a growing maturity in how major holders view their Ethereum investments. Instead of treating ETH as a short-term speculative asset, some early adopters now seem to view it as a long-term holding, with value tied to network strength, adoption, and security.

In a landscape often defined by volatility, impulsive trades, and profit-driven moves, this staking behavior offers a stabilizing signal. It may also reshape how new investors perceive Ethereum, not just as a currency to trade, but as a protocol to support and a long-term system to trust.

Final Thought: Staking Over Selling

The re-awakening of a wallet from the early days and its decision to stake, not sell, marks more than just one large transaction. It represents a shift in mindset among early holders: from profit-taking to long-term commitment.

In a world overwhelmed by headlines about whales dumping coins, liquidations, and price swings, this move is quietly powerful. It says: ETH is not just a means to quick gains. For many, including early backers, it is a long-term investment in a protocol, an ecosystem, a community.

Whether other legacy wallets follow this path remains uncertain. But for now, the staking action by this Ethereum ICO Wallet adds a reassuring note to the evolving story of Ether, one grounded in commitment, confidence, and conviction.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL