Spot Bitcoin ETFs See Strongest Inflows of the Month

Spot Bitcoin ETFs saw a sharp rise in investor demand as Spot Bitcoin ETFs recorded $457 million in net inflows in a single trading day, marking their strongest performance in more than a month. The surge highlights renewed institutional interest and suggests early positioning ahead of potential macroeconomic changes that could impact risk assets, including Bitcoin.

Spot Bitcoin ETFs Post Strong Daily Inflows

The latest inflow data shows that Spot Bitcoin ETFs attracted a combined $457 million in fresh capital. This was the largest daily inflow since early November and came after several weeks of mixed or subdued activity. The strong performance suggests that investors are becoming more confident in gaining Bitcoin exposure through regulated financial products.

Fidelity’s Wise Origin Bitcoin Fund led the inflows, bringing in the majority of new capital. BlackRock’s iShares Bitcoin Trust followed with a solid contribution, reinforcing its position as one of the most widely held Bitcoin ETFs. While some funds recorded minor outflows, the overall picture remained clearly positive for Spot Bitcoin ETFs.

Spot Bitcoin ETFs and Total Market Impact

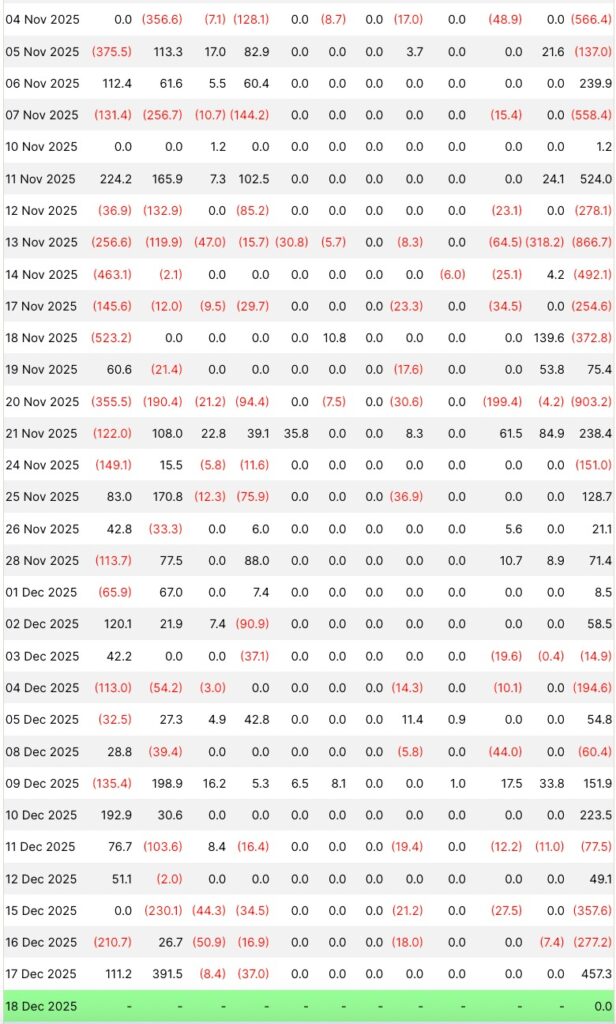

The ETF flow data shown above highlights the volatility and scale of capital movements into Spot Bitcoin ETFs throughout November and December. Several sessions recorded substantial inflows, including days where total net inflows exceeded $500 million, while other periods showed sharp outflows as market sentiment shifted. This pattern reinforces the view that institutional participation remains active but highly responsive to macro conditions and Bitcoin price action. The recent $457 million inflow stands out against this backdrop, signaling renewed confidence after a stretch of uneven flows and suggesting that large investors are selectively increasing exposure rather than exiting the market entirely.

With the latest inflows added, cumulative net inflows into US Spot Bitcoin ETFs have now surpassed $57 billion. Total assets under management across these funds have risen above $112 billion. This means Spot Bitcoin ETFs now represent a meaningful share of Bitcoin’s overall market capitalization, showing how influential ETF products have become within the crypto market.

The growth also reflects how investors increasingly prefer ETFs as a convenient and regulated way to gain Bitcoin exposure. Rather than directly holding Bitcoin, many institutions see ETFs as a lower-risk entry point that fits within traditional portfolio structures.

Early Positioning Behind Spot Bitcoin ETF Demand

Analysts believe the recent inflows into Spot Bitcoin ETFs represent early positioning rather than a late-stage rally. Investors appear to be moving capital ahead of potential shifts in interest rate policy, rather than reacting to sudden price spikes. Expectations around future rate cuts have made Bitcoin attractive once again as a liquidity-driven asset.

This early positioning suggests that investors are preparing for a more favorable environment for risk assets. However, analysts also caution that inflows may remain uneven, as ETF demand tends to fluctuate with market sentiment and price volatility.

Macro Environment Supports Spot Bitcoin ETFs

Macroeconomic signals are playing a major role in renewed interest in Spot Bitcoin ETFs. Political and economic developments have increased expectations that interest rates may decline in the coming year. Historically, lower interest rates support assets like Bitcoin by making alternative investments more attractive.

As liquidity conditions improve, institutional investors often seek exposure to assets that can benefit from easing financial conditions. Spot Bitcoin ETFs allow these investors to participate without operational challenges tied to direct Bitcoin ownership.

Bitcoin Market Structure Remains Challenging

Despite strong ETF inflows, the broader Bitcoin market continues to face structural challenges. Bitcoin has returned to price levels last seen about a year ago, with a heavy concentration of supply acting as resistance. This has created pressure on price momentum and limited immediate upside.

On-chain data shows a large amount of Bitcoin is currently held at a loss, the highest level seen during this market cycle. This suggests that while long-term confidence remains, short-term conviction is still fragile. Spot buying has been inconsistent, and derivatives markets have leaned toward reducing risk rather than rebuilding aggressive positions.

Institutional Interest and Spot Bitcoin ETFs

The resurgence of inflows into Spot Bitcoin ETFs highlights growing institutional confidence. Many professional investors view ETFs as a stable bridge between traditional finance and digital assets. The recent capital inflow indicates that large investors are gradually re-entering the market after a period of caution.

Spot Bitcoin ETFs also benefit from strong brand recognition, liquidity, and regulatory clarity. These factors play a critical role in determining where institutional capital flows, especially during uncertain market conditions.

Differences Among Spot Bitcoin ETF Providers

Not all Spot Bitcoin ETFs performed equally during the inflow surge. Some funds attracted substantial capital, while others experienced modest withdrawals. These differences reflect investor preferences related to fees, liquidity, issuer reputation, and trading volume.

Funds with established track records and strong institutional backing continue to dominate inflows. This trend suggests that competition among ETF providers will remain intense as the market matures.

What Lies Ahead for Spot Bitcoin ETFs

The outlook for Spot Bitcoin ETFs will largely depend on macroeconomic developments and Bitcoin’s ability to attract sustained demand. If interest rate expectations continue to shift toward easing, ETF inflows may remain supportive of the market.

However, analysts warn that volatility is likely to persist. Without strong follow-through from spot buyers and renewed derivatives activity, Bitcoin’s price could remain range-bound. Even so, the recent inflow surge signals that institutional investors are positioning themselves early rather than waiting on the sidelines.

Conclusion

The $457 million inflow into Spot Bitcoin ETFs marks a significant moment of renewed confidence in Bitcoin as an investable asset. While broader market conditions remain mixed, ETF activity shows that institutions are once again engaging with Bitcoin through regulated financial channels. Whether this trend continues will depend on liquidity conditions, interest rate policy, and Bitcoin’s ability to overcome key market resistance levels.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe