Bitcoin Hashrate Rebound After Xinjiang Mining Concerns

Bitcoin Hashrate Rebound is once again in focus after fears surrounding mining activity in China’s Xinjiang region briefly shook confidence in the Bitcoin network. Reports of mining shutdowns initially suggested a sharp decline in computing power, but updated data now shows the impact was smaller and temporary. The recovery highlights how resilient and decentralized Bitcoin mining has become, even in the face of regulatory pressure and regional disruptions.

Bitcoin Hashrate Rebound After Xinjiang Mining Fears

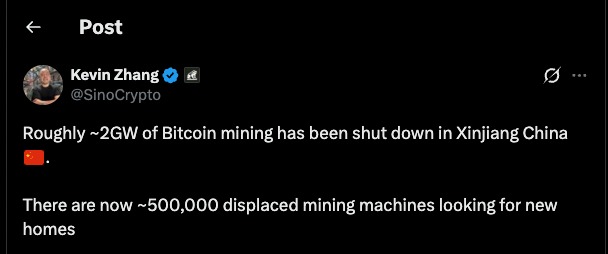

The concerns were amplified by a widely shared social media post claiming that roughly 2 gigawatts of Bitcoin mining capacity had been shut down in Xinjiang, displacing an estimated 500,000 mining machines. The post quickly gained traction across the crypto community, reinforcing fears that a large portion of global hash power had suddenly gone offline. While such claims reflected the scale of anxiety at the time, subsequent data suggested that the real impact on the Bitcoin network was significantly smaller and far more temporary than initially assumed.

Concerns began when reports surfaced that mining operations in Xinjiang were being restricted or shut down. Xinjiang is known for hosting large mining facilities due to its access to low-cost electricity. Early estimates claimed that hundreds of thousands of mining machines could have gone offline, potentially removing a massive portion of Bitcoin’s total hash power in a very short time.

These reports quickly spread across social media, triggering fears that Bitcoin’s network security and transaction processing could be affected. Some analysts speculated that the hashrate drop could be severe enough to disrupt block production and increase confirmation times.

However, as more accurate data became available, it became clear that the initial reaction overstated the situation.

Understanding the Bitcoin Hashrate Rebound

What the Bitcoin Hashrate Rebound Means

Bitcoin Hashrate Rebound refers to the recovery of computing power used to secure the Bitcoin network after a temporary decline. Hashrate measures how much processing power miners contribute to validating transactions and producing new blocks. A rebound shows that miners either returned online or that other miners increased activity to compensate.

In this case, while a decline did occur, it was much smaller than early estimates suggested. Instead of losing a massive portion of global hash power, the network experienced a more modest dip that recovered within days.

Why the Initial Numbers Were Misleading

Several factors contributed to exaggerated early claims. First, short-term hashrate fluctuations are common and do not always reflect permanent shutdowns. Mining machines can go offline temporarily due to power adjustments, maintenance, or regional electricity controls.

Second, data showed that some of the hashrate decline came from outside China, including parts of North America. This means the drop could not be fully attributed to Xinjiang mining activity alone.

Once these factors were considered, it became clear that the Bitcoin network remained stable.

China’s Role in the Bitcoin Hashrate Rebound

Mining Activity Despite the Ban

Although China officially banned cryptocurrency mining in 2021, mining activity linked to the country has slowly returned. Estimates now suggest that China accounts for a noticeable share of global Bitcoin mining, even if it no longer dominates the sector.

Regions like Xinjiang continue to attract miners due to cheap and abundant electricity. Some miners operate quietly or through data centers that lease computing resources, making mining harder to track and regulate.

This reality helps explain why a local disruption did not result in long-term damage to the network.

Why Miners Continue Operating

Miners follow profitability. Areas with low energy costs, available infrastructure, and access to cooling solutions remain attractive regardless of regulatory uncertainty. Xinjiang offers these advantages, which explains why mining activity persists there despite official restrictions.

The Bitcoin Hashrate Rebound shows that miners are willing to adapt, relocate, or temporarily pause operations rather than exit the network entirely.

Network Strength Shown by Bitcoin Hashrate Rebound

Decentralization in Action

One of the strongest takeaways from the Bitcoin Hashrate Rebound is how decentralized mining has become. Unlike in earlier years when mining was heavily concentrated in one country, today’s network is spread across many regions.

When one area experiences disruption, others can quickly compensate. This geographic diversity reduces the risk of a single point of failure and strengthens the overall network.

Automatic Difficulty Adjustment

Bitcoin’s protocol includes an automatic difficulty adjustment mechanism. Every two weeks, the network recalculates mining difficulty based on available hash power. This ensures that blocks continue to be produced at a consistent rate, even if miners temporarily leave or rejoin the network.

Because of this system, short-term hashrate drops rarely cause long-term problems.

Market Confidence and Miner Behavior

The quick Bitcoin Hashrate Rebound helped calm market fears. A prolonged or deep decline could have signaled miner capitulation or declining confidence in mining profitability. Instead, the recovery showed that miners remain committed and financially motivated to secure the network.

For investors and observers, this stability reinforces trust in Bitcoin’s long-term infrastructure.

Regulatory Lessons From the Xinjiang Situation

This episode also highlights how quickly regulatory headlines can influence sentiment. Initial reports sparked concern before full data was available. The rebound emphasized the importance of waiting for confirmation rather than reacting to speculation.

Bitcoin’s global nature means that no single region can easily disrupt the entire network. Even strong regulatory actions tend to cause temporary shifts rather than permanent damage.

Conclusion

Bitcoin Hashrate Rebound following the Xinjiang mining fears demonstrates the strength, flexibility, and decentralization of the Bitcoin network. While localized disruptions did occur, they were brief and limited in scope. Miners returned quickly, global hash power stabilized, and network security remained intact.

The event serves as a reminder that Bitcoin has matured into a system capable of absorbing shocks without losing functionality. As mining continues to spread across regions and adapt to changing conditions, short-term fears are unlikely to derail the network’s long-term stability.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Solana

Solana