BitGo Stock IPO Faces Volatility After Market Debut

BitGo stock entered the public markets with strong early enthusiasm but quickly faced sharp price swings as investors reassessed the company’s valuation. BitGo stock began trading after pricing its initial public offering at $18 per share, briefly climbing well above that level before falling below its IPO price within days. The stock’s movement highlights the cautious mood surrounding newly listed crypto-related companies.

The crypto custody firm’s public debut attracted attention because it marked one of the more notable digital asset companies to go public in recent years. While the early price jump suggested strong demand, the later decline showed that investor confidence remained fragile in the current market environment.

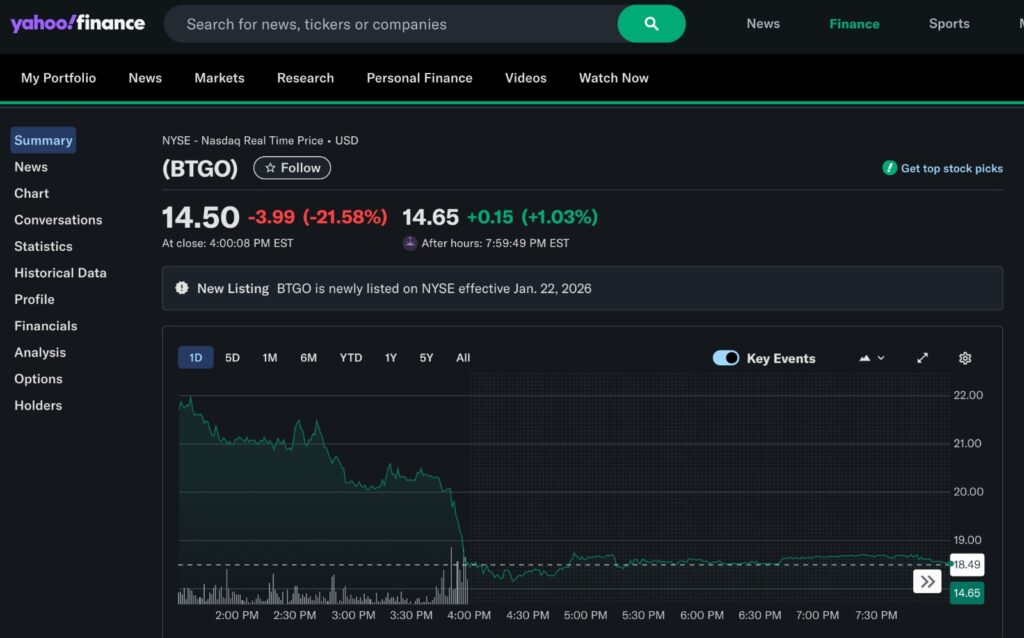

The intraday chart shows that most of BitGo stock’s decline occurred during regular trading hours, followed by relatively flat price action into the close and after-hours session. This pattern often reflects an early wave of selling pressure being absorbed rather than continuously accelerating. Once the initial imbalance cleared, trading activity appeared more measured, suggesting participants were reassessing rather than reacting. Charts like this tend to capture a transition from emotion-driven moves to more deliberate positioning.

BitGo stock IPO starts strong

BitGo stock made its debut on the New York Stock Exchange under the ticker symbol BTGO. On its first trading day, shares surged by about 25 percent above the IPO price, briefly trading above $22. This early jump reflected optimism around BitGo’s position as a major infrastructure provider in the digital asset industry.

The company priced its IPO above its originally marketed range of $15 to $17 per share. By offering shares at $18, BitGo and its early investors raised roughly $213 million. The pricing decision signaled confidence from underwriters and institutional buyers who saw long-term potential in crypto custody services.

The strong opening performance also suggested that some investors were eager for exposure to crypto-related businesses that focus on infrastructure rather than trading or speculation.

Why BitGo stock lost momentum

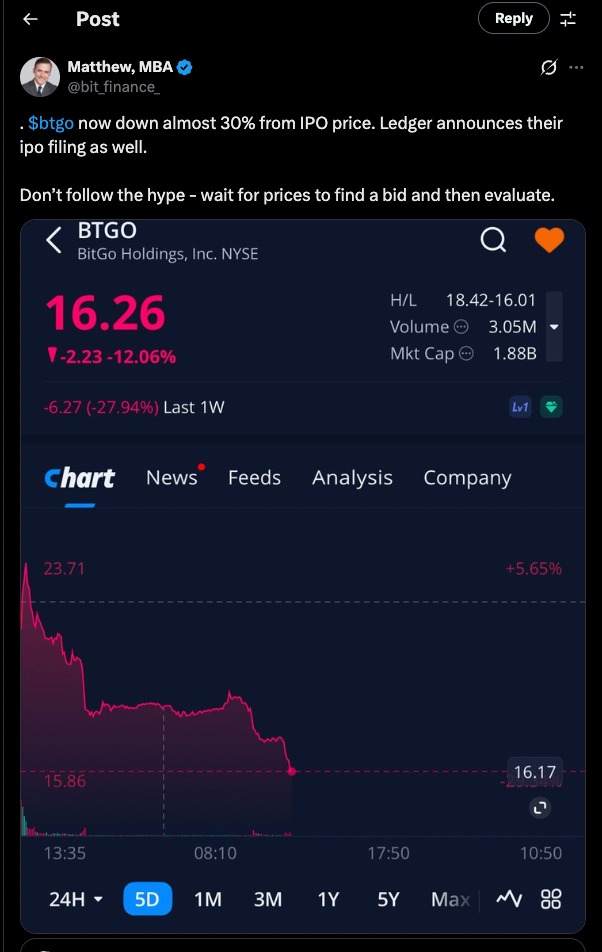

Despite the strong start, BitGo stock was unable to maintain its early gains. As trading continued, investors began taking profits, which pushed the price lower. Within the first week of trading, the stock fell below its IPO price, at one point declining more than 13 percent from the offer level.

Profit-taking is common after IPOs, especially when shares jump quickly on the first day. Early buyers often sell to lock in gains, creating downward pressure on the price. BitGo stock also faced limited trading liquidity, a typical challenge for newly listed companies with a relatively small number of publicly available shares.

Beyond technical factors, broader concerns about the crypto market played a role. Investors remain cautious about companies tied to digital assets due to regulatory uncertainty, market volatility, and shifting interest rate expectations.

The commentary reflects how some market participants frame early post-IPO declines, particularly in sectors that have seen cycles of enthusiasm and pullbacks. Rather than focusing on short-term price movement alone, these reactions highlight the tendency for investors to wait for volatility to settle before reassessing value. Such perspectives often surface when a new listing transitions from speculative interest to more deliberate scrutiny. In this context, the reaction serves as a snapshot of sentiment rather than a definitive assessment of the company.

Editor’s View: BitGo stock and investor psychology

Early IPO trading often reflects emotion more than conviction, and BitGo stock followed that familiar pattern. Initial buyers were responding to scarcity, momentum, and the symbolism of a crypto firm reaching public markets, rather than to a fully formed long-term thesis. Once that excitement faded, the stock price began to reflect hesitation about valuation, timing, and broader market conditions. This shift does not imply rejection of the company, but rather a pause as investors recalibrate expectations in a market that has become more cautious and selective.

What BitGo stock performance says about crypto IPOs

The early performance of BitGo stock offers insight into the current state of the crypto IPO market. After a long slowdown in public listings from digital asset firms, BitGo’s IPO was seen as a test of renewed investor interest.

The mixed results suggest that while there is still demand for well-established crypto infrastructure companies, investors are more selective than in previous market cycles. Strong fundamentals alone may not be enough to support sustained price growth immediately after going public.

Other crypto firms considering IPOs may take note of BitGo stock’s volatility. Market timing, valuation, and investor communication will likely be critical factors for future offerings.

BitGo stock and company fundamentals

BitGo operates as a digital asset custody and infrastructure provider, serving institutional clients such as exchanges, funds, and large investors. At the time of its IPO, the company reported overseeing more than $90 billion in assets under custody.

This scale places BitGo among the largest crypto custody providers globally. Its business model focuses on security, compliance, and long-term institutional adoption rather than retail trading activity.

These characteristics helped support investor interest during the IPO process. However, public market investors often expect clearer paths to profitability and consistent revenue growth, which can take time to demonstrate after listing.

Investor sentiment around BitGo stock

Market observers noted that BitGo stock’s early decline did not necessarily reflect a lack of confidence in the company itself. Instead, it highlighted cautious sentiment across equity markets, particularly toward companies linked to emerging industries.

Investors are increasingly focused on fundamentals, balance sheets, and sustainable revenue rather than hype-driven growth. This shift has affected many newly public companies, not just those in the crypto sector.

For BitGo stock, long-term performance will likely depend on execution, regulatory developments, and broader adoption of digital asset infrastructure by traditional financial institutions.

What comes next for BitGo stock

While the initial post-IPO volatility may concern some investors, it is not unusual for new listings to experience price swings in their first weeks of trading. BitGo stock’s future performance will be shaped by earnings reports, market conditions, and progress within the crypto industry.

If demand for institutional crypto custody continues to grow, BitGo may benefit from its established position and regulatory focus. However, short-term price movements will likely remain sensitive to changes in investor sentiment and macroeconomic trends.

In summary, BitGo stock’s journey from a strong IPO pop to a drop below its offer price reflects both opportunity and caution in today’s crypto equity market. The debut serves as an important signal for investors and companies alike as the digital asset sector continues to mature.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL