Bitcoin Buy Strategy Continues Strategy Accumulation

Bitcoin Buy Strategy remains a central theme in the cryptocurrency market as Michael Saylor signaled that Strategy is preparing to acquire more Bitcoin during the ongoing market downturn. The company’s approach to Bitcoin accumulation continues to attract widespread attention, particularly as Strategy extends its consecutive buying streak in an environment marked by sharp price fluctuations and heightened investor caution.

Bitcoin Buy Strategy Signals Continued Accumulation

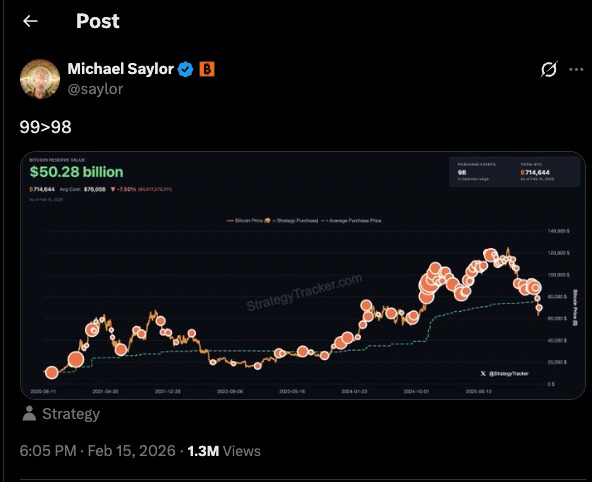

Michael Saylor, co-founder of Strategy, once again captured market interest after posting the company’s Bitcoin accumulation chart on X. This chart has become a widely recognized symbol associated with Strategy’s Bitcoin purchases. Over time, similar posts have frequently preceded official announcements of new acquisitions, leading many market participants to interpret the update as an indication that another purchase may soon follow.

The recurrence of this posting pattern has gradually shifted how market participants interpret Strategy’s communications. What might otherwise be a routine social media update now carries informational weight, particularly for traders and analysts monitoring corporate behavior. The visual format of the chart, combined with its timing, functions less as commentary and more as a recognizable signal within the company’s established rhythm. In practice, the market often reacts not just to confirmed purchases but to these subtle cues that precede them.

The latest signal is especially notable because it coincides with week 12 of Strategy’s consecutive Bitcoin buying activity. Such persistence is unusual among publicly traded companies, particularly during periods of market uncertainty. While many firms tend to adopt defensive strategies when asset prices decline, Strategy’s Bitcoin Buy Strategy emphasizes continued accumulation regardless of short term volatility.

Recent Transactions Reinforce the Bitcoin Buy Strategy

Strategy’s most recent confirmed Bitcoin purchase took place on Feb. 9. During this transaction, the company acquired 1,142 BTC for more than 90 million dollars. This purchase increased Strategy’s total Bitcoin holdings to 714,644 BTC. At market prices at the time of publication, these holdings were valued at approximately 49.3 billion dollars, underscoring the scale of the company’s exposure to Bitcoin.

The size of Strategy’s Bitcoin reserves has become one of the defining characteristics of the firm. Each additional acquisition not only expands its digital asset position but also reinforces the company’s long term commitment to Bitcoin as a treasury reserve asset. This accumulation strategy continues to distinguish Strategy from other corporations that have either reduced their crypto exposure or paused acquisitions during market downturns.

Market Conditions Challenge the Bitcoin Buy Strategy

The renewed focus on Strategy’s Bitcoin activity comes amid challenging market conditions. Bitcoin and the broader cryptocurrency market experienced significant declines following a flash crash in October. During this event, Bitcoin’s price fell by more than 50 percent from its previous all time high above 125,000 dollars. The correction pushed Bitcoin’s valuation below Strategy’s reported cost basis of 76,000 dollars per BTC.

Such dramatic price movements have historically triggered speculation about whether heavily exposed institutions might alter their strategies. In many cases, sharp declines prompt companies to reconsider asset allocations or limit further investment. However, Strategy’s Bitcoin Buy Strategy appears largely unaffected by these fluctuations, reflecting a long term perspective that prioritizes accumulation over reactionary decision making.

Bitcoin Buy Strategy Defies Analyst Expectations

Strategy’s continued buying activity has drawn attention partly because it contradicts earlier analyst predictions. Some market observers had suggested that a severe downturn might force Strategy to sell portions of its Bitcoin holdings or temporarily halt its accumulation program. Instead, the company maintained its purchasing pattern even as Bitcoin prices declined significantly.

This consistency has contributed to Strategy’s reputation as one of the most committed institutional participants in the Bitcoin ecosystem. The company’s actions signal confidence in Bitcoin’s long term potential, even during periods of heightened volatility and uncertain market sentiment. For supporters, this reinforces the narrative of Bitcoin as a strategic reserve asset rather than a speculative instrument.

Valuation Metrics and the Bitcoin Buy Strategy

Beyond Bitcoin price movements, Strategy also faces challenges related to valuation metrics that influence investor perception. A key measure for crypto treasury companies is the multiple on net asset value, commonly referred to as mNAV. This metric compares a company’s market valuation with the value of its underlying assets.

Companies with an mNAV above 1 typically trade at a premium relative to their net asset holdings, enabling easier access to financing and stock issuance. Conversely, an mNAV below 1 may indicate market skepticism and can complicate capital raising efforts. Strategy’s mNAV declined to approximately 0.90, reflecting broader pressures across the crypto treasury sector.

Sector Pressures and Market Sentiment

The decline in mNAV values is not unique to Strategy. Prior to the October flash crash, several crypto treasury companies were already experiencing weakening stock performance. Lower asset prices, combined with changing investor risk preferences, contributed to valuation compression across the sector.

For companies pursuing aggressive digital asset accumulation, these dynamics introduce additional complexity. Reduced valuation multiples can limit financing flexibility and amplify market scrutiny. Despite these pressures, Strategy’s Bitcoin Buy Strategy continues to emphasize long term accumulation rather than short term market reactions.

Editor’s View: Interpreting Accumulation Behavior

What often escapes purely numerical analysis is the signaling effect of consistency. Repeated buying during periods of weakness can influence how both supporters and skeptics interpret a company’s conviction, regardless of the immediate financial impact. Markets tend to react not only to balance sheet changes but also to perceived intent, especially when leadership actions appear methodical rather than opportunistic. In this context, the accumulation pattern itself becomes part of the narrative, shaping sentiment independently of price movements.

Financial Results Add Further Context

Strategy’s financial performance has also played a role in shaping market discussions. Earlier this month, the company reported a fourth quarter loss totaling 12.4 billion dollars. The announcement triggered a notable decline in Strategy’s stock price, which fell by roughly 17 percent following the earnings release.

Although the stock experienced immediate downward pressure, shares later recovered part of the decline. Strategy’s stock closed at 133.88 dollars on Friday, indicating partial stabilization. These movements highlight the sensitivity of crypto exposed equities to both financial disclosures and digital asset price fluctuations.

Bitcoin Buy Strategy and Long Term Outlook

Strategy’s continued accumulation of Bitcoin amid declining prices and valuation challenges underscores the firm’s distinctive corporate philosophy. The Bitcoin Buy Strategy reflects a conviction driven approach that prioritizes long term positioning over short term market dynamics. This strategy continues to shape how investors, analysts, and institutions evaluate the role of Bitcoin within corporate balance sheets.

As cryptocurrency markets evolve, Strategy’s actions remain a prominent reference point in debates about institutional adoption. Supporters view the approach as a forward looking bet on Bitcoin’s future, while critics emphasize the risks associated with concentrated exposure. Regardless of perspective, the Bitcoin Buy Strategy remains a defining feature of Strategy’s market identity and ongoing narrative.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe