Trade Finance Blockchain and the Future of Global Trade

Trade Finance Blockchain is emerging as a powerful solution to long standing challenges in global trade. Even though trillions of dollars in goods move across borders every year, trade finance still depends heavily on paper documents, manual checks and disconnected systems. This creates delays, raises costs and limits access to financing, especially for smaller businesses.

Trade finance blockchain and outdated global systems

Trade finance supports international commerce by helping buyers and sellers manage payment risk and secure working capital. However, many of the processes involved have not changed for decades. Paper based letters of credit, physical bills of lading and repetitive compliance checks slow transactions and increase the chance of errors.

The global trade finance market is enormous, yet a large financing gap persists. Many small and medium sized enterprises struggle to obtain funding because banks face high onboarding costs and limited visibility into transaction risks. Trade finance blockchain solutions aim to address these issues by creating shared, digital systems that reduce friction and improve trust.

Why trade finance blockchain adoption is accelerating

Recent global disruptions have highlighted the weaknesses of traditional trade finance infrastructure. Supply chain interruptions, rising geopolitical tensions and stricter regulatory requirements have made speed and transparency more important than ever.

Trade finance blockchain enables multiple parties to access the same verified data in real time. Instead of each participant maintaining separate records, blockchain creates a single shared ledger. This reduces duplication, improves accuracy and allows faster decision making across the trade ecosystem.

Digital documents and faster settlement

One of the clearest benefits of trade finance blockchain is the digitization of trade documents. Key instruments such as letters of credit and shipping documents can be issued and transferred digitally. This significantly shortens processing times and lowers operational costs.

Faster settlement is another major advantage. Traditional trade transactions can take weeks to complete, tying up capital and increasing risk. Blockchain based systems allow transactions to settle automatically once predefined conditions are met. This improves liquidity for businesses and financial institutions alike.

Trade finance blockchain and financial inclusion

A major opportunity highlighted in the article is financial inclusion. Smaller exporters and importers are often excluded from trade finance because they lack credit histories or generate transactions that are too costly for banks to process.

Trade finance blockchain platforms can reduce onboarding and compliance costs by using shared digital identities and standardized data. Greater transparency also improves risk assessment, making it easier for lenders to support smaller businesses. As a result, blockchain has the potential to narrow the global trade finance gap.

Transparency as a risk reduction tool

Transparency is central to the value of trade finance blockchain. Every transaction recorded on a blockchain is time stamped and cannot be altered. This reduces the risk of fraud and document manipulation.

Banks benefit from improved visibility into transaction flows, which supports better risk management and regulatory reporting. Businesses gain clearer insight into their supply chains, helping them identify issues early and resolve disputes faster. These transparency benefits strengthen trust across the trade network.

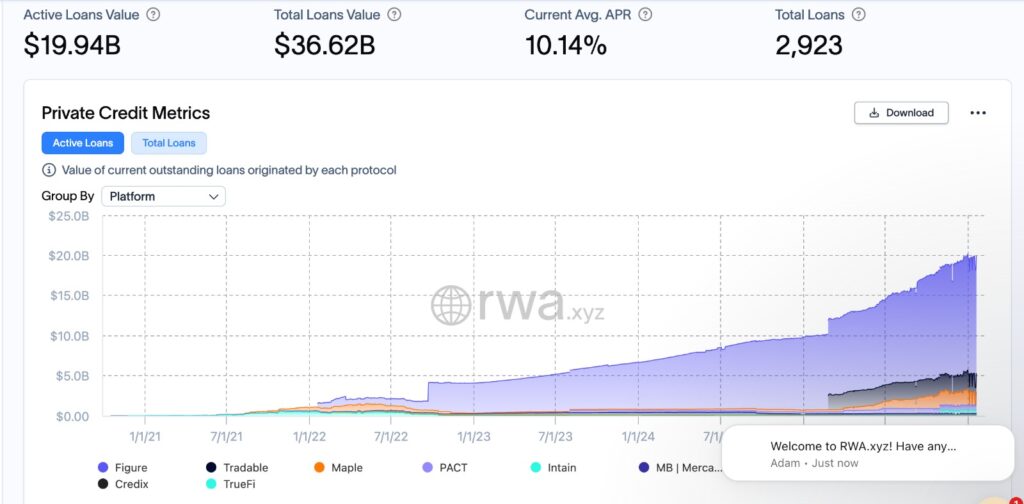

The steady rise shown in this chart reflects more than simple growth in on-chain lending activity. It suggests that participants are becoming comfortable holding credit exposure over longer periods, rather than treating these loans as short term experiments. The concentration of volume among a few platforms also hints at a preference for familiarity and perceived reliability, even in a market built around innovation. What stands out is not just expansion, but the gradual normalization of private credit as an on-chain asset class.

Editor’s View: Why trade finance resists change longer than expected

Trade finance has never struggled because of a lack of technology, but because of deeply ingrained habits and incentives. Many participants are comfortable managing risk through familiarity rather than efficiency, even when processes are slow or costly. Paper documents, manual checks and layered approvals often persist because they distribute responsibility rather than optimize outcomes. This helps explain why progress feels gradual, even when the economic case for modernization is clear.

Collaboration is key for trade finance blockchain

The article emphasizes that blockchain adoption in trade finance cannot succeed in isolation. Trade involves many stakeholders, including banks, logistics firms, insurers and regulators. Collaboration is essential to ensure systems work together.

Industry pilot programs and consortiums have played a key role in testing blockchain solutions in real world trade scenarios. These initiatives help identify technical challenges and build shared standards. However, scaling from pilots to full deployment remains a work in progress.

Regulatory and legal considerations

Legal recognition of digital trade documents remains a challenge in many jurisdictions. Trade finance blockchain solutions must operate across borders with different legal frameworks and regulatory requirements.

Progress is being made, but regulatory alignment is uneven. The article notes that ongoing engagement between technology providers, financial institutions and regulators is critical to avoid fragmentation and ensure long term success.

Trade finance blockchain beyond efficiency

While efficiency and cost savings are important, the long term impact of trade finance blockchain could be even greater. Blockchain may enable new ways to manage and distribute trade risk, such as tokenizing trade assets or improving access to secondary financing markets.

Better data sharing and automation could also support advanced analytics and smarter decision making. Over time, this may change how trade finance is priced and how capital flows through global markets.

Steady progress despite challenges

The article takes a balanced view of trade finance blockchain adoption. While the technology offers clear benefits, it is not a quick solution. Legacy systems, organizational resistance and regulatory complexity continue to slow progress.

Even so, momentum is building. As global trade becomes more complex and interconnected, the limitations of traditional systems are becoming harder to ignore. Trade finance blockchain offers a practical path toward greater efficiency, transparency and inclusion.

In summary, Trade Finance Blockchain represents a meaningful opportunity to modernize global trade finance. By reducing friction, improving access to capital and increasing trust, blockchain technology is positioned to play an increasingly important role in the future of international trade.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL