CLARITY Act Debate Divides the Crypto Industry

CLARITY Act Debate has become a major point of tension within the cryptocurrency industry as lawmakers push forward with a proposed U.S. market structure bill aimed at regulating digital assets. While the bill is designed to bring long-awaited regulatory clarity, industry leaders are sharply divided over whether the current version helps or harms innovation.

The Digital Asset Market Clarity Act, commonly referred to as the CLARITY Act, seeks to define how cryptocurrencies should be classified and regulated in the United States. At its core, the bill attempts to clarify which digital assets fall under securities law and which should be treated as commodities, while also outlining the responsibilities of regulators such as the Securities and Exchange Commission and the Commodity Futures Trading Commission.

Why the CLARITY Act Debate Matters

The CLARITY Act Debate matters because the lack of clear rules has long been one of the biggest challenges facing the crypto industry. Companies argue that unclear regulations make it difficult to operate, raise capital, and build products in the U.S. without fear of enforcement actions.

Supporters believe the bill could finally provide a clear framework that protects consumers while allowing responsible innovation. Critics, however, argue that certain provisions could limit growth, restrict decentralized technologies, and give regulators excessive power.

Coinbase’s Role in the CLARITY Act Debate

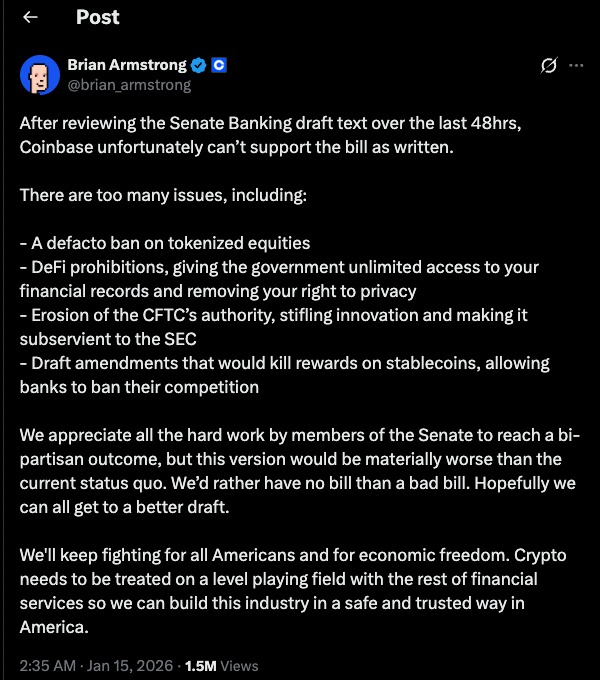

One of the most notable developments in the CLARITY Act Debate came when Coinbase withdrew its support for the bill. After reviewing updated draft language from lawmakers, Coinbase leadership stated that the legislation contained too many problematic elements to endorse.

According to the company, the bill could negatively impact tokenized assets, weaken the authority of the CFTC, and introduce rules that may discourage innovation. Coinbase’s leadership made it clear that passing a flawed law could be worse than passing no law at all.

This decision highlighted a growing divide between companies that want immediate regulatory clarity and those that believe the current proposal introduces new risks.

The statement underscores how opposition to the bill is rooted in specific structural concerns rather than broad resistance to regulation. By outlining concrete issues such as tokenized equities, DeFi access, regulatory balance, and stablecoin rewards, the response frames the debate as one about implementation rather than intent. It also highlights how quickly industry support can shift when draft language moves from principle to detail. For readers, this moment clarifies why the CLARITY Act Debate has become less about whether rules are needed and more about how permanent their consequences might be.

Key Concerns Driving the CLARITY Act Debate

Impact on Tokenization and DeFi

A major issue in the CLARITY Act Debate is how the bill treats tokenized assets and decentralized finance. Critics argue that the draft language could effectively restrict or discourage tokenized equities and impose heavy compliance burdens on decentralized platforms.

Developers worry that strict definitions and limitations could undermine the open and permissionless nature of blockchain-based systems. For many in the industry, tokenization and DeFi represent the future of finance, and any restrictions are seen as a threat to long-term growth.

Privacy and Regulatory Oversight

Privacy concerns are another central issue in the CLARITY Act Debate. Some industry leaders believe the bill could allow regulators broad access to financial data, raising questions about user privacy and data protection.

Supporters of the bill argue that transparency is necessary to prevent fraud, protect consumers, and maintain trust in financial markets. Critics counter that excessive oversight could drive users and companies away from U.S. platforms.

Stablecoin Rules and Rewards

The treatment of stablecoins has also fueled the CLARITY Act Debate. Proposed language includes limits on offering rewards or interest simply for holding payment stablecoins. While certain reward structures may still be allowed, critics argue these restrictions could harm adoption and reduce competition.

Stablecoins play a key role in crypto trading, payments, and liquidity. Any changes to how they can be used or incentivized could have wide-ranging effects across the ecosystem.

Supporters Push for Progress

Despite the criticism, many influential voices continue to support the CLARITY Act. Advocates argue that no bill will be perfect, but delaying regulation only prolongs uncertainty.

Supporters believe the legislation represents a meaningful step toward establishing clear rules that allow builders and investors to operate with confidence. They emphasize that bipartisan cooperation has made progress possible and that improvements can still be made as the bill evolves.

For these supporters, the risks of inaction outweigh the flaws in the current draft.

Market Response and Industry Impact

The CLARITY Act Debate has not caused major short-term market disruptions. Broader factors such as macroeconomic conditions and institutional demand continue to play a larger role in crypto prices than legislative discussions.

However, the long-term impact could be significant. If passed, the CLARITY Act could establish foundational rules for how digital assets are treated in the U.S., potentially reducing legal uncertainty and encouraging institutional participation.

On the other hand, failure to reach consensus could leave the industry operating under fragmented and unclear guidance, increasing compliance costs and legal risks.

Editor’s View: Why the CLARITY Act Debate Feels So Divisive

The intensity of the CLARITY Act Debate reflects more than disagreement over policy details. It exposes a deeper split in how different parts of the crypto industry perceive risk. Companies that have already built compliance-heavy businesses tend to see imperfect rules as manageable, while builders closer to protocols and infrastructure see rigid definitions as long-term constraints. This difference is less about ideology and more about where each group sits in the market cycle and what they stand to lose if flexibility disappears too early.

What Comes Next in the CLARITY Act Debate

As discussions continue, lawmakers are expected to review feedback from industry leaders and consider revisions to the bill. Compromise language may emerge on issues such as DeFi oversight, stablecoin rewards, and regulatory authority.

Political factors will also influence the bill’s progress. Changes in leadership, election cycles, and shifting priorities could delay or reshape the legislation.

The CLARITY Act Debate ultimately reflects a broader struggle to balance innovation with regulation. The outcome will help determine whether the United States becomes a leader in digital asset development or risks falling behind as companies seek clearer rules elsewhere.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe