Crypto ETFs: Vanguard Opens Access to Millions

Crypto ETFs mark a significant turning point for Vanguard as the firm reverses its long-held stance against offering digital-asset investment products. Crypto ETFs now have a place on Vanguard’s platform, meaning millions of its U.S. clients can trade regulated funds tied to leading cryptocurrencies. This update signals a major shift inside one of the world’s largest and most traditionally conservative asset managers.

Crypto ETFs enter the mainstream with Vanguard’s policy change

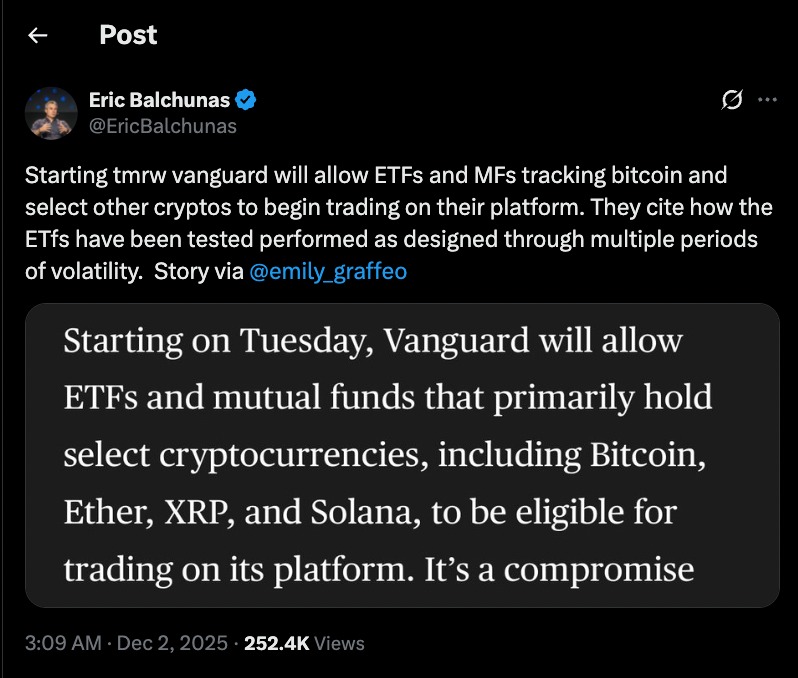

The tweet highlights the key details behind Vanguard’s shift, confirming that the firm will now permit ETFs and mutual funds holding major cryptocurrencies to trade on its platform. It reinforces the timing of the rollout and reflects how industry analysts view this as a meaningful, measured step toward expanding regulated crypto access for mainstream investors.

For years, Vanguard restricted access to crypto-related products, dismissing them as speculative and incompatible with long-term investment strategies. Now, the firm has opened the door for clients to buy and sell regulated ETFs and mutual funds linked to cryptocurrencies such as Bitcoin, Ether, XRP and Solana. Vanguard emphasizes that only compliant, approved funds will be available, ensuring that clients interact with products that meet strict regulatory standards. While the company still refuses to launch its own crypto funds, this new policy grants users broader access to the digital-asset market.

This shift impacts more than 50 million brokerage accounts across the United States. Because many of those investors prefer regulated, familiar investment vehicles instead of direct crypto holdings, the availability of Crypto ETFs offers an accessible pathway into digital assets without requiring the use of wallets or exchanges.

Why Vanguard changed course on Crypto ETFs

Responding to rising investor demand

The introduction of Crypto ETFs on Vanguard’s platform can be traced largely to strong and persistent investor interest. Even during volatile periods, demand for crypto exposure has remained steady. Other major firms have already launched compliant digital-asset ETFs, drawing significant investment inflows. Vanguard’s refusal to support these products risked leaving customers without competitive options. By enabling access to approved funds, the company acknowledges that crypto exposure has become a mainstream request among investors of all types.

Adapting to industry evolution

As the world’s second-largest asset manager with more than $11 trillion under management, Vanguard influences global investing trends. Its acceptance of Crypto ETFs, even in a limited form, reflects a growing realization that digital assets cannot be ignored. Institutions that once dismissed cryptocurrencies now recognize regulated crypto funds as viable components of diversified portfolios. Vanguard’s updated stance allows it to remain competitive while maintaining a risk-aware posture.

By permitting third-party Crypto ETFs rather than creating its own, the firm minimizes risk while still meeting customer needs. This strategy lets Vanguard expand its offerings without signaling a full corporate embrace of digital assets.

What investors should expect from Vanguard’s Crypto ETFs decision

Expanded access through regulated channels

One of the strongest effects of this policy update is the expansion of safe, regulated access to Crypto ETFs. Many investors who previously avoided direct crypto exposure due to security concerns or unfamiliarity can now participate through mainstream brokerage accounts. Regulated ETFs tracking assets like Bitcoin and Ether provide a secure entry point without requiring knowledge of private keys, blockchain mechanics or crypto exchanges.

Potential market impact

Because Vanguard serves such a large investor base, opening access to Crypto ETFs could influence the broader digital-asset market. Increased buying interest from retail investors and financial professionals could boost inflows into major cryptocurrency funds. Some analysts believe that even moderate allocations from Vanguard clients may contribute to price momentum. Others caution that any influx of new participants may also amplify market volatility, as crypto-linked ETFs remain sensitive to rapid price changes in underlying assets.

While short-term predictions remain uncertain, one thing is clear: Vanguard’s move signals growing acceptance of regulated crypto products among traditional finance institutions.

Continued limitations and cautious positioning

Despite allowing trading of Crypto ETFs, Vanguard maintains firm boundaries. The company still refuses to issue its own crypto funds and prohibits access to products connected with unregulated tokens or memecoins. This cautious posture aligns with Vanguard’s long-standing philosophy of prioritizing long-term, stable investment strategies. The company’s message is clear: it will provide regulated options, but it does not endorse speculative crypto behavior.

Crypto ETFs and the shifting landscape of traditional finance

Growing institutional acceptance

Vanguard’s policy reversal contributes to a noticeable shift in how traditional institutions view digital assets. Regulated Crypto ETFs have prompted many large financial organizations to consider integrating crypto exposure into their platforms. Once-skeptical firms now acknowledge that digital assets are becoming embedded in modern investment strategies. With Vanguard joining the list of companies facilitating crypto trading, institutional hesitation continues to erode.

A possible tipping point for adoption

Allowing access to Crypto ETFs through a major brokerage platform may encourage broader participation across the investment world. For many individuals, the barrier to entry has been access and convenience rather than interest. As more investors encounter Crypto ETFs through familiar channels, digital-asset exposure may gradually become as routine as adding gold or emerging-market funds to a portfolio. If other major asset managers follow Vanguard’s example, the shift could accelerate dramatically.

What comes next for investors and the crypto market

Several key questions now emerge. Will Vanguard’s customers meaningfully adopt Crypto ETFs, or will usage remain limited to a small portion of portfolios? How will the crypto market respond to potential new inflows from a conservative investor base? Will other asset managers expand their digital-asset offerings as competition intensifies? The answers will determine whether this marks a minor policy update or a pivotal moment in the relationship between traditional finance and crypto.

Vanguard’s decision to permit trading of regulated Crypto ETFs represents a major milestone in the integration of digital assets into mainstream investment infrastructure. While cautious and measured, this shift gives millions of investors a new pathway into crypto markets. As traditional finance adapts to evolving investor expectations, Crypto ETFs are likely to play a central role in shaping how the next generation of investors accesses digital assets.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL