Gold Market Cap Surges by Over $1 Trillion in One Day

Gold Market Cap surged dramatically in a single trading day, capturing global attention as gold added more than a trillion dollars to its total valuation. This rare movement pushed gold to new record highs and highlighted a growing shift in investor sentiment toward traditional safe-haven assets. While digital assets like Bitcoin continue to attract long-term interest, the sudden rise in gold’s value demonstrated the scale, stability, and influence of the precious metal in times of economic uncertainty.

Gold prices climbed sharply, moving above key psychological levels and driving the total market capitalization of gold to roughly $34 trillion. The increase alone was almost equal to the entire market value of Bitcoin, placing the magnitude of the move into clear perspective. Such a dramatic one-day change is uncommon for an asset as mature and widely held as gold, making the rally particularly notable for both traditional and crypto-focused investors.

Gold Market Cap Reaches Historic Levels

The latest Gold Market Cap expansion was driven by a strong rise in spot gold prices, which increased by more than four percent in a single day. This surge pushed gold to a new nominal high, reinforcing its reputation as a store of value during periods of heightened market stress. Investors responded to macroeconomic concerns by reallocating capital into assets perceived as stable and reliable.

Gold’s market value has always been vast due to its centuries-long role in global finance. However, the speed at which value was added during this rally stands out. The single-day increase was large enough to rival the market capitalization of the world’s largest cryptocurrencies, underscoring the sheer scale of gold as an asset class.

Why Gold Market Cap Can Move So Quickly

Although gold is considered a slow-moving asset compared to equities or cryptocurrencies, sharp price increases can still occur when demand rises rapidly. Factors such as geopolitical uncertainty, inflation concerns, and shifting interest rate expectations often trigger strong buying activity. When these forces align, gold prices can rise quickly, leading to substantial changes in total market capitalization.

Another contributing factor is the size of the gold market itself. Even modest percentage gains translate into massive dollar increases due to gold’s already enormous valuation. This explains how a relatively small price movement resulted in over a trillion dollars being added to the Gold Market Cap in just one day.

Gold Market Cap Versus Bitcoin Market Value

The recent rally renewed comparisons between gold and Bitcoin, two assets often viewed as alternatives to traditional fiat currencies. While Bitcoin is frequently described as digital gold, the difference in scale between the two assets remains significant. The one-day increase in gold’s market value nearly matched Bitcoin’s total market capitalization.

Over longer time frames, gold has delivered steady gains with lower volatility, while Bitcoin has experienced sharper price swings. During periods of market instability, investors tend to favor assets with proven track records, which helps explain why gold outperformed Bitcoin during this period.

Investor Behavior Behind the Gold Market Cap Surge

Investor behavior played a major role in the rapid expansion of the Gold Market Cap. As risk appetite declined, capital flowed out of more volatile assets and into gold. Institutional investors, in particular, often turn to gold when seeking to preserve capital rather than chase growth.

This shift does not necessarily signal a loss of confidence in digital assets, but rather reflects short-term risk management decisions. Gold’s long-standing reputation as a hedge against inflation and economic uncertainty continues to make it attractive when markets become unpredictable.

Silver and the Broader Precious Metals Rally

The movement in gold was not isolated. Silver also recorded strong gains during the same period, contributing to a broader rally across the precious metals sector. This coordinated rise suggests a wider investor preference for tangible assets with intrinsic value.

Silver’s performance often complements gold, as both metals tend to benefit from similar macroeconomic conditions. The strength of silver further reinforced confidence in the precious metals market and added momentum to the overall increase in Gold Market Cap.

Market Cap Comparisons Across Asset Classes

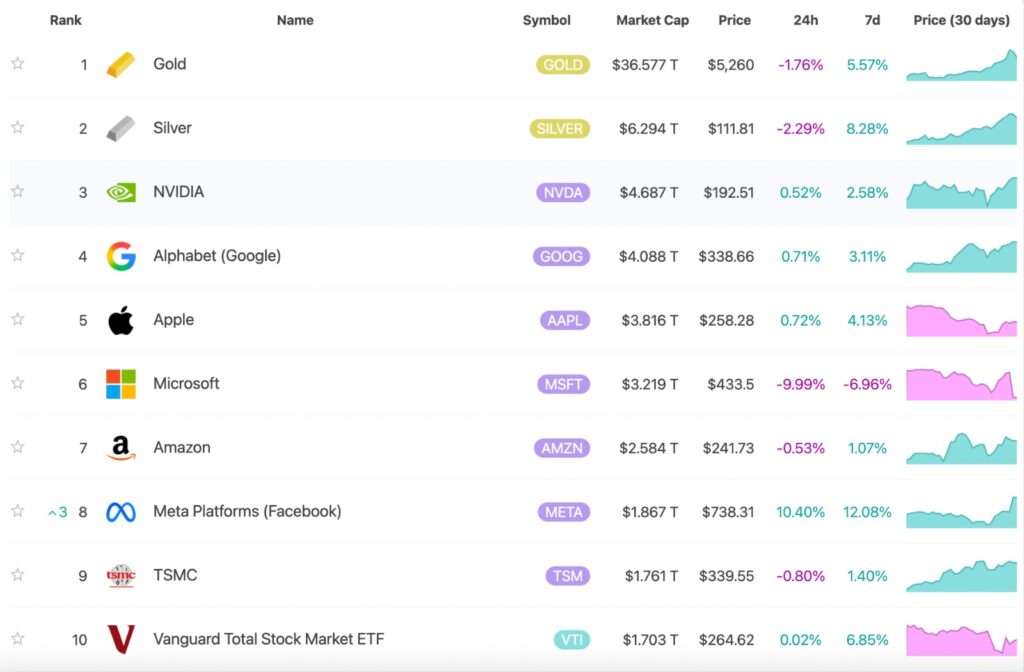

Seeing gold ranked alongside major corporations and broad-market ETFs puts its scale into perspective in a way raw numbers often fail to convey. Unlike equities, gold does not represent future earnings or growth expectations, yet its market value exceeds that of the largest technology firms combined. This contrast helps explain why gold behaves differently during periods of stress, as its valuation is driven more by preservation and trust than by performance metrics. The comparison also highlights why shifts into gold can feel sudden, even though they are often the result of gradual changes in investor confidence.

When compared to equities, technology companies, or cryptocurrencies, gold’s market capitalization stands in a class of its own. Even the world’s largest corporations represent only a fraction of gold’s total valuation. This scale explains why movements in gold prices can have wide-reaching implications for global financial markets.

The contrast also highlights the relative youth of digital assets. While cryptocurrencies may offer higher growth potential, gold’s size and stability continue to make it a cornerstone of global asset allocation strategies.

Editors View: How Investors Actually React in Moments Like This

What often gets missed in large market cap moves is that they rarely begin with conviction and usually start with hesitation. Many investors do not rush into gold because they expect dramatic gains, but because they quietly lose confidence in other signals they normally trust. When uncertainty rises across multiple fronts at once, capital tends to drift toward familiarity rather than opportunity. Gold benefits in these moments not because it is exciting, but because it is boring in a way that feels reliable. That reliability, more than any chart pattern, explains why capital can move so quickly into an asset that has existed for thousands of years.

What the Gold Market Cap Surge Means for Investors

The sudden increase in Gold Market Cap serves as a reminder of how quickly investor sentiment can shift. During times of uncertainty, capital preservation often becomes a priority, and gold remains one of the most trusted options for that purpose.

For investors, the event underscores the importance of diversification. Balancing exposure between traditional assets like gold and emerging assets such as cryptocurrencies can help manage risk across different market environments.

Future Outlook for Gold Market Cap

Looking ahead, gold’s role as a defensive asset is likely to remain strong. If economic uncertainty, inflation pressures, or geopolitical risks persist, demand for gold could continue to support a high Gold Market Cap. While price movements may stabilize after such a sharp rally, gold’s long-term position appears secure.

At the same time, Bitcoin and other digital assets will continue to evolve and attract investors seeking growth and innovation. The comparison between gold and Bitcoin is not about choosing one over the other, but understanding how each asset responds to different market conditions.

In conclusion, the massive one-day expansion of gold’s market value highlights the enduring power of traditional safe-haven assets. The Gold Market Cap surge was not just a headline moment, but a clear reflection of investor priorities in uncertain times, reinforcing gold’s central role in the global financial system.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL