Crypto Market Rally Fueled by Trump Tariff Pause

Crypto Market Rally momentum strengthened after Bitcoin and major altcoins surged following President Donald Trump’s decision to pause the implementation of planned US tariffs. The announcement eased growing concerns over trade tensions between the United States and the European Union, triggering a wave of optimism across global financial markets. As risk sentiment improved, investors moved back into cryptocurrencies, pushing prices higher across the board.

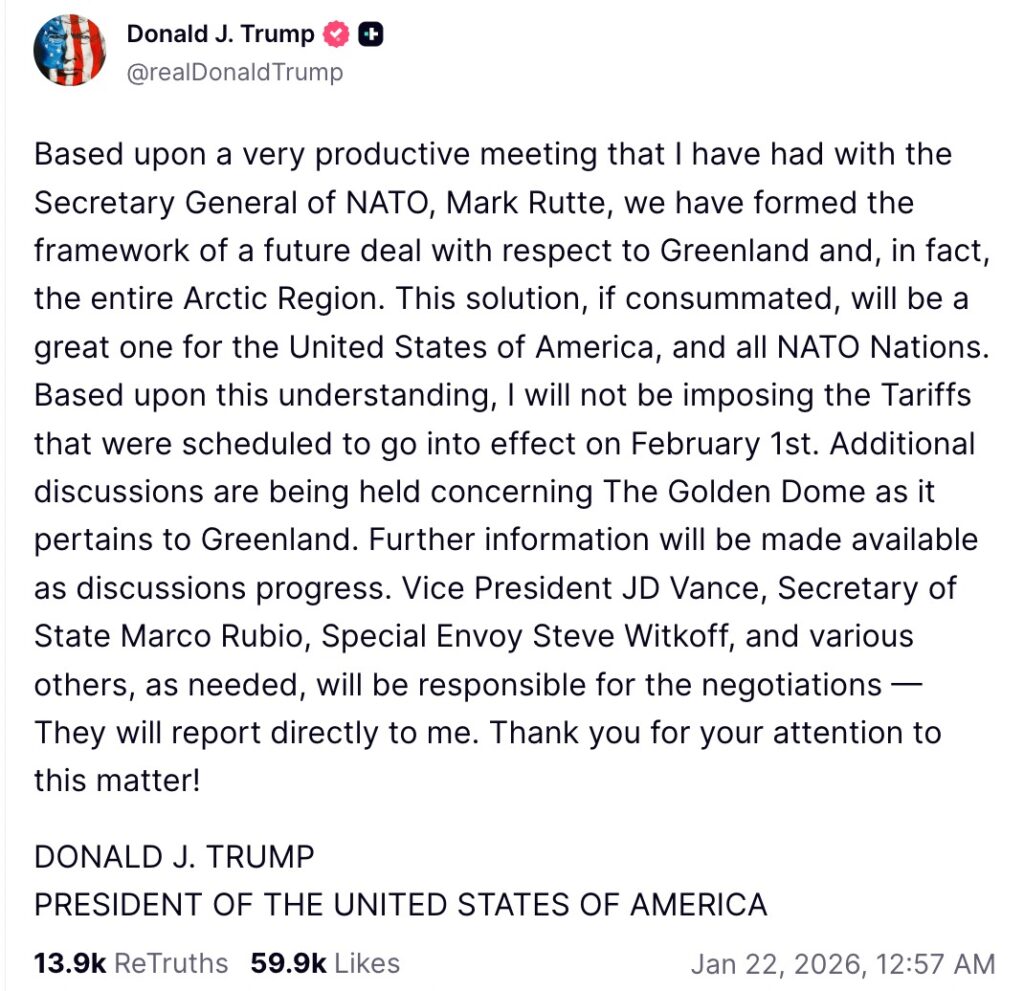

The tariff pause came after diplomatic discussions involving NATO allies and cooperation around strategic Arctic regions. Markets interpreted this move as a sign of de-escalation in geopolitical pressure, which had previously weighed heavily on risk assets. Cryptocurrencies, often sensitive to macroeconomic shifts, responded quickly as uncertainty eased and confidence returned.

Crypto Market Rally Driven by Improved Risk Sentiment

The Crypto Market Rally was closely tied to changes in broader market sentiment. Before the announcement, traders had been bracing for tariffs scheduled to take effect in early February. These potential trade barriers raised fears of economic slowdown and strained relations between major global partners. As a result, investors had adopted a cautious stance, reducing exposure to volatile assets such as cryptocurrencies.

Once the tariff pause was confirmed, markets reacted almost immediately. The easing of trade-related stress encouraged a shift toward risk-on behavior, with investors seeking higher returns in assets like Bitcoin and altcoins. This change in sentiment highlighted how closely the crypto market tracks geopolitical developments and global policy signals.

The statement helped clarify why markets moved so quickly. Rather than reacting to rumors or secondary reporting, traders were responding to a direct signal from the source of policy risk itself. The language emphasized postponement rather than escalation, which mattered in a market already positioned defensively. In that environment, the absence of a negative surprise was enough to shift short-term positioning.

Bitcoin Strengthens Amid Crypto Market Rally

Bitcoin played a central role in the Crypto Market Rally, stabilizing and pushing higher as confidence returned. As the largest cryptocurrency by market capitalization, Bitcoin often sets the tone for the broader digital asset market. Its recovery reflected renewed investor trust following the reduction in immediate geopolitical risk.

The rally helped Bitcoin maintain its dominant position in the market, reinforcing its status as a key indicator of overall crypto sentiment. Traders viewed the tariff pause as a supportive macro signal, reducing downside risk and encouraging fresh buying interest. This renewed momentum helped Bitcoin anchor gains across the wider market.

Altcoins Outperform During Crypto Market Rally

While Bitcoin gained strength, the Crypto Market Rally was even more pronounced among altcoins. Ethereum posted solid gains as investors increased exposure to smart contract platforms. Other major altcoins such as Solana and XRP also recorded strong upward moves, benefiting from improved liquidity and rising risk appetite.

Beyond large-cap tokens, mid-cap and smaller cryptocurrencies saw notable surges. Sectors such as decentralized finance and meme coins experienced increased trading activity, signaling broad market participation. This rotation toward higher-risk assets suggested that investors were growing more confident in the short-term outlook.

Macro Developments Fuel the Crypto Market Rally

The Crypto Market Rally underscored the growing influence of macroeconomic and geopolitical factors on digital assets. Prior to the tariff pause, uncertainty surrounding EU-US relations had contributed to volatility across financial markets. Disagreements over trade frameworks and strategic cooperation had dampened investor confidence.

By delaying tariff implementation, the US administration reduced one of the key sources of market stress. This move helped stabilize expectations and allowed investors to reassess risk exposure. The reaction in crypto markets demonstrated how policy decisions and diplomatic signals can directly impact digital asset prices.

Traditional Markets Align With Crypto Market Rally

The Crypto Market Rally did not occur in isolation. Traditional financial markets also responded positively to the easing of trade tensions. Equity futures moved higher as investors anticipated reduced economic disruption and improved trade relations. This alignment between traditional markets and cryptocurrencies highlighted the increasing interconnectedness of global finance.

Earlier tariff threats had driven investors toward safer assets, contributing to sell-offs in risk-sensitive markets. The reversal of this trend following the tariff pause reinforced the idea that cryptocurrencies now behave similarly to other risk assets during periods of macro uncertainty.

Investor Takeaways From the Crypto Market Rally

For investors, the Crypto Market Rally offered a clear reminder of how quickly sentiment can shift in response to geopolitical news. While the tariff pause provided short-term relief, market participants remain aware that trade tensions could resurface. Future developments in international negotiations, economic data, and central bank policy will continue to influence market direction.

The rally also highlighted the importance of monitoring macro headlines when investing in cryptocurrencies. Digital assets remain highly responsive to changes in global risk appetite, making them vulnerable to sudden volatility. Investors may need to balance optimism with caution as conditions evolve.

Editor’s View: Why the Reaction Made Sense

Beyond price movements, the Crypto Market Rally reflected a psychological reset among traders rather than a shift in long-term fundamentals. Markets had been positioned defensively, not because of new data, but because uncertainty itself had become the dominant risk. The tariff pause did not resolve structural trade issues, but it removed an immediate unknown, which is often enough to change short-term behavior. In that context, the rally looked less like enthusiasm and more like relief being priced back into the market.

Outlook Following the Crypto Market Rally

The Crypto Market Rally reflects a broader trend of cryptocurrencies reacting to global economic narratives rather than operating in isolation. As digital assets become more integrated into mainstream finance, their sensitivity to geopolitical developments is likely to increase.

While the tariff pause has boosted confidence for now, sustained momentum will depend on continued progress in trade relations and economic stability. Any renewed tensions could quickly reverse gains, while further easing could support additional upside. The recent rally serves as a reminder that crypto markets remain dynamic, fast-moving, and closely tied to global events.

In summary, the Crypto Market Rally was driven by improved risk sentiment following President Trump’s decision to pause planned tariffs. Bitcoin and altcoins benefited from reduced geopolitical uncertainty, highlighting the growing role of macroeconomic factors in shaping crypto market performance.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe