Crypto ETP Outflows Reach $1.7B Weekly Loss

Crypto ETP Outflows dominated digital asset markets last week as investors pulled approximately $1.7 billion from crypto exchange-traded products, marking the largest weekly outflow since mid-November 2025. The sharp reversal followed a period of strong inflows and reflects a notable shift in market sentiment toward caution and risk reduction. Bitcoin and Ether products were responsible for the majority of withdrawals, while select altcoin products showed limited resilience.

Crypto ETP Outflows Signal Sudden Sentiment Shift

Crypto ETP outflows refer to net capital withdrawals from exchange-traded products that offer regulated exposure to cryptocurrencies. These products are commonly used by institutional and professional investors who prefer structured vehicles over direct token ownership. A large outflow typically signals declining confidence or a reassessment of market risk.

The most recent data shows that roughly $1.73 billion exited crypto ETPs in a single week, ending a strong inflow streak that had added over $2 billion the week prior. This abrupt shift highlights how quickly sentiment can change when macroeconomic and market-specific pressures intensify.

Bitcoin and Ether Drive Crypto ETP Outflows

Bitcoin Products Face Heavy Selling Pressure

Bitcoin-linked ETPs recorded the largest share of crypto ETP outflows, with approximately $1.09 billion withdrawn over the week. As the largest and most widely held digital asset, Bitcoin often acts as the primary entry and exit point for institutional capital. When confidence weakens, Bitcoin products tend to experience the earliest and largest withdrawals.

The scale of Bitcoin outflows suggests that investors are reducing exposure rather than rotating within the asset class. This behavior reflects caution rather than selective repositioning.

Ether Products Follow the Same Trend

Ether-based ETPs also experienced significant pressure, recording roughly $630 million in net outflows. Combined with Bitcoin, these two assets accounted for nearly all the capital that left crypto exchange-traded products during the period.

Ether’s losses mirror broader concerns around crypto valuations, lack of short-term catalysts, and reduced appetite for risk assets. Together, Bitcoin and Ether withdrawals underline a broad defensive posture among investors.

Altcoins Show Mixed Crypto ETP Outflows

While major assets faced strong selling, some altcoin-focused ETPs recorded modest inflows. Solana-linked products saw around $17 million in inflows, while Chainlink products added just under $4 million. These inflows suggest that a smaller segment of investors continues to pursue targeted opportunities despite overall market weakness.

In contrast, other altcoin products were not immune. XRP-linked ETPs recorded approximately $18 million in outflows, while Sui products lost around $6 million. These figures remain small compared to Bitcoin and Ether but show that caution extends across most of the market.

Issuer Breakdown of Crypto ETP Outflows

Major Issuers Experience Significant Withdrawals

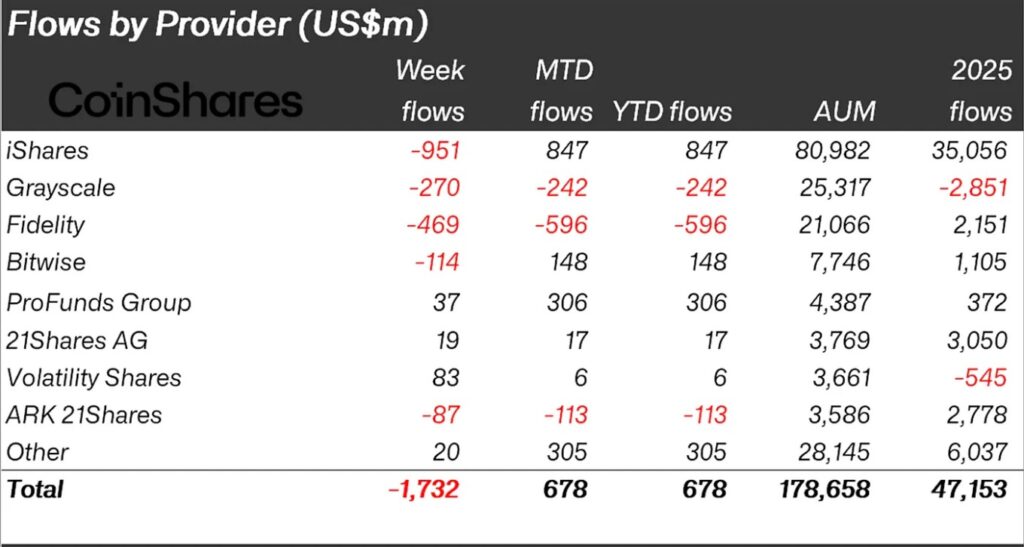

The issuer-level breakdown highlights how concentrated the recent withdrawals were among the largest providers, particularly those most commonly used by institutional investors. Large weekly outflows from firms like iShares, Fidelity, and Grayscale suggest portfolio-level adjustments rather than isolated product failures. At the same time, smaller but consistent inflows into niche providers point to selective positioning rather than a full retreat from crypto exposure. This uneven distribution reinforces the idea that capital is being reallocated within the ecosystem, not exiting it uniformly.

Crypto ETP outflows were heavily concentrated among the largest issuers. BlackRock’s iShares crypto products saw nearly $951 million in net outflows, making it the most affected provider during the week. Fidelity Investments followed with around $469 million in withdrawals, while Grayscale products recorded approximately $270 million in outflows.

These figures reflect the scale of institutional participation in crypto ETPs. When sentiment shifts, the largest providers naturally experience the biggest capital movements.

Smaller Issuers See Select Inflows

Despite the overall negative trend, some smaller issuers reported net inflows. Volatility-focused crypto products recorded around $83 million in inflows, while ProFunds attracted roughly $37 million. These inflows suggest that certain tactical or niche strategies remain attractive to investors seeking hedging or short-term positioning.

Regional Impact of Crypto ETP Outflows

The United States accounted for the overwhelming majority of crypto ETP outflows. U.S.-listed products saw approximately $1.8 billion leave the market during the week. This concentration highlights how strongly U.S. investor sentiment influences global crypto investment trends.

As a result of these withdrawals, total assets under management across crypto exchange-traded products fell from roughly $193 billion to about $178 billion in a single week. This decline underscores how rapidly capital can exit the market when confidence weakens.

Macro Factors Behind Crypto ETP Outflows

Interest Rate Expectations Weigh on Markets

One of the main drivers behind recent crypto ETP outflows has been changing expectations around interest rates. Reduced confidence in near-term rate cuts has lowered risk appetite, making speculative assets like crypto less attractive relative to safer alternatives.

Higher interest rates tend to pressure risk assets by increasing the opportunity cost of holding volatile investments. This macro backdrop has contributed to a broad pullback across digital asset products.

Weak Price Momentum Adds Pressure

Crypto markets have struggled to maintain upward momentum in recent months. Price declines and failed breakouts have reinforced bearish sentiment, prompting investors to lock in gains or reduce exposure. Without strong catalysts, many investors prefer to wait on the sidelines.

What Crypto ETP Outflows Mean Going Forward

A Period of Rebalancing

Large crypto ETP outflows do not necessarily indicate long-term weakness. In many cases, they reflect portfolio rebalancing after strong rallies or during periods of uncertainty. Investors may return once macro conditions stabilize or new catalysts emerge.

Institutional Confidence Remains Key

Crypto ETP flows remain one of the clearest indicators of institutional sentiment. A return to inflows would likely signal renewed confidence, while continued outflows may suggest prolonged caution.

Editor’s View: Reading Between the Outflows

Large crypto ETP outflows are often interpreted as outright rejection of the asset class, but that framing can miss the human element behind the data. Many institutional investors operate under strict risk and volatility constraints, which means exposure is frequently reduced not because conviction disappears, but because uncertainty increases. When price action stalls and macro signals become less clear, stepping aside is often a procedural decision rather than an emotional one. In that sense, these outflows may reflect hesitation and patience more than a decisive shift in long-term belief.

Conclusion

Crypto ETP Outflows reached $1.7 billion in a single week, the largest weekly withdrawal since mid-November 2025. Bitcoin and Ether products bore the brunt of the selling, while altcoins showed mixed results. Driven by macroeconomic uncertainty, weaker price momentum, and reduced risk appetite, these outflows highlight a cautious phase for crypto markets. As conditions evolve, crypto ETP flows will continue to serve as a critical gauge of investor confidence.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL