Bitcoin and Ether longs surge as whale bets $55M on rebound

Bitcoin and Ether longs are once again making headlines after a major crypto whale, known as HyperUnit, placed massive bets on both assets. The trader, famous for correctly predicting the US-China tariff crash last month, has opened $55 million in new long positions, suggesting a possible reversal in the ongoing market correction.

According to crypto analytics platform Arkham, the HyperUnit whale opened a $37 million Bitcoin long and an $18 million Ether long on the decentralized derivatives exchange Hyperliquid. The move quickly drew attention across the crypto community, as it came just weeks after HyperUnit profited over $200 million from shorting the market during the tariff-led crash in early October.

HyperUnit whale returns with massive Bitcoin and Ether longs

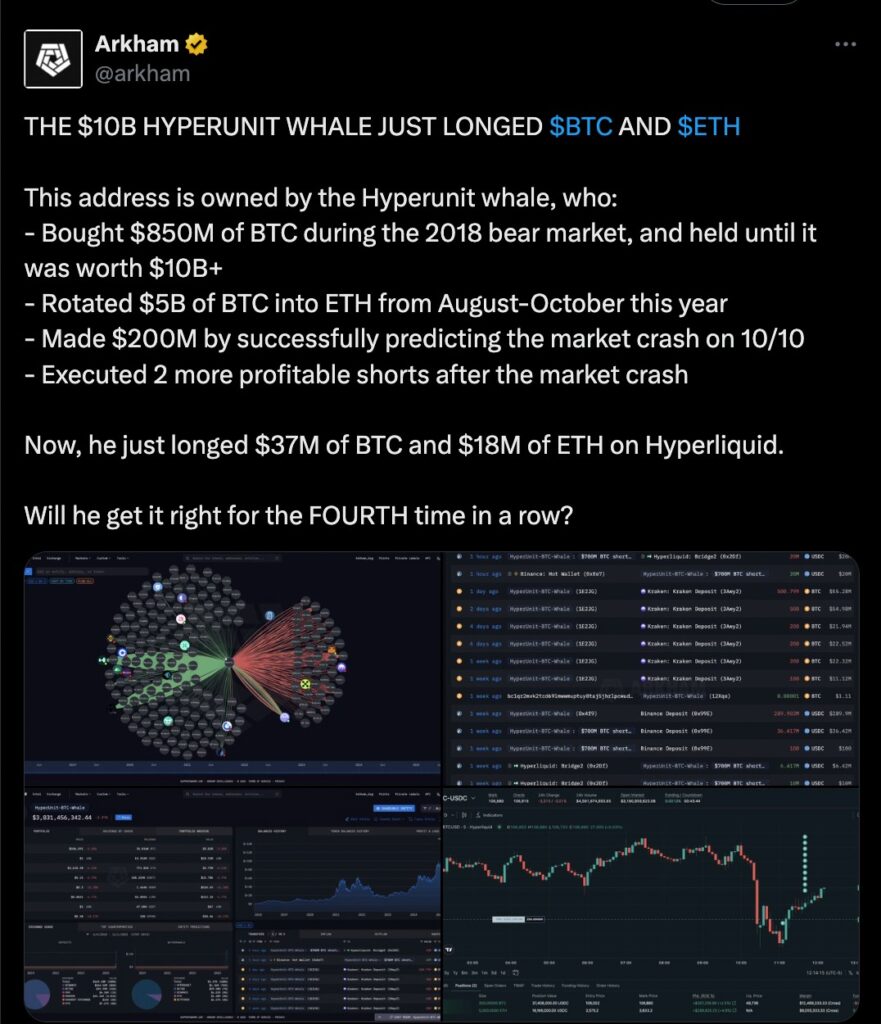

A post by crypto intelligence platform Arkham on X highlighted the whale’s latest move, confirming that the address linked to HyperUnit had just opened $37 million in Bitcoin longs and $18 million in Ether longs on Hyperliquid. The post also summarized the trader’s impressive history, including buying $850 million worth of Bitcoin during the 2018 bear market, rotating $5 billion of BTC into ETH between August and October, and profiting $200 million from correctly predicting the October 10 market crash. The attached charts and transaction data provided visual proof of the whale’s on-chain activity and open positions.

(Image source: Arkham/X)

The HyperUnit whale has become a standout figure in the trading world after a series of accurate market calls. On Oct. 10, they predicted a sharp downturn linked to tensions between the United States and China over tariffs, turning that insight into a $200 million gain. Since then, they’ve correctly executed two additional profitable short trades.

Now, with $55 million in Bitcoin and Ether longs, market watchers are wondering if HyperUnit is positioning for another winning streak. Arkham even posed the question on social media: “Will they get it right for the fourth time in a row?”

HyperUnit’s trading record and timing have sparked discussions about whether the market has finally found a bottom. While the broader sentiment remains cautious, such large-scale bets from experienced whales often influence other traders to reconsider their market outlook.

Long-term holder with deep Bitcoin roots

HyperUnit’s involvement in the crypto market stretches back nearly seven years. During the depths of the 2018 bear market, the whale reportedly purchased around $850 million worth of Bitcoin, when prices were a fraction of today’s levels, and held until their portfolio ballooned to about $10 billion. This long-term conviction combined with well-timed trades has earned them respect among both retail and institutional traders.

As of now, Bitcoin is trading around $106,598, while Ether stands at $3,602. Both assets remain below their record highs, with Bitcoin down approximately 15.5% from its peak and Ether down 27.3%. Despite this decline, HyperUnit’s new Bitcoin and Ether longs indicate renewed optimism that the market may soon bounce back.

Bitcoin and Ether longs defy market fear

While traders like HyperUnit are betting on a rebound, the broader market sentiment remains cautious. The Crypto Fear & Greed Index currently sits at 42, placing it firmly in the “Fear” zone. This suggests that retail investors are still hesitant to re-enter the market after recent losses.

However, some analysts view this as a potentially bullish indicator. Historically, fear-driven environments often coincide with market bottoms, creating opportunities for long-term investors to accumulate assets before a recovery phase. HyperUnit’s aggressive positions could therefore reflect a contrarian strategy, taking advantage of widespread pessimism.

Whale activity and investor psychology

Bitwise CEO Hunter Horsley weighed in on the behavior of large crypto holders, or “OG whales,” who have played a major role in recent market movements. Horsley explained that after years of substantial gains, sometimes achieving 100x or even 1000x returns, these early investors face emotional challenges staying fully invested during downturns.

“They’ve got life to live,” Horsley said, noting that even temporary drawdowns can be difficult for individuals whose net worth fluctuates by tens or hundreds of millions. Still, he added that most major holders plan to retain the majority of their portfolios.

Supporting this view, data from CryptoQuant shows that long-term holders sold approximately 405,000 Bitcoin between Oct. 2 and Nov. 2. While this selling contributed to recent weakness, analysts argue that such shakeouts often precede market stabilization.

Bitcoin and Ether longs rise as exchange supply drops

Another key factor supporting the bullish case for Bitcoin and Ether longs is the declining amount of Bitcoin held on exchanges. Blockchain analytics platform Santiment recently reported that there are now 208,980 fewer BTC on exchanges compared to six months ago.

This trend suggests that investors are moving coins into cold storage rather than keeping them available for sale, a signal that selling pressure may be easing. Santiment emphasized that “when a coin’s supply is not moving to exchanges, the risk of further sell-offs is limited.”

In essence, traders appear to be shifting from reactive selling to cautious accumulation. Combined with HyperUnit’s large long positions, this movement of coins away from exchanges supports the idea that the worst of the correction could be behind the market.

Institutional and retail perspectives on the rebound

Institutional sentiment has been mixed since the October downturn. Some funds have taken a defensive approach, reducing exposure to volatile assets. Others, however, see opportunity in current prices. The renewed focus on Bitcoin and Ether longs suggests that certain players believe a recovery could be imminent, particularly if macroeconomic pressures ease.

Retail investors, meanwhile, have been slower to return. Many remain wary after experiencing sharp losses in recent weeks. Yet, historical data shows that when whales accumulate and market fear peaks, major reversals often follow.

HyperUnit’s bold $55 million commitment is therefore being interpreted as a signal of confidence, possibly even an attempt to front-run a broader market recovery.

Bitcoin and Ether longs: what’s next for the market?

The coming weeks will reveal whether HyperUnit’s latest bet pays off. If Bitcoin can reclaim momentum and push above resistance near its all-time high, the whale’s positions could deliver another nine-figure profit. On the other hand, continued macro uncertainty could delay any sustained rally.

Still, the broader on-chain data, declining exchange balances, reduced selling pressure, and historically high levels of fear, suggests that the crypto market might be approaching an inflection point.

For now, all eyes are on the HyperUnit whale and their Bitcoin and Ether longs. Whether this trade marks the start of a new bullish chapter or another short-lived bounce, one thing is clear: the actions of major players continue to shape sentiment in the ever-evolving world of crypto.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe