Coinbase Loss Q4 Earnings Explained

Coinbase Loss defined the fourth quarter of 2025 for Coinbase Global, as the major cryptocurrency exchange reported a substantial financial setback following weaker market conditions. The company disclosed a net loss of 667 million dollars, marking a notable shift after several quarters of profitability. The results highlighted how sensitive crypto exchange performance remains to broader digital asset trends, particularly fluctuations in prices and trading activity.

Coinbase Loss and Quarterly Earnings

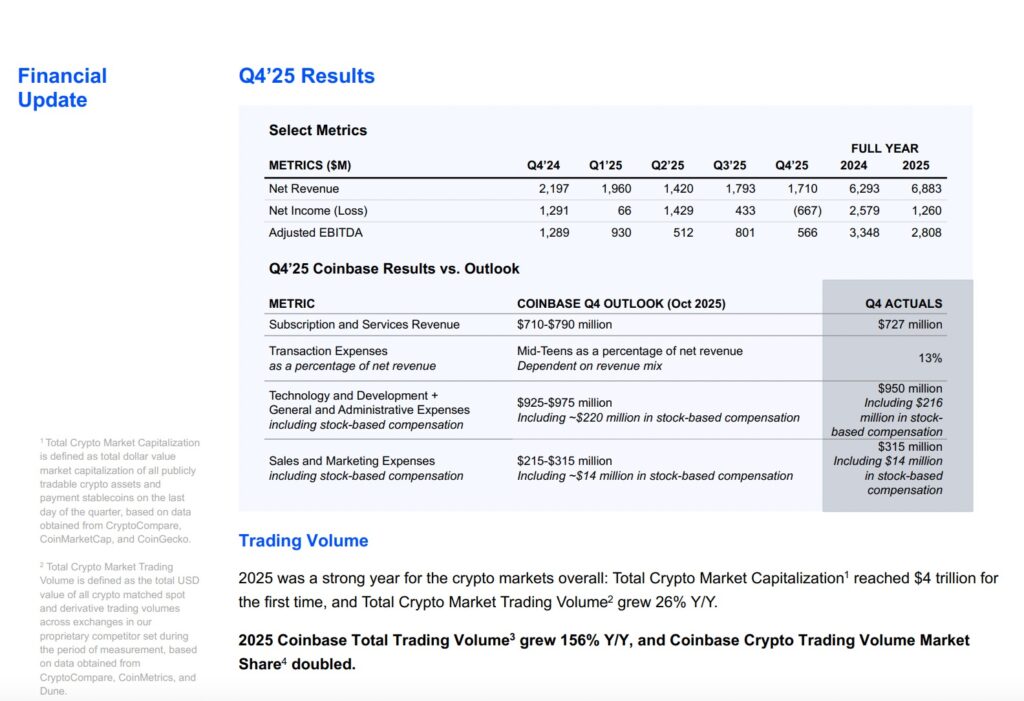

The quarterly figures illustrate the uneven revenue dynamics Coinbase faced during the period. While net revenue remained substantial, the shift from positive net income in prior quarters to a reported loss highlights how sensitive profitability can be to changes in trading conditions and expense structures. Variations across adjusted EBITDA and cost categories further show that operational performance cannot be evaluated through a single metric alone. Taken together, the data emphasizes the importance of revenue mix, market activity, and cost management in determining exchange earnings stability.

The Coinbase Loss stood out because it ended a streak of consecutive profitable quarters for the company. Coinbase had previously demonstrated resilience during earlier phases of market volatility, but changing conditions in late 2025 created new challenges. The reported loss reflected a combination of declining revenues, reduced transaction activity, and softer investor engagement across cryptocurrency markets.

Coinbase recorded net revenue of 1.78 billion dollars for the quarter, representing a year on year decline of approximately 21.5 percent. This figure fell below market expectations and contributed to the earnings disappointment. Earnings per share also missed analyst forecasts, signaling weaker financial performance than investors had anticipated.

Market Conditions Behind Coinbase Loss

The Coinbase Loss was closely linked to developments within the cryptocurrency market during the fourth quarter. Bitcoin and other major digital assets experienced a significant decline in prices, reversing gains achieved earlier in the year. Bitcoin’s drop during this period had a direct effect on trading volumes, investor sentiment, and exchange activity.

Price declines typically reduce speculative trading behavior as market participants adopt more cautious strategies. Lower asset valuations can discourage both retail and institutional investors from executing frequent trades. For exchanges like Coinbase, which rely heavily on transaction fees, reduced trading activity often leads to noticeable revenue pressure.

Transaction Revenue Decline

Transaction revenue represented one of the most affected areas of Coinbase’s business. This revenue stream, historically the company’s primary source of income, declined sharply compared with the previous year. The decrease reflected weaker trading volumes driven by market uncertainty and declining crypto prices.

Retail trading activity saw particular weakness as individual investors reduced participation amid volatility. Institutional trading volumes also softened, though market dynamics in this segment tend to differ from retail behavior. The overall decline in transaction revenue played a central role in the quarterly loss.

Subscription and Services Revenue Growth

While transaction revenues fell, Coinbase’s subscription and services segment demonstrated relative stability. This business line includes income from staking services, stablecoin related activities, custody solutions, and other platform offerings that are less dependent on frequent trading. During the quarter, subscription and services revenue increased compared with the prior year.

The growth of this segment reflects Coinbase’s ongoing efforts to diversify its revenue structure. By expanding products that generate recurring income, the company aims to reduce reliance on transaction based earnings. However, despite this growth, subscription revenue was not sufficient to offset the sharp declines in trading related income.

Editor’s View: Market Behavior Beyond the Numbers

Periods of declining prices often reshape participant behavior in ways that raw metrics fail to capture. Trading slowdowns rarely stem from a single factor, but instead from a collective shift in risk tolerance, attention, and conviction. When volatility increases while confidence weakens, many market participants choose inactivity over reaction, which quietly compresses exchange activity. This behavioral pause can persist even when prices stabilize, reflecting hesitation rather than renewed optimism.

Investor Reaction to Coinbase Loss

Financial markets reacted with volatility following the Coinbase Loss announcement. Coinbase shares experienced downward pressure immediately after the earnings release, reflecting investor concerns over the net loss and revenue miss. Subsequent price movements suggested mixed sentiment as some investors evaluated the results within the context of broader crypto market cycles.

Stock price fluctuations are common for crypto related companies, whose valuations are often closely tied to digital asset performance. Earnings reports that reveal revenue declines or unexpected losses frequently trigger sharp market reactions. Coinbase’s experience was consistent with this pattern.

Forward Guidance and Outlook

Looking ahead, Coinbase provided cautious guidance for the first quarter of 2026. Management signaled expectations of continued uncertainty, particularly regarding transaction revenues and overall trading activity. The company projected subscription and services revenue within a conservative range, reflecting a measured outlook amid ongoing market volatility.

Such projections indicate that Coinbase is preparing for the possibility of sustained market softness rather than a rapid rebound. This conservative stance aligns with the unpredictable nature of cryptocurrency markets, where price movements and investor behavior can shift quickly.

Coinbase Loss in the Crypto Cycle

The Coinbase Loss fits within a familiar pattern observed throughout cryptocurrency market history. Digital asset markets have repeatedly experienced cycles of rapid expansion followed by corrections. During bullish phases, rising prices and strong investor participation tend to drive exchange revenues higher. Conversely, downturns often compress volumes and pressure profitability.

For Coinbase, the fourth quarter results illustrate how these cycles influence financial outcomes. Even well established exchanges with large user bases and diversified offerings remain exposed to market driven revenue fluctuations. This structural characteristic defines much of the crypto exchange business model.

Strategic Implications for Coinbase

Beyond short term financial impacts, the Coinbase Loss underscores the importance of Coinbase’s diversification strategy. Expanding stable income sources, such as subscription services and platform based products, may help reduce earnings volatility over time. Building resilience against market downturns remains a critical objective for long term sustainability.

Coinbase has continued investing in services designed to generate recurring revenues and attract broader customer engagement. While such initiatives can strengthen business stability, transitions in revenue composition typically require extended timeframes to materially alter financial performance.

Conclusion

Coinbase Loss serves as a reminder of the inherent volatility within cryptocurrency driven businesses. The company’s fourth quarter performance reflected the combined effects of declining digital asset prices, reduced trading volumes, and shifting market sentiment. Despite near term challenges, Coinbase’s scale, brand recognition, and diversification efforts position it to navigate evolving market conditions.

Future performance will depend on both broader cryptocurrency market developments and the company’s ability to balance transaction dependent revenues with more stable service based income streams.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe