Chainlink ETF Moves Forward with DTCC Listing

Chainlink ETF has appeared on the Depository Trust & Clearing Corporation (DTCC) registry under the ticker CLNK, marking a major step toward a possible launch. The listing does not guarantee approval by regulators, but it is viewed as a positive signal that the product is nearing readiness for trading. The move adds to the growing interest in crypto-linked funds following earlier approvals of spot Bitcoin and Ethereum ETFs.

Understanding the Chainlink ETF and the DTCC Listing

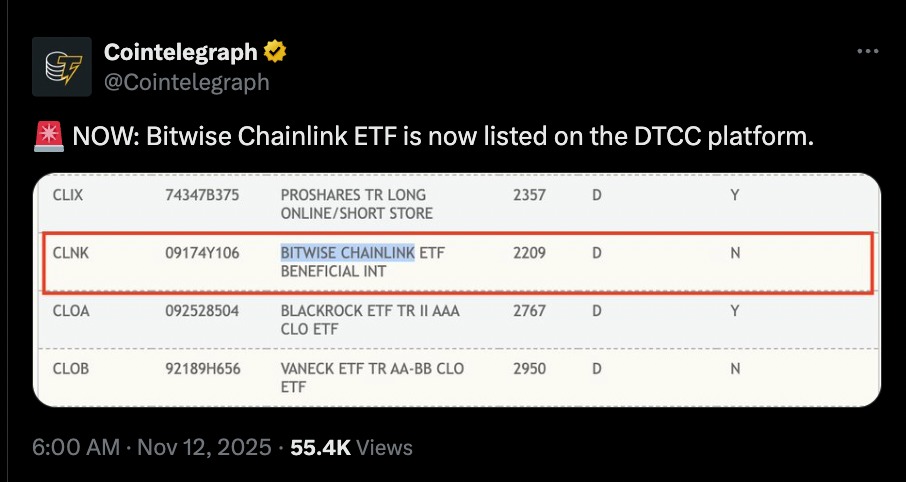

The screenshot above shows the official post from Cointelegraph confirming that the Bitwise Chainlink ETF, listed under the ticker symbol CLNK, has appeared on the DTCC platform. This image, shared on November 12, 2025, highlights the fund’s registration details alongside other listed ETFs. While such listings are not definitive proof of regulatory approval, they often signal that the product is in its final stages of readiness before launch.

The DTCC is the central securities depository for the United States, responsible for clearing and settling trillions of dollars in transactions each day. When a product like the Chainlink ETF is added to its registry, it indicates that back-office and settlement preparations have begun. This step is often completed shortly before a fund receives final approval or starts trading.

For the Chainlink ETF, Bitwise Asset Management is the sponsor. Its goal is to offer investors regulated access to Chainlink (LINK), the native token of the decentralized oracle network that powers real-world data connections for blockchain applications. The ETF would hold LINK tokens directly rather than relying on futures contracts or derivatives.

The registry entry shows the product listed under both “active” and “pre-launch” categories. This classification suggests that technical readiness is advancing, but formal trading cannot begin until the U.S. Securities and Exchange Commission (SEC) grants permission. Historically, such listings have preceded ETF launches, which explains the growing market excitement around the Chainlink ETF.

Why the DTCC Listing Matters for the Chainlink ETF

A DTCC listing signals that a fund’s structure and ticker have been validated for potential trading, clearing, and settlement. It ensures that when approval arrives, market participants can create and redeem shares seamlessly. In practice, the listing allows broker-dealers and exchanges to integrate the product into their systems ahead of time.

The Chainlink ETF being recorded on DTCC’s system also provides confidence to institutional players. It shows Bitwise is taking operational steps similar to other funds that eventually received approval. Still, it is crucial to remember that a DTCC listing alone does not mean the SEC has approved or endorsed the product. It is an administrative milestone, not a regulatory verdict.

The Regulatory Pathway Ahead

Bitwise filed its initial Form S-1 registration statement with the SEC in August, proposing a spot ETF that would hold physical LINK tokens. This filing outlines how the ETF will track the price of LINK, its custodian arrangements, and risk disclosures. Bitwise is expected to use the CME CF Chainlink-Dollar Reference Rate to calculate its net asset value (NAV). Custody of LINK would likely be handled by a qualified third party, such as Coinbase Custody Trust Company.

Before the ETF can trade, Bitwise must file additional forms, including Form 8-A and possibly a 19b-4 if the ETF will be listed on a national securities exchange. These documents allow the SEC to review the structure, compliance, and investor protection mechanisms of the fund.

The regulatory review process has been slower than usual, partly because of the ongoing U.S. government shutdown, which has limited the SEC’s capacity to process filings. This delay introduces uncertainty about the ETF’s timeline, even though back-end preparations are advancing.

Next Steps for the Chainlink ETF

The immediate focus for Bitwise is ensuring operational readiness. That includes finalizing the custodian agreement, confirming NAV calculation procedures, and preparing for share creation and redemption processes. Once the SEC resumes normal activity, Bitwise could push for approval and subsequent exchange listing.

Even if approval takes time, the listing on the DTCC is a concrete step that shows Bitwise is preparing for eventual trading. Investors should see this as progress rather than a guarantee. Regulatory reviews are rigorous and often involve multiple rounds of feedback before the green light is given.

Broader Impact of the Chainlink ETF

For the Chainlink Ecosystem

If approved, the Chainlink ETF could have a significant impact on LINK’s liquidity and perception. Institutional investors who are restricted from buying cryptocurrencies directly would gain a regulated way to gain exposure to LINK. This could increase trading volume and strengthen Chainlink’s position as the leading decentralized oracle network connecting blockchain smart contracts to real-world data.

For the ETF Market

The Chainlink ETF listing underscores the continuing evolution of crypto investment products. After years of focus on Bitcoin and Ethereum ETFs, asset managers are now exploring exposure to other established blockchain projects. Each new listing tests regulatory boundaries and public demand for alternative crypto assets.

For Investors

Retail and institutional investors watching the Chainlink ETF’s progress should remain realistic. While a DTCC listing often precedes launch, the SEC can still delay or reject the product. Investors should monitor official filings and approval notices rather than rely solely on registry updates. Nonetheless, many view this milestone as an encouraging sign that crypto finance is expanding beyond the two largest digital assets.

Key Facts About the Chainlink ETF

- Ticker symbol: CLNK

- Sponsor: Bitwise Asset Management

- Underlying asset: Chainlink (LINK)

- Structure: Spot ETF holding LINK directly

- Status: Listed as “active” and “pre-launch” on DTCC

- Current regulatory step: Awaiting SEC approval

- Primary filings: Form S-1 submitted; Form 8-A pending

- Infrastructure partner: DTCC for post-trade processing

These points collectively show that the groundwork for the fund is largely in place, pending final regulatory clearance.

Market Outlook and Conclusion

The addition of the Chainlink ETF to the DTCC registry highlights how crypto finance continues to integrate into traditional market systems. While no official trading date has been announced, the move signals readiness across major market infrastructure providers.

Analysts note that if the SEC eventually approves the product, it could open a new chapter for crypto ETFs that focus on specific blockchain networks rather than broad indexes or top-two coins. For Bitwise, this would mark another milestone in its strategy to expand digital-asset exposure through regulated investment vehicles.

In conclusion, the Chainlink ETF’s DTCC listing is an important indicator of forward momentum. It demonstrates that the necessary systems are being prepared for launch and that institutional interest in Chainlink is growing. However, final approval remains the key hurdle. Until the SEC issues its decision, the listing should be seen as progress rather than a promise, but one that clearly moves the Chainlink ETF closer to reality.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Solana

Solana