Solana Memecoins Face a Legal Turning Point

Solana memecoins are at the center of a growing legal debate that could reshape how speculative tokens are created and traded on the Solana network. What began as a fast-moving trend fueled by low fees and rapid transactions has now attracted serious legal attention, raising questions about fairness, transparency, and responsibility within decentralized ecosystems.

The recent price movement of Solana reflects the broader uncertainty surrounding the network as legal developments unfold. Over the past month, SOL has experienced noticeable fluctuations, mirroring shifts in market sentiment tied to activity on the network and increased scrutiny of its memecoin ecosystem. While price action alone does not determine the outcome of ongoing legal proceedings, it highlights how closely traders are watching developments related to Solana’s infrastructure and high-profile platforms operating on it. As news around the lawsuit continues to surface, market participants appear to be reacting cautiously, balancing speculative interest with emerging risks.

Solana memecoins and their explosive growth

Solana memecoins surged in popularity as traders looked for quick launches and instant liquidity. The Solana blockchain offered an ideal environment with fast confirmation times and minimal transaction costs. These advantages made it easier for users to create and trade tokens at an unprecedented pace.

During this boom, thousands of memecoins flooded the network. Most were driven by social media hype rather than real utility, but they still generated massive trading volume. This activity positioned Solana as one of the most active blockchains during the memecoin cycle and brought new users into the ecosystem.

Pump.fun’s role in Solana memecoins

Pump.fun became the main engine behind the Solana memecoins explosion. The platform allowed anyone to launch a token instantly using automated pricing models. Instead of traditional liquidity pools, prices moved through bonding curves that adjusted based on buying and selling activity.

This structure lowered barriers to entry and encouraged experimentation. As a result, Pump.fun became responsible for a significant portion of new token launches on Solana. However, the simplicity of the process also meant that many tokens had no long-term plans, increasing speculative risk for retail traders.

Why Solana memecoins are facing legal scrutiny

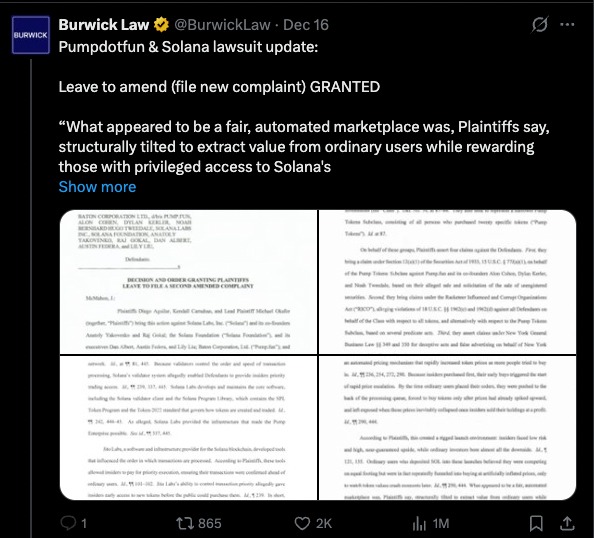

The legal concerns surrounding Solana memecoins gained further clarity after a public update from Burwick Law, the firm involved in the case. According to the filing, the court granted plaintiffs permission to amend and refile their complaint, reinforcing claims that what appeared to be a neutral, automated marketplace may have been structurally tilted in favor of participants with privileged access. The language highlights allegations that ordinary users were systematically disadvantaged, while insiders benefited from Solana’s infrastructure and transaction mechanics. This development signals that the case is advancing beyond preliminary dismissal concerns and that the court is willing to examine how platform design may have influenced market outcomes.

The legal case now unfolding goes beyond a single platform or token. The lawsuit claims that Solana’s technical design, combined with Pump.fun’s launch mechanics, enabled unfair advantages for insiders. According to the allegations, certain participants were able to accumulate large token positions before public traders could react.

One key concern involves supply concentration. A large percentage of some memecoin supplies reportedly ended up in the hands of a small group of holders. Plaintiffs argue that this made price manipulation easier and placed retail investors at a disadvantage.

Solana memecoins and network-level responsibility

What makes this case unusual is its focus on the network itself. Rather than blaming only token creators, the lawsuit questions whether Solana’s validator structure and transaction processing speed contributed to unequal access.

Solana’s high throughput allows transactions to be processed extremely quickly. While this is usually seen as a benefit, critics argue that it may also favor those with advanced infrastructure or insider access. This raises broader questions about whether technical advantages can unintentionally create unfair trading conditions.

Market impact of the Solana memecoins lawsuit

The lawsuit has already sparked debate across the crypto community. Some fear it could open the door to increased regulation or further legal action against decentralized platforms. Others argue that the case highlights weaknesses that need to be addressed for the ecosystem to mature.

If the court rules against the defendants, platforms like Pump.fun may be forced to change how tokens are launched. This could include clearer disclosures, limits on early allocations, or added safeguards for retail users. Such changes would likely slow the pace of memecoin creation but could improve trust.

Pump.fun and the risks of rapid token creation

Pump.fun demonstrated how quickly decentralized systems can scale. Millions of tokens were launched in a short period, but only a tiny fraction retained value. Most disappeared after brief bursts of trading activity.

This pattern exposed a major risk of the Solana memecoins model. While accessibility increased, investor protection did not keep pace. Many traders entered without understanding the mechanics of bonding curves or the risks of concentrated supply.

Solana memecoins and investor protection concerns

The lawsuit highlights a growing tension between innovation and accountability. Decentralized platforms aim to remove gatekeepers, but this also makes it harder to enforce standards. Without clear rules, speculative markets can become chaotic.

Supporters of Solana argue that users are responsible for their own decisions. Critics counter that platforms profiting from transaction volume should bear some responsibility for how systems are designed. This debate sits at the heart of the current legal challenge.

The future of Solana memecoins

Regardless of the outcome, Solana memecoins have already changed the blockchain landscape. They proved that token creation could be fast, cheap, and accessible to anyone. At the same time, they exposed structural risks that cannot be ignored.

If legal pressure leads to reforms, the memecoin market may become smaller but more sustainable. Developers could adopt better transparency practices, and traders may approach new tokens with greater caution.

What this means for the Solana ecosystem

The Solana memecoins case is not just about speculation. It raises fundamental questions about how decentralized networks evolve under real-world legal systems. As blockchains grow, they face increasing pressure to balance freedom with fairness.

For Solana, the challenge will be preserving innovation while addressing legitimate concerns. The outcome of this case could influence how future platforms are built, not only on Solana but across the crypto industry.

In the end, Solana memecoins may be remembered as both a breakthrough and a warning. They showed what decentralized technology can achieve at scale, but they also revealed the consequences of unchecked speculation in open financial systems.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe