Ethereum Mainnet Activity Surpasses Layer 2 Usage

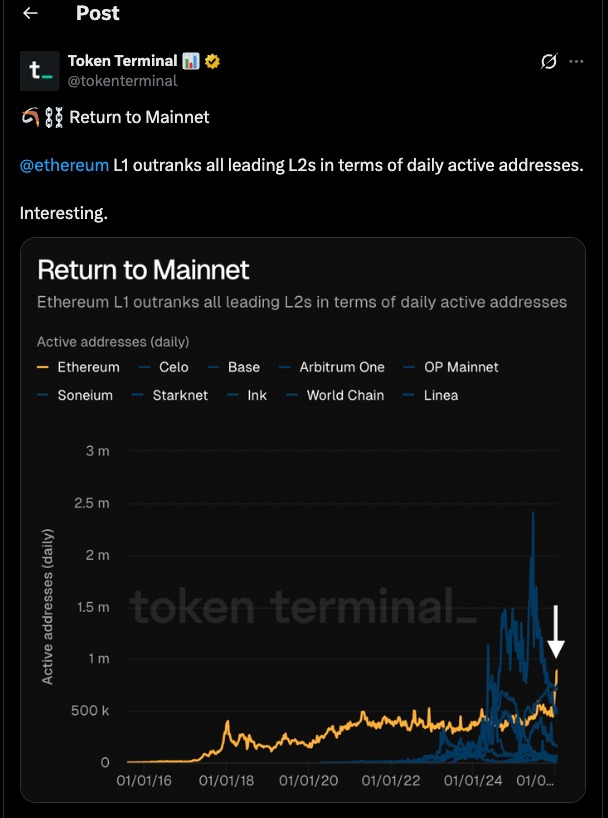

Ethereum Mainnet Activity is increasing again as daily active addresses on the Ethereum main network have surpassed the combined total of all layer 2 networks. This development shows that users are returning to the main Ethereum chain despite the growth of scaling solutions designed to reduce fees and improve speed.

For a long time, layer 2 networks were expected to take over most user activity because they offer cheaper and faster transactions. However, recent data shows that more users are choosing to interact directly with the Ethereum mainnet. This signals a shift in how people use the network and what they value most when making onchain transactions.

Ethereum Mainnet Activity Sees Strong User Growth

Ethereum Mainnet Activity has reached levels not seen in recent years. The number of unique wallet addresses interacting with the mainnet on a daily basis has grown steadily and now exceeds the total daily addresses across all major layer 2 platforms.

This increase suggests that users still see value in the mainnet despite higher transaction fees. The main Ethereum network continues to be viewed as the most secure and reliable settlement layer, especially for important or high value transactions.

The chart highlights how Ethereum’s base layer has recently overtaken leading layer 2 networks in daily active addresses. While layer 2 usage still shows sharp spikes tied to specific applications or incentives, mainnet activity appears steadier and more consistent over time. This contrast suggests that recent growth on Ethereum is not driven by a single event, but by broader, sustained usage. The data supports the view that users are intentionally choosing the mainnet rather than arriving there by accident.

Why Ethereum Mainnet Activity Is Rising

Ethereum Mainnet Activity is growing for several reasons. One major factor is the increase in onchain experiments, including new token launches and applications that require direct interaction with Ethereum’s base layer.

Some activities rely heavily on Ethereum’s security and composability, which means they work best on the mainnet. In these cases, users are willing to pay higher fees to ensure their transactions settle directly on Ethereum rather than through a secondary network.

Another contributor is the rise of data heavy transactions. Certain types of onchain data usage perform better on the mainnet, pushing more users back to the base layer.

Ethereum Mainnet Activity Compared to Layer 2 Networks

Ethereum Mainnet Activity overtaking layer 2 networks does not mean that layer 2 adoption is declining. Layer 2 platforms continue to process large numbers of transactions and remain critical to Ethereum’s long term scaling strategy.

The difference lies in how each layer is used. Layer 2 networks are often chosen for frequent, lower value transactions where speed and cost matter most. The mainnet, on the other hand, is preferred for contract deployments, governance actions, and high value financial interactions.

This division shows that Ethereum is becoming a multi layer ecosystem where each layer serves a specific purpose rather than competing directly with one another.

Fees and Their Impact on Ethereum Mainnet Activity

Transaction fees have always influenced Ethereum Mainnet Activity. High gas fees previously pushed many users toward layer 2 networks. Recently, however, fee conditions have become more predictable, making it easier for users to plan mainnet transactions.

Better tools for estimating gas costs have also reduced uncertainty. Many users now see higher fees as an acceptable cost for stronger security and better compatibility with complex decentralized applications.

Ethereum Mainnet Activity Supports Network Security

Ethereum Mainnet Activity plays an important role in strengthening the network. More transactions mean higher fee revenue for validators, which helps maintain strong economic incentives to secure the chain.

Higher activity also shows confidence from developers. Most major protocols still deploy their core contracts on the mainnet before expanding to layer 2 networks. Increased address activity suggests that Ethereum remains the primary foundation for innovation.

Ethereum Mainnet Activity and Market Behavior

Ethereum Mainnet Activity often reflects broader market sentiment. When onchain engagement increases, it usually means more users are actively participating in decentralized finance, digital collectibles, and other blockchain based services.

While address counts do not directly predict price movements, higher activity levels often indicate growing interest in the ecosystem. This can lead to more development and long term adoption.

Ethereum Mainnet Activity Does Not Replace Layer 2 Solutions

The rise in Ethereum Mainnet Activity does not signal the failure of layer 2 networks. Instead, it highlights how different layers are used for different needs.

Layer 2 solutions remain essential for scaling Ethereum and supporting mass adoption. At the same time, the mainnet continues to act as the core settlement and coordination layer for the entire ecosystem.

Editor’s View: Ethereum Mainnet Activity and User Choice

Beyond the raw address counts, this shift suggests a change in how users think about risk and trust. When activity moves back to the mainnet, it often reflects a preference for clearer settlement guarantees and fewer dependencies, even if that comes at a higher cost. For some users, especially those interacting with newer protocols or larger positions, the simplicity of transacting directly on Ethereum outweighs efficiency gains elsewhere. This behavior is difficult to capture in charts, but it has appeared before during periods when confidence in infrastructure mattered more than convenience.

What Ethereum Mainnet Activity Means Going Forward

Ethereum Mainnet Activity surpassing layer 2 usage shows that the base layer is still highly relevant. Even as the ecosystem grows, the mainnet remains central to security, governance, and innovation.

This trend demonstrates Ethereum’s flexibility. Rather than being replaced by scaling solutions, the mainnet works alongside them. Users can choose the layer that best fits their goals, whether that is speed, cost, or security.

As new applications and use cases emerge, Ethereum Mainnet Activity will remain one of the most important indicators of network health. The recent growth in daily addresses confirms that Ethereum’s foundation continues to attract users in an increasingly layered ecosystem.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL