Solana ETF Inflows Extend Seven Day Streak

Solana ETF Inflows continued for a seventh consecutive day despite a notable decline in SOL’s price and a broader downturn across the cryptocurrency market. The steady inflow streak highlights continued demand for Solana exchange traded funds even as price performance and several onchain metrics remain under pressure.

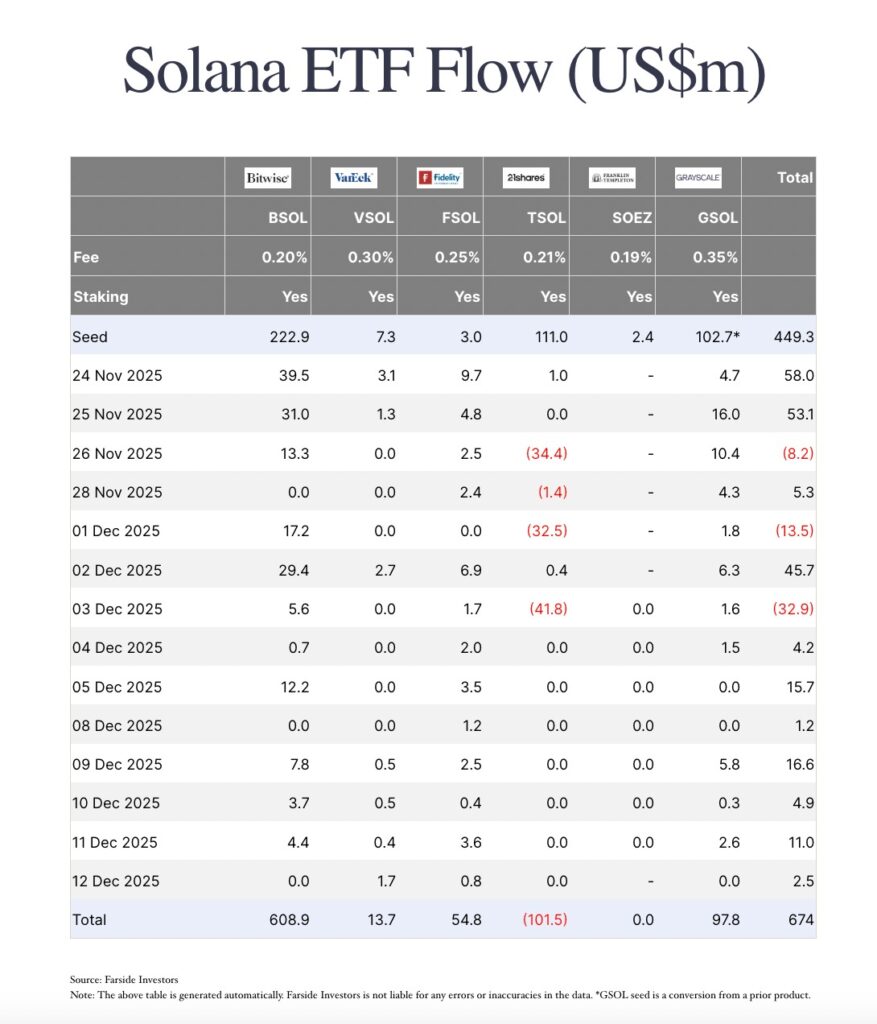

Solana exchange traded funds recorded net inflows each day over the seven day period, with Tuesday marking the highest daily inflow during the streak. On that day, approximately 16.6 million dollars flowed into SOL ETFs, according to data from investment management firm Farside Investors. The consistent inflows occurred while SOL’s price trended downward and the wider crypto market experienced a drawdown.

As a result of the sustained inflows, total net inflows into Solana ETFs reached 674 million dollars at the time of writing, based on Farside data. The inflow figures point to continued interest from investors despite weaker price action and declining network metrics.

Solana ETF Inflows Signal Ongoing Investor Interest

The table above shows daily Solana ETF flows across multiple issuers, highlighting consistent net inflows during the recent seven-day period. Data from Farside Investors indicates that SOL ETFs recorded steady capital inflows despite broader market weakness, with cumulative net inflows reaching approximately 674 million dollars. The figures also show variation across individual products, reflecting differing investor allocation patterns while maintaining overall positive inflow momentum.

Solana ETF Inflows indicate demand from institutional and traditional finance investors even as market conditions remain challenging. The continued inflows stand in contrast to the performance of SOL itself, which has struggled to regain upward momentum during the same period.

Solana ETFs first debuted in the United States in July with the launch of REX-Osprey’s staked SOL ETF. This was followed in October by the launch of Bitwise’s BSOL Solana ETF. According to Bloomberg ETF analyst James Seyffart, the Bitwise product was one of the hottest ETF launches of 2025.

The timing of the ETF launches coincided with increased attention on regulated crypto investment products in the US market. Despite this, SOL’s price performance has not reflected the positive momentum seen in ETF inflows.

ETF Flows During Market Drawdown

The Solana ETF Inflows streak occurred during an ongoing market drawdown that has affected both prices and onchain metrics. Metrics such as total value locked, which measures the amount of capital held in smart contracts, have declined during this period.

Even with these declines, ETF flows suggest continued interest in SOL exposure through regulated investment vehicles. The inflows highlight a disconnect between ETF demand and the token’s market performance.

Solana Price Performance Remains Weak

While Solana ETF Inflows have remained positive, SOL’s market capitalization has declined. According to data from crypto market analytics platform Nansen, Solana’s market capitalization has fallen by more than 2 percent over the past seven days.

SOL’s price continues to trade at a significant discount compared to its all-time high. The token is down nearly 55 percent from its peak price of approximately 295 dollars, which was reached in January. This decline was fueled in part by the launch of the Trump memecoin on the Solana network.

The price weakness reflects ongoing selling pressure and reduced momentum across the Solana ecosystem. Despite ETF inflows, SOL has not been able to reclaim key technical levels.

SOL Trading Below Key Support Levels

SOL has been trading well below its 365 day moving average since November. The 365 day moving average is widely considered a critical long-term support level, and trading below it signals sustained weakness.

The token is also down about 47 percent from a local high of roughly 253 dollars recorded in September. Since then, price action has remained constrained, with repeated attempts to move higher failing to hold.

According to available data, SOL is facing resistance between the 140 dollar and 145 dollar price range. The token has failed to close above this resistance zone in December, despite the launch of Solana ETFs in the US.

Derivatives and Market Data Reflect Caution

Additional market data points to cautious sentiment around SOL. Open interest for SOL perpetual futures stood at over 447 million dollars at the time of writing, according to Nansen. Perpetual futures are contracts without an expiration date and are often used to gauge trader positioning.

The open interest data shows ongoing participation in derivatives markets but does not signal a clear reversal in price direction. Combined with declining market capitalization and weak price structure, the data reflects continued pressure on SOL.

Regulatory and Market Context

The period of Solana ETF Inflows comes amid broader discussions around financial markets and blockchain technology. Securities and Exchange Commission Chair Paul Atkins stated that US financial markets are poised to move onchain, reflecting growing attention from regulators and policymakers.

This statement comes at a time when interest in internet capital markets has been increasing among crypto industry executives and US regulators. However, this interest has not yet translated into improved price performance for SOL.

ETF Demand Versus Token Performance

The divergence between Solana ETF Inflows and SOL’s price highlights differing dynamics within the market. While ETFs continue to attract capital, the token itself remains under pressure due to broader market conditions and declining onchain activity.

Despite the launch of ETFs and continued inflows, SOL has not been able to overcome technical resistance or reverse its broader downtrend. The gap between ETF demand and spot price performance remains a key feature of Solana’s current market situation.

Conclusion

Solana ETF Inflows have recorded a seven day streak even as SOL’s price continues to struggle and broader crypto markets remain under pressure. With total net inflows reaching 674 million dollars, ETF demand reflects ongoing interest from institutional and traditional finance investors.

At the same time, SOL’s price remains significantly below its all-time high, trades under key support levels, and faces resistance near the 140 dollar to 145 dollar range. Declining market capitalization and onchain metrics further underscore the challenges facing the token.

The contrast between steady ETF inflows and weak price performance highlights the current disconnect in the Solana market, as investment flows continue despite sustained downside pressure on SOL.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe