AI Crypto Wallets Enable Autonomous Digital Agents

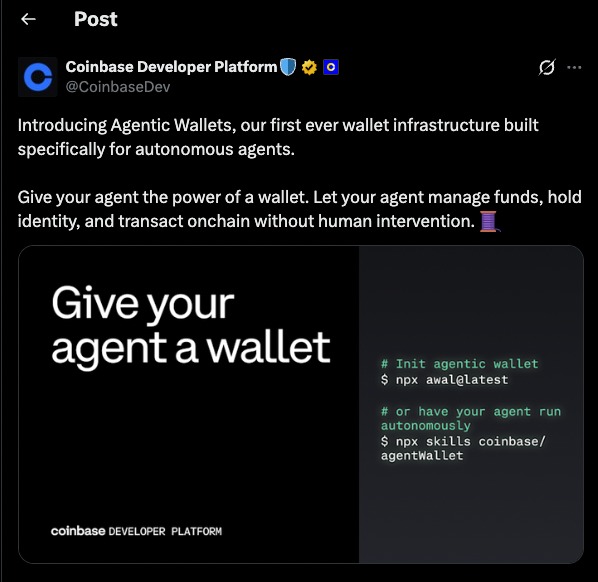

AI Crypto Wallets are emerging as a powerful bridge between artificial intelligence and decentralized finance. Coinbase recently introduced a new wallet infrastructure designed specifically for AI agents, enabling them to hold assets, make transactions, and execute financial actions without constant human intervention. This development signals an important shift in how digital systems may participate in economic activity, moving beyond passive analysis into direct financial interaction.

What Are AI Crypto Wallets?

AI Crypto Wallets differ significantly from traditional cryptocurrency wallets. Instead of being designed primarily for human users, these wallets are built for software agents that operate autonomously. Their core purpose is to allow AI systems to manage and use digital assets programmatically, based on predefined rules and permissions.

In conventional setups, AI tools can analyze data, generate insights, or recommend actions. However, they typically lack the ability to directly execute financial transactions. AI Crypto Wallets address this limitation by giving agents a native financial layer. This means an AI system can not only suggest a trade or payment but actually perform it within established boundaries.

Such wallets are designed to function as part of an agent’s operational logic. They allow artificial intelligence to interact with blockchain networks, decentralized applications, and smart contracts as an active economic participant rather than a passive observer.

Why Coinbase Introduced AI Crypto Wallets

The motivation behind AI Crypto Wallets centers on expanding the practical capabilities of autonomous agents. As AI systems become more sophisticated, their usefulness increasingly depends on the ability to take real-world actions. Financial transactions are a critical component of this evolution.

By enabling agents to directly control and move funds, Coinbase is effectively unlocking new categories of machine-driven activity. AI agents can pay for services, access resources, manage investments, or interact with decentralized finance protocols without requiring manual approval at every step.

This infrastructure also supports continuous operation. Unlike human users, AI agents can function around the clock. With integrated wallets, they can react instantly to changing conditions, whether those involve market fluctuations, pricing shifts, or computational needs.

The announcement highlights how Coinbase positions Agentic Wallets not simply as a developer tool, but as a foundational component for autonomous systems. The language used emphasizes identity, fund management, and direct onchain interaction, signaling a broader design philosophy rather than a narrow feature release. This framing reflects an industry trend where infrastructure providers increasingly focus on enabling machine-native financial behavior. It also suggests that wallet functionality is becoming an integral layer of agent architecture rather than an external integration.

Core Capabilities of AI Crypto Wallets

Autonomous Transactions

One of the defining features of AI Crypto Wallets is the ability to perform transactions independently. Agents can send and receive cryptocurrency, pay network fees, and interact with blockchain-based systems according to programmed logic.

This autonomy reduces friction in digital workflows. Instead of relying on external approvals or human actions, agents can complete tasks end to end. For example, an AI agent tasked with retrieving data from a paid API could automatically process the required payment before accessing the resource.

Continuous Financial Operations

AI Crypto Wallets allow agents to operate without time constraints. Financial decisions and actions can occur at any hour, enabling real-time responses to dynamic environments. This is especially relevant in decentralized finance, where conditions such as yields, liquidity, and prices can change rapidly.

An AI agent could monitor multiple protocols, detect opportunities, and rebalance positions immediately. The absence of delays associated with manual oversight can significantly enhance efficiency and responsiveness.

Programmatic Control

Another important capability is fine-grained programmatic control. AI Crypto Wallets are not simply containers for assets; they are programmable tools. Developers can define spending limits, permitted actions, and risk parameters that govern agent behavior.

This structure helps ensure that agents act within safe and predictable boundaries. Rather than granting unrestricted control, wallet permissions can be tailored to specific tasks or strategies.

Efficiency Improvements

On supported blockchain networks, AI Crypto Wallets can enable more efficient transaction flows. Reduced friction and optimized fee handling allow agents to conduct frequent operations without unnecessary overhead. This is particularly useful for high-frequency or microtransaction-based activities.

Security and Guardrails

Security is a central concern when granting financial capabilities to autonomous systems. AI Crypto Wallets incorporate multiple protective mechanisms to mitigate risks. Permissions and constraints act as the first line of defense, ensuring agents cannot exceed defined limits.

Private key management is another critical factor. Secure environments isolate sensitive credentials from the agent’s decision-making logic. This separation reduces the likelihood of accidental exposure or misuse.

These guardrails are essential for building trust in agent-driven finance. Without robust controls, autonomous wallets could introduce unacceptable vulnerabilities. With them, developers gain a framework for safe experimentation and deployment.

Potential Use Cases for AI Crypto Wallets

AI Crypto Wallets open the door to a wide range of applications. In infrastructure and cloud services, agents could autonomously purchase computing resources or storage. In digital marketplaces, they might handle payments, subscriptions, or licensing.

Decentralized finance represents another major area of opportunity. Agents can manage liquidity, execute trades, or optimize yield strategies continuously. Their ability to process information and act instantly could transform automated financial management.

Gaming and virtual economies may also benefit. AI-driven characters or systems could manage assets, conduct trades, or participate in economic systems without direct human control.

Editor’s View: Human Behavior Behind Automation

Markets are not driven purely by logic, even when automation becomes more prevalent. Participants often respond not just to price movements, but to narratives, perceived risks, and collective sentiment. The introduction of AI Crypto Wallets may therefore influence behavior in subtle ways, as traders and builders adjust their assumptions about speed, competition, and decision making. Some may see efficiency gains, while others may become more cautious about interacting with systems that operate beyond human reaction times. These shifts tend to emerge gradually and rarely appear clearly in data at first glance.

Broader Implications

The introduction of AI Crypto Wallets reflects a broader trend toward machine-native economic systems. As AI agents become more capable, the ability to transact digitally becomes increasingly important. Wallet-enabled agents may eventually participate in complex networks of services and exchanges.

This evolution suggests the possibility of a machine economy, where autonomous systems interact financially with one another. Payments, resource allocation, and value exchange could occur seamlessly between software entities.

Challenges and Considerations

Despite their promise, AI Crypto Wallets also raise important questions. Autonomous financial behavior introduces new dimensions of risk, including potential errors, unexpected interactions, or market effects. Careful design and oversight remain crucial.

Regulatory, ethical, and security considerations will shape how widely such systems are adopted. Clear permission structures and responsible implementation practices are likely to play a decisive role.

Conclusion

AI Crypto Wallets represent a significant step in integrating artificial intelligence with decentralized financial infrastructure. By enabling agents to hold and use digital assets directly, Coinbase has expanded the functional scope of AI systems. While challenges remain, this innovation highlights a future where autonomous software can participate meaningfully in digital economies.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe