Bitcoin Hashrate Drops as US Winter Storm Halts Miners

Bitcoin Hashrate fell sharply as a powerful winter storm swept across large parts of the United States, forcing many Bitcoin miners to temporarily shut down or reduce operations. The extreme weather brought freezing temperatures, snow, ice, and widespread power disruptions, placing heavy pressure on regional electricity grids. As a result, miners in key U.S. locations scaled back their energy usage, causing a noticeable decline in the total computing power securing the Bitcoin network.

The United States has become one of the most important regions for Bitcoin mining, and when weather events disrupt operations at this scale, the impact can be seen across the entire network. During the storm, the Bitcoin network experienced slower block production as mining power dropped significantly in a short period of time.

What Bitcoin Hashrate Means for the Network

Bitcoin Hashrate refers to the total amount of computational power being used by miners to process transactions and secure the blockchain. It is a critical indicator of network health and security. When hashrate is high, the network is more secure and blocks are mined closer to the expected 10-minute average.

When hashrate drops suddenly, block times can slow down. This does not break the network, but it can cause delays in transaction confirmations until the system adjusts. The recent winter storm created exactly this situation, as a large amount of mining capacity went offline almost simultaneously.

The storm’s impact highlighted how dependent Bitcoin mining is on real-world infrastructure such as electricity grids and weather conditions.

Bitcoin Hashrate Declines Across Major Mining Pools

Foundry USA Sees Major Reduction

One of the most significant reductions in Bitcoin Hashrate came from Foundry USA, one of the largest Bitcoin mining pools in the world. During the storm, Foundry USA’s hashrate dropped by roughly 60 percent. This represented a reduction of nearly 200 exahashes per second of mining power.

Even after this sharp decline, Foundry USA remained the largest mining pool by share of total hashrate. However, its pullback alone was enough to noticeably affect overall network performance, showing how concentrated mining activity has become in the United States.

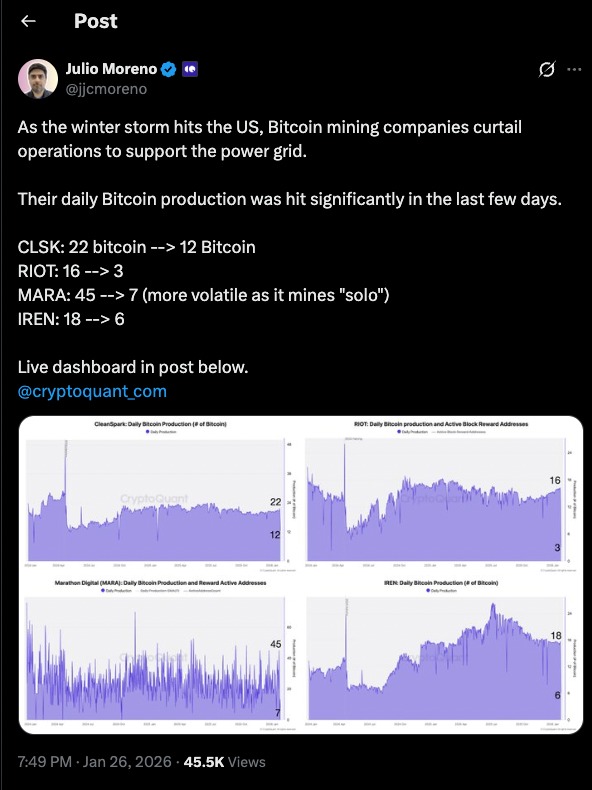

The production figures shared by industry analysts illustrate how sharply mining output can fall when operators curtail activity, even over a short period. For publicly listed miners, these drops reflect deliberate operational choices rather than technical failure, as machines are powered down in response to grid conditions. The uneven declines across firms also highlight differences in mining strategy, infrastructure, and exposure to demand response programs. In this context, reduced Bitcoin output is less a signal of distress and more a reflection of how tightly mining operations are now integrated with energy management decisions.

Other US-Based Miners Also Cut Back

Foundry USA was not alone. Other mining pools and operators based in the U.S. also reduced their hashrate during the storm. Pools such as Luxor, as well as operations connected to Antpool and Binance Pool, showed declines as miners shut down machines or reduced output.

In total, hundreds of exahashes per second were removed from the network during the peak of the storm. Some of these reductions were mandatory due to power outages, while others were voluntary as miners responded to grid conditions.

Why Miners Shut Down During the Winter Storm

Bitcoin Hashrate and Grid Stability

Bitcoin miners are large electricity consumers, but they are also highly flexible. Unlike many industries, mining operations can shut down almost instantly without damaging equipment or long-term productivity. This makes miners useful participants in energy demand response programs.

During the winter storm, electricity demand surged as households and businesses relied heavily on heating. To avoid grid failure and blackouts, miners reduced power usage to free up electricity for essential services.

In some areas, miners were compensated for curtailing operations, while in others, shutdowns were necessary simply to maintain grid stability.

Power Outages and Safety Concerns

In addition to voluntary curtailments, widespread power outages also played a role. The storm knocked out power to large numbers of homes and businesses, and mining facilities were affected as well. In extreme cold conditions, safety concerns and infrastructure risks made it impractical for many miners to continue operating.

Short-Term Effects of Lower Bitcoin Hashrate

The immediate effect of the hashrate drop was slower block production. At times, average block times increased to around 12 minutes instead of the usual 10 minutes. This led to temporary congestion and slower transaction confirmations.

However, Bitcoin is designed to handle these situations. The network automatically adjusts its mining difficulty every 2016 blocks to ensure long-term stability. If hashrate remains lower for an extended period, difficulty decreases, making it easier for miners to find blocks.

Because the winter storm was temporary, the hashrate decline was expected to reverse once miners returned online.

Broader Implications for Bitcoin Mining

Geographic Concentration Risks

The event highlighted the risks of geographic concentration in Bitcoin mining. With a large share of global hashrate located in the United States, regional weather events can now have global network effects.

This has led to renewed discussion about the importance of diversifying mining locations and energy sources to reduce exposure to extreme weather and grid stress.

Economic Pressures on Miners

The storm occurred during a period when miners are already facing financial pressure from energy costs and market conditions. Temporary shutdowns reduce revenue and can strain smaller operators more than larger, well-capitalized firms.

Some miners are exploring ways to diversify operations or invest in more resilient infrastructure to reduce future disruptions.

Editor’s View: Bitcoin Hashrate and Miner Decision-Making Under Stress

What the hashrate charts do not show is the mindset behind these shutdowns. For many miners, curtailing operations during extreme weather is no longer an emergency reaction but an operational habit shaped by past grid crises. Years of exposure to volatile energy markets have trained operators to think in terms of optionality rather than constant uptime. In that sense, the hashrate drop reflects not panic, but a calculated acceptance that short-term revenue loss can be preferable to long-term operational risk.

Bitcoin Hashrate Resilience Going Forward

The winter storm served as a real-world stress test for Bitcoin Hashrate resilience. While the network experienced slower performance, it continued operating without interruption. The event demonstrated both the vulnerability of mining infrastructure to weather and the flexibility of miners as grid participants.

As extreme weather events become more common, miners and policymakers alike may place greater emphasis on energy planning, grid cooperation, and infrastructure resilience. For Bitcoin, the episode reinforced that while short-term disruptions can happen, the network is built to adapt and recover.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL