Bitcoin Leverage Reshapes Strategy’s Market Valuation

Bitcoin Leverage has emerged as the key reason behind the sharp disconnect between Strategy’s stock performance and Bitcoin’s relative strength over the past several months. While Bitcoin managed to remain resilient, Strategy’s shares fell by roughly 66 percent, forcing investors to reassess whether the company still functions as a reliable proxy for Bitcoin exposure. This growing gap highlights how leverage, balance sheet complexity, and dilution risks are reshaping market sentiment.

Bitcoin Leverage and Strategy’s Repricing by the Market

For years, Strategy benefited from being viewed as a leveraged Bitcoin vehicle. Investors were willing to pay a premium for its stock because it offered amplified exposure to Bitcoin’s price movements. However, as market conditions shifted, that perception changed rapidly. Instead of rewarding leverage, investors began pricing in its risks.

Strategy holds a massive Bitcoin position valued at tens of billions of dollars. Despite this, its stock began trading at a meaningful discount compared to the value of its Bitcoin holdings. This shift clearly signaled that the market was no longer valuing Strategy purely on its Bitcoin exposure. Instead, concerns around leverage, debt obligations, and dilution became dominant factors in valuation.

The disappearance of the net asset value premium marked a turning point. What was once considered an advantage now became a liability. Investors began questioning whether holding Strategy stock was worth the added risk compared to simply owning Bitcoin directly.

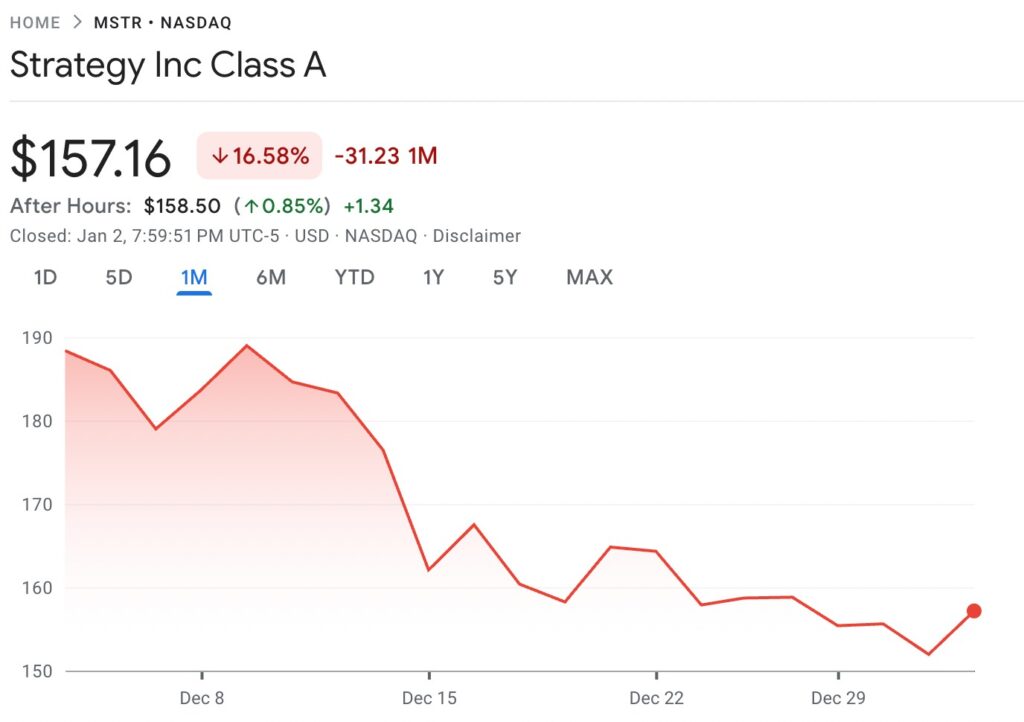

Over the past month, MSTR’s price movement points to consolidation rather than clear direction. The chart shows repeated attempts to stabilize, with brief rebounds followed by pullbacks that suggest lingering uncertainty among investors. Neither buyers nor sellers appear fully committed, reflecting an ongoing reassessment of how much value the market assigns to leveraged Bitcoin exposure. This kind of price behavior often emerges when sentiment is cautious but not decisively negative.

How Bitcoin Leverage Turned From Advantage to Risk

Bitcoin Leverage works well in rising markets but becomes dangerous when sentiment weakens. Strategy’s aggressive use of leverage magnified gains during bullish periods, but once conditions cooled, those same mechanics amplified losses. As confidence declined, leverage accelerated downside pressure on the stock.

Another factor contributing to this decline was dilution. Strategy continued issuing shares and financial instruments, which diluted existing shareholders. Even though the company still held significant Bitcoin reserves, investors realized that their individual claim on those assets was shrinking over time.

As a result, the market began treating Strategy’s equity less like a simple Bitcoin play and more like a complex financial product. This shift reduced demand for the stock and further pressured its valuation.

Bitcoin Leverage and Investor Sentiment Shift

Investor behavior clearly changed as leverage risks became more visible. During periods of uncertainty, markets typically favor clarity and simplicity. In this environment, direct Bitcoin ownership became more appealing than holding shares in a heavily leveraged company.

Strategy’s complex capital structure made it harder for investors to accurately assess risk. Convertible notes, preferred shares, and debt obligations added layers of uncertainty. This complexity stood in contrast to Bitcoin itself, which offers straightforward exposure without corporate overhead or dilution.

As volatility increased, many investors chose to reduce exposure to leveraged instruments. This shift in sentiment further weakened Strategy’s stock price, even though Bitcoin itself did not experience a comparable decline.

Income Strategy Signals Defensive Positioning

In response to growing pressure, Strategy introduced a high-yield income product offering monthly dividends with an annualized return of around 11 percent. While this move was presented as a new opportunity, the market largely viewed it as a defensive response rather than a growth initiative.

High dividend yields often signal that a company is trying to stabilize investor confidence. In this case, the strategy suggested that management was responding to stress rather than expanding from a position of strength. Investors remained cautious because the core issues of leverage and dilution were not resolved.

Rather than restoring confidence, the income-focused approach reinforced concerns that the company was shifting priorities due to market pressure.

Separating Bitcoin Leverage From Bitcoin Strength

One of the most important lessons from this period is the distinction between Bitcoin and leveraged exposure to it. Bitcoin’s price remained relatively stable compared to the steep drop in Strategy’s stock. This clearly demonstrated that the decline was not driven by weakness in Bitcoin itself.

Instead, the market was repricing the risks associated with leverage, debt, and equity dilution. Investors learned that owning a company tied to Bitcoin is not the same as owning Bitcoin directly. Structural risk can significantly impact returns, even when the underlying asset performs well.

This realization caused many market participants to rethink how they gain exposure to digital assets, especially during uncertain conditions.

What Bitcoin Leverage Teaches Investors

Bitcoin Leverage amplifies outcomes in both directions. While it can generate outsized gains during strong market cycles, it can also magnify losses when sentiment turns negative. Strategy’s experience shows how quickly leverage can shift from being a growth driver to a valuation burden.

Markets are increasingly cautious about paying premiums for leverage-heavy narratives. Transparency, balance sheet strength, and simplicity are becoming more important to investors, especially in volatile asset classes like crypto.

The sharp repricing of Strategy’s stock reflects a broader trend toward risk awareness and capital discipline.

Editor’s View: Bitcoin Leverage and Investor Psychology

What stood out during this period was not panic, but quiet disengagement. Many investors did not rush to sell Bitcoin itself; instead, they reduced exposure to structures that felt harder to explain under pressure. When markets become uncertain, people tend to prefer assets they can understand without footnotes, even if the returns are less dramatic. Strategy’s decline reflected that shift in preference, where simplicity became more valuable than leverage.

Final Thoughts on Bitcoin Leverage and Strategy

In conclusion, Strategy’s 66 percent decline relative to Bitcoin’s stability was driven by leverage-related risks rather than a failure of Bitcoin’s fundamentals. The collapse of valuation premiums, concerns over dilution, and growing skepticism toward leveraged proxies all played major roles.

Bitcoin Leverage remains a powerful tool, but only when market conditions support it. When sentiment weakens, leverage can quickly erode value. Strategy’s recent performance highlights the importance of understanding structural risk when investing in Bitcoin-linked equities.

For investors, the takeaway is clear: exposure matters, but how that exposure is structured matters even more.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe