Bitcoin Losses Crash Reflects Historic Capitulation

Bitcoin Losses Crash has become a defining feature of the current cryptocurrency market environment as Bitcoin records one of the largest realized loss events in its history. Recent data shows that investors collectively realized roughly 2.3 billion dollars in losses within a short period, a scale that places this selloff alongside some of the most severe downturns Bitcoin has experienced. The event reflects strong capitulation behavior, where holders sell their assets below purchase price amid rising uncertainty and declining market confidence.

Understanding the Bitcoin Losses Crash

Bitcoin Losses Crash describes a situation where large numbers of Bitcoin holders sell at prices lower than their original cost basis. These losses are called realized losses because they occur when assets are actually sold rather than simply declining in market value. This distinction is important, as realized losses capture true investor behavior and sentiment rather than temporary fluctuations.

During the recent market turbulence, realized losses surged dramatically, indicating that many traders chose to exit positions despite unfavorable pricing. Such events often signal stress across the market, as participants react to falling prices, volatility, and fear of deeper declines. When realized losses reach extreme levels, they typically highlight a broad shift in investor psychology.

Why Realized Losses Matter

Realized losses offer insight into how investors respond under pressure. A falling price alone does not guarantee that investors incur losses unless they sell. However, when realized losses spike, it reveals that holders are actively locking in negative returns. This behavior frequently emerges during panic driven phases, when fear overtakes patience.

Large realized loss events have historically appeared during major corrections and bear markets. They often coincide with heavy selling volumes and rapid price movements. Observing these patterns allows analysts to gauge market stress and identify periods of potential exhaustion, though it does not guarantee immediate recovery.

Price Movements Behind the Bitcoin Losses Crash

The Bitcoin Losses Crash unfolded after Bitcoin declined sharply from previous highs. The asset had earlier climbed above 126000 dollars before entering a prolonged correction. As prices fell, many investors who entered near peak levels found themselves holding positions at a loss. This created conditions for widespread selling, particularly among short term holders.

Although Bitcoin experienced brief rebounds, these moves were not sufficient to reverse the broader downward trend. Temporary rallies can offer short lived optimism, yet persistent selling pressure often continues until market conditions stabilize. The recent environment has been marked by heightened volatility, contributing to uncertainty among traders.

Historical Perspective on Bitcoin Losses Crash Events

Comparisons With Past Downturns

Bitcoin Losses Crash events are not new in the asset’s history. Bitcoin has undergone multiple severe corrections, many of which involved large realized losses and sharp sentiment shifts. Previous cycles have demonstrated that significant drawdowns are a recurring aspect of cryptocurrency markets.

The magnitude of current realized losses has drawn comparisons with earlier market crashes, where panic selling and fear dominated trading behavior. While each downturn has distinct causes, common patterns include rapid declines, rising volatility, and widespread investor anxiety.

Market Cycles and Capitulation

Bitcoin markets have long been associated with cyclical expansions and contractions. Bull markets typically generate strong optimism and aggressive buying, while bear markets bring caution and risk reduction. Bitcoin Losses Crash phases often appear near the more painful stages of market contractions, when sellers overwhelm buyers.

Capitulation represents a critical concept in these cycles. It occurs when investors abandon positions en masse, usually after prolonged stress or sudden price shocks. Such behavior can intensify losses but may also mark transitions toward eventual stabilization.

Indicators of Market Stress

Realized Price Dynamics

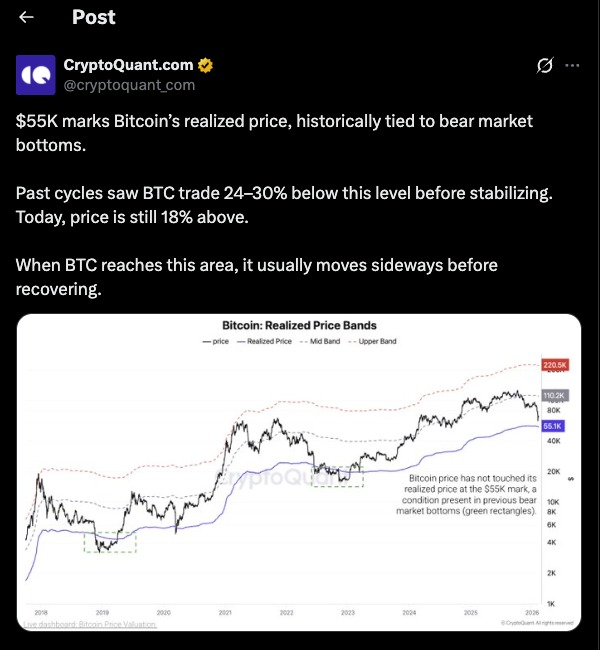

The realized price framework is often referenced during periods of heavy loss realization because it reflects the average cost basis of the network rather than short term market sentiment. Historical cycles show that Bitcoin has occasionally traded meaningfully below this level during extended bear phases, though such deviations were typically associated with extreme stress rather than routine volatility. What makes this metric noteworthy is not its precision, but its ability to contextualize investor positioning across the entire market. In practice, realized price functions less as a predictive tool and more as a structural reference point for understanding where widespread financial pressure may emerge.

One metric closely watched during the Bitcoin Losses Crash is the realized price, which represents the average acquisition cost of coins in circulation. When market prices approach or fall below this level, a large share of holders may be at a loss. This can influence selling behavior and overall sentiment.

In earlier market cycles, Bitcoin occasionally traded well below realized price before forming durable bottoms. While this historical tendency provides context, it does not ensure identical outcomes in every cycle. Market conditions and participant behavior continue to evolve over time.

Sentiment and Fear

Elevated realized losses often align with extreme fear across the market. Periods of fear driven trading tend to produce heightened volatility and rapid decision making. Investors may react emotionally, prioritizing short term preservation over long term strategy.

Extreme fear readings do not automatically signal a reversal, but they highlight stress and uncertainty. Understanding this psychological dimension is essential for interpreting market dynamics and avoiding impulsive reactions.

Editor’s View: Reading Beyond the Data

What often goes unnoticed during a Bitcoin Losses Crash is how quickly conviction can erode when volatility clusters rather than trends. Investors rarely respond to price alone; they react to the pace, unpredictability, and narrative surrounding the move. A sharp decline after extended optimism tends to feel more destabilizing than a slow grind lower, even if the percentage change is similar. This helps explain why capitulation events frequently appear sudden, as participants collectively reassess risk at the same time rather than gradually.

Investor Implications

Bitcoin Losses Crash conditions challenge both traders and long term investors. Rapid declines can test conviction and risk tolerance, especially for participants with short investment horizons. Market turbulence underscores the importance of strategy, discipline, and risk management.

Managing Volatility

Some investors respond by reducing exposure or adjusting portfolio allocations. Others adopt gradual accumulation methods to mitigate timing risk. No approach eliminates uncertainty entirely, yet structured planning may help reduce the impact of emotional decision making.

Long Term Considerations

Bitcoin’s history shows that deep corrections have occurred multiple times. Long term participants often emphasize patience and resilience, though recovery timelines vary widely. Market stabilization typically depends on broader factors including liquidity, sentiment, and macroeconomic influences.

Conclusion

Bitcoin Losses Crash reflects a period of significant market pressure characterized by large realized losses and heightened volatility. The scale of losses highlights how investor behavior shifts during downturns, particularly when fear and uncertainty intensify. While historical patterns suggest that such phases are part of Bitcoin’s broader market cycles, predicting exact outcomes remains difficult. Investors navigating this environment must balance caution with long term perspective, recognizing that volatility is an inherent feature of digital asset markets.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe