Decentralized Stablecoins Need Better Design Standards

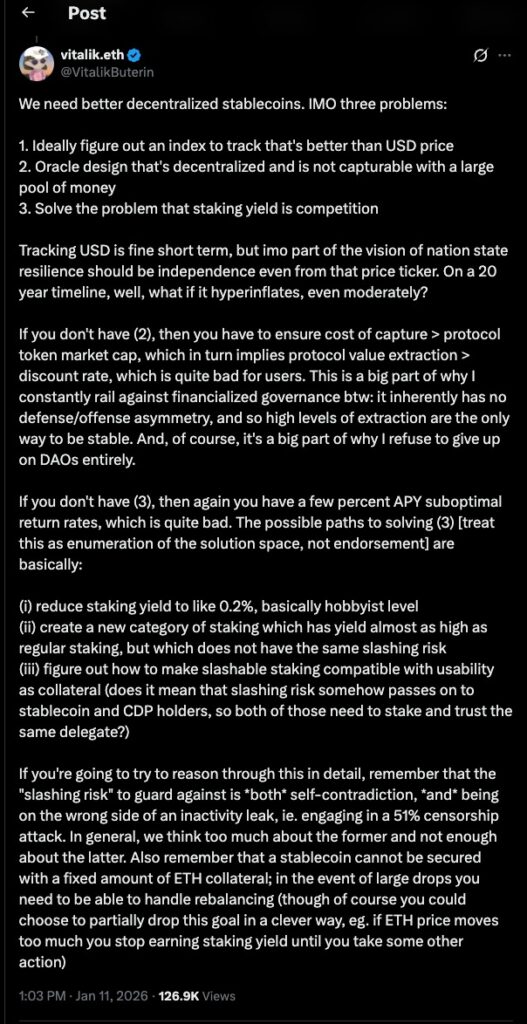

Decentralized Stablecoins are becoming one of the most important topics in the future of blockchain finance, according to Ethereum co-founder Vitalik Buterin. He argues that while stablecoins play a vital role in crypto markets, today’s decentralized models still suffer from serious structural weaknesses. If these issues are not addressed, decentralized stablecoins may never reach their full potential as reliable, long-term financial tools.

Stablecoins are designed to maintain a consistent value, most often pegged to the US dollar. They are widely used for trading, payments, and decentralized finance applications. However, the majority of stablecoins today are centralized, meaning they depend on trusted companies to hold reserves. Decentralized stablecoins aim to remove this reliance by using smart contracts, collateral, and economic incentives instead. Buterin believes that simply removing centralized control is not enough. The design itself must improve.

Why Decentralized Stablecoins Matter

This post captures how Buterin frames the problem not as a single failure, but as a chain of design trade-offs that reinforce one another. What stands out is the focus on stress scenarios rather than normal market conditions, suggesting that stability must be proven when incentives break down, not when they align. The tweet also reflects a long-term mindset, where design decisions are evaluated over decades rather than short-term market cycles. In that context, the critique is less about existing implementations and more about setting a higher bar for what decentralized stability should mean.

Decentralized Stablecoins are critical for the vision of open and permissionless finance. They allow users to store value, transact, and build applications without depending on banks or governments. In theory, this creates a more resilient and censorship-resistant financial system.

Despite these advantages, decentralized stablecoins still represent a small portion of the overall stablecoin market. Most users continue to rely on centralized alternatives because they are easier to understand and often more stable in practice. Buterin argues that decentralized stablecoins must evolve beyond their current limitations to compete effectively.

Decentralized Stablecoins and Dollar Dependence

One major issue is that most decentralized stablecoins are still tied to the US dollar. While the dollar is widely used and familiar, it is not a perfect long-term benchmark. Over time, inflation reduces purchasing power, and monetary policy decisions can affect value in unpredictable ways.

Buterin suggests that decentralized stablecoins should explore alternatives to simple dollar pegs. Instead of tracking a single fiat currency, future designs could aim to maintain stable purchasing power based on broader economic indicators. This could help protect users over long time horizons and reduce dependence on any one national currency.

Editor’s View: Why Users Still Prefer Centralized Stability

One reason decentralized stablecoins struggle to gain adoption is not purely technical, but psychological. In volatile markets, users often prioritize familiarity and perceived reliability over ideological purity, even if that reliability depends on centralized actors. Many market participants treat stablecoins less as long-term stores of value and more as temporary parking tools, which reduces the incentive to question underlying design trade-offs. This gap between how stablecoins are intended to function and how they are actually used helps explain why structural weaknesses persist without immediate user backlash.

Oracle Problems in Decentralized Stablecoins

Another critical weakness lies in oracles. Oracles provide blockchains with external data, such as asset prices. Decentralized stablecoins rely heavily on oracles to determine whether they are properly collateralized.

Buterin warns that oracle systems can become targets for manipulation. If attackers are able to influence price data, they can destabilize the entire system. To prevent this, protocols often increase economic costs or add complex safeguards, but these solutions can reduce efficiency and accessibility.

For decentralized stablecoins to succeed, oracle systems must become more robust, more decentralized, and harder to manipulate without placing excessive burdens on users.

Incentive Conflicts in Decentralized Stablecoins

Decentralized Stablecoins also face incentive problems related to staking. On proof-of-stake networks like Ethereum, users can earn rewards by staking tokens to secure the network. However, those same tokens are often used as collateral for stablecoins.

This creates a conflict. Users must choose between earning staking rewards or locking their assets into stablecoin systems that may offer lower returns. As a result, stablecoin adoption can suffer, and the broader ecosystem becomes less efficient.

Buterin outlines several possible solutions, such as lowering staking rewards overall, redesigning staking mechanisms, or redistributing risk among participants. Each option has trade-offs, and no single solution is perfect, but the problem must be addressed for decentralized stablecoins to scale.

Risk Management and System Resilience

Beyond these core issues, Buterin emphasizes the importance of resilience. Decentralized stablecoins must be able to survive extreme market conditions, sudden price drops, and unexpected attacks. Simply locking up large amounts of collateral is not enough if the system cannot adapt quickly.

Protocols need flexible mechanisms that can respond dynamically to stress. Without these safeguards, even well-collateralized stablecoins can fail during periods of high volatility.

Governance Challenges for Decentralized Stablecoins

Governance is another area of concern. Many decentralized stablecoins rely on token-based voting systems, where influence is tied to economic ownership. Buterin warns that this can encourage short-term profit extraction rather than long-term stability.

If governance systems prioritize financial power over technical resilience, protocols may become vulnerable to coordinated attacks or misaligned incentives. Stronger governance models that emphasize security and sustainability are needed.

The Current State of Decentralized Stablecoins

While some decentralized stablecoins have achieved moderate success, they remain far smaller than centralized competitors. This gap reflects both technical limitations and user trust issues. Many existing designs still resemble centralized models, undermining the original goal of decentralization.

Buterin’s analysis suggests that future progress will require deeper innovation rather than incremental changes. New approaches to benchmarks, oracles, incentives, and governance will be necessary.

The Future of Decentralized Stablecoins

Decentralized Stablecoins have the potential to become a cornerstone of global digital finance, but only if their underlying structures improve. Buterin’s critique serves as a roadmap for developers and researchers working in this space.

By addressing dollar dependence, strengthening oracle systems, aligning incentives, and improving governance, decentralized stablecoins can move closer to delivering true financial independence. The next generation of designs may define whether stablecoins remain niche tools or evolve into foundational infrastructure for decentralized economies.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL