Ethereum Stablecoin Volume Sets New Record in Q4

Ethereum Stablecoin Volume surged to unprecedented levels in the fourth quarter, marking one of the strongest indicators yet of Ethereum’s continued importance in the global crypto economy. During Q4, stablecoin transfers on the Ethereum network surpassed 8 trillion dollars in total value, setting a new all-time quarterly record and reinforcing Ethereum’s position as the leading settlement layer for digital dollars.

This milestone reflects more than just market hype. Stablecoins are widely used for trading, payments, decentralized finance, and capital movement, making their transfer volume a reliable signal of real blockchain activity. The latest data shows that Ethereum remains the primary network where this activity takes place, even as newer blockchains compete for market share.

Ethereum Stablecoin Volume Hits a New Quarterly High

Throughout the final months of the year, Ethereum stablecoin volume increased steadily before breaking previous records. The more than 8 trillion dollars in transfers represents the highest quarterly stablecoin activity ever recorded on Ethereum. This growth occurred during a period of renewed momentum in the crypto market, when trading activity and onchain participation accelerated.

Stablecoins such as USDT and USDC account for the majority of this volume. These assets are commonly used as trading pairs on exchanges, liquidity tools in decentralized finance, and settlement instruments for large transactions. Their heavy use on Ethereum highlights the network’s role as the backbone of stablecoin infrastructure.

Key Drivers Behind Ethereum Stablecoin Volume Growth

One major factor behind the rise in Ethereum stablecoin volume was increased trading activity across crypto markets. As prices became more volatile and investor interest returned, traders moved capital frequently between exchanges, wallets, and protocols using stablecoins as a low-risk medium of exchange.

Decentralized finance also played a significant role. Lending platforms, decentralized exchanges, and yield-generating protocols rely heavily on stablecoins for liquidity and collateral. As usage across these platforms expanded, the amount of stablecoins moving across Ethereum grew alongside it.

Another important factor was institutional participation. Larger market participants often prefer Ethereum due to its security, liquidity depth, and established infrastructure. High-value stablecoin transfers are more likely to occur on Ethereum, contributing significantly to total transfer volume.

Market Volatility and Stablecoin Activity

Ethereum stablecoin volume often increases during periods of uncertainty and volatility. When market conditions become unpredictable, many participants convert volatile assets into stablecoins to preserve value while remaining active in the crypto ecosystem. This behavior results in higher transfer volumes as funds move rapidly between different platforms.

During Q4, this pattern was clearly visible. Rather than exiting the market entirely, users stayed onchain and relied on stablecoins for flexibility and risk management. This reinforces Ethereum’s role as a financial hub where users can respond quickly to changing market conditions.

Ethereum’s Dominance in Stablecoin Transfers

Despite growing competition from other blockchains that offer lower transaction fees and faster processing times, Ethereum continues to dominate stablecoin transfers by total value. Other networks have gained traction for smaller payments and retail transactions, but Ethereum remains the preferred choice for large settlements and complex financial activity.

Ethereum’s dominance is supported by its mature ecosystem, deep liquidity, and widespread integration across wallets, exchanges, and applications. These advantages make it difficult for competitors to replace Ethereum as the primary stablecoin settlement layer, especially for high-value transactions.

The Role of Layer Two Networks

Layer two solutions have also contributed indirectly to Ethereum stablecoin volume. While some stablecoin activity has moved to these scaling networks to reduce costs, Ethereum mainnet remains the core settlement layer. Assets are frequently bridged back and forth, generating additional transaction volume on Ethereum itself.

By improving efficiency and reducing congestion, layer two networks help sustain long-term growth without fully diverting activity away from Ethereum. This layered approach strengthens Ethereum’s overall ecosystem rather than weakening it.

What Rising Ethereum Stablecoin Volume Means

The record-breaking Ethereum stablecoin volume has important implications for the network. High transaction activity generates fee revenue and increases ETH burn, which supports Ethereum’s economic model. Sustained usage also signals strong real-world demand beyond speculative trading.

Stablecoin transfers are particularly valuable as a metric because they reflect genuine financial activity. Payments, settlements, and capital movement are all tied to stablecoin usage, making this growth a strong indicator of network health.

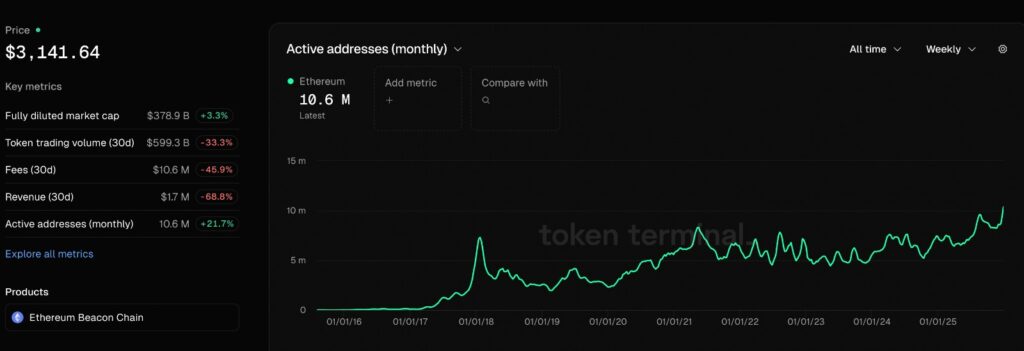

The rise in monthly active addresses adds important context to the surge in stablecoin transfers. Higher address activity suggests that volume is being driven by a broader base of users rather than a small number of large transactions. It also points to repeated engagement, where participants return to the network instead of appearing briefly during market spikes. Taken together, this supports the view that Ethereum’s stablecoin activity is tied to routine usage rather than isolated bursts of demand.

A Signal of Broader Ecosystem Strength

The surge in Ethereum stablecoin volume benefits the wider crypto ecosystem. High liquidity supports more efficient markets and enables developers to build more advanced financial applications. It also reinforces Ethereum’s reputation as the most reliable platform for decentralized finance.

For builders, investors, and institutions, this data confirms that Ethereum remains the most active and trusted blockchain for stablecoin-based transactions. The network continues to attract users even as alternatives attempt to challenge its position.

Editor’s View:

What stands out behind the surge in Ethereum stablecoin volume is not just activity, but intent. Many participants appear to be treating stablecoins less as temporary parking assets and more as working capital that stays in motion across the network. This suggests a level of comfort with onchain infrastructure where users expect reliability during both calm and uncertain periods. In that sense, the volume reflects trust built over time rather than a single burst of speculative behavior.

Looking Ahead

Ethereum stablecoin volume reaching a new high in Q4 sets a strong benchmark for future growth. Whether this level is sustained will depend on market conditions, regulatory developments, and continued innovation within the Ethereum ecosystem.

What is clear is that Ethereum has firmly established itself as the central hub for stablecoin activity. As stablecoins continue to play a critical role in global digital finance, Ethereum is likely to remain at the core of that system for the foreseeable future.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL