Memecoin Market: Is the Hype Really Over?

Memecoin Market activity has been under the spotlight recently as new data points to a noticeable slowdown across the sector. The sharp increase in popularity that powered meme-based cryptocurrencies earlier in the year appears to be losing momentum. With market cap slipping, trading activity cooling, and investor enthusiasm softening, analysts are now asking whether the memecoin surge that once defined retail speculation is starting to fade. The latest numbers show clear signs of stress, and this has prompted traders to reassess how sustainable the space really is.

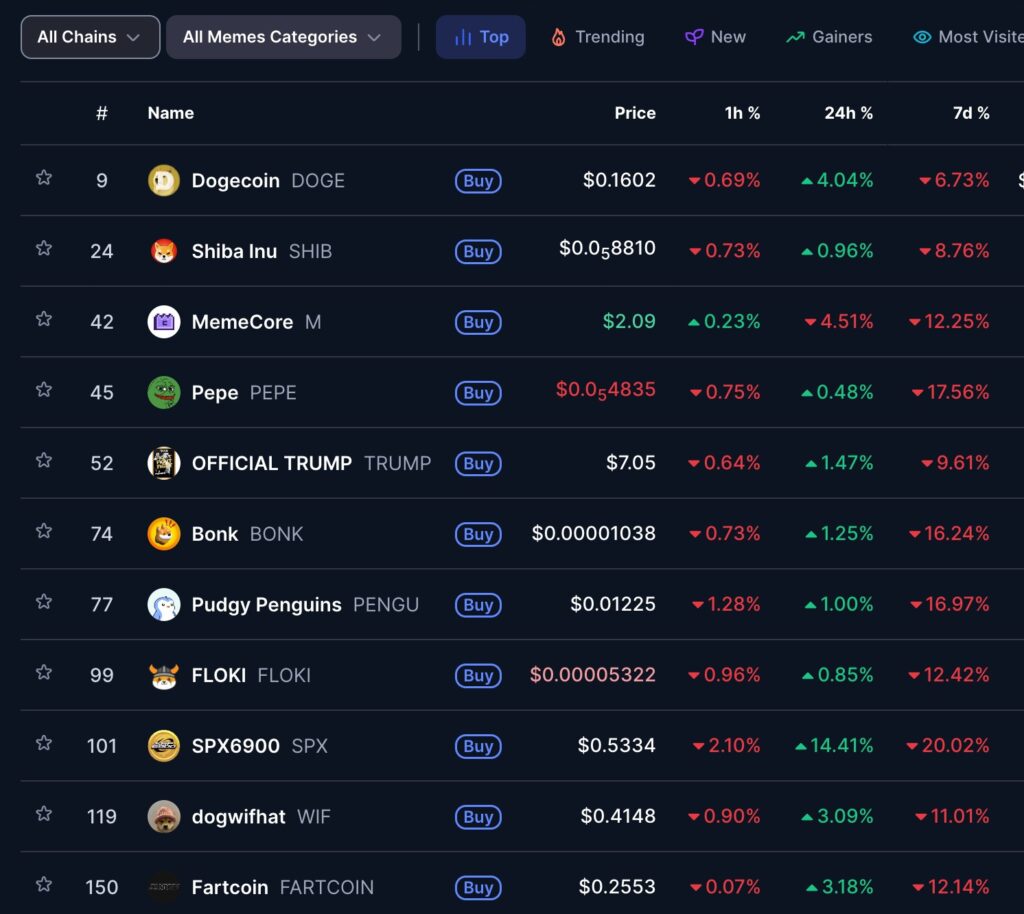

The latest price chart from CoinMarketCap adds further clarity to the current state of the memecoin market. Many of the leading tokens shown in the image have continued to trend downward, reflecting the same broader weakness seen across recent market data. The visible declines in well-known assets such as Dogecoin, Shiba Inu, Pepe and others reinforce the ongoing loss of momentum in the sector. With several top memecoins showing red across their 24-hour and weekly performance indicators, the chart illustrates how investor sentiment has shifted and how the overall market environment is placing additional pressure on meme-driven tokens.

Market Overview

The most recent market data shows that the total value of the Memecoin Market dropped to about 52 billion dollars, registering a decline of around 1.4 percent in a single day. Daily trading volume also fell, reaching roughly 5.4 billion dollars. While the broader cryptocurrency market continues to sit in the multi-trillion-dollar range, memecoins are underperforming when compared to other major categories. This underperformance suggests that fewer traders are actively participating in meme-based tokens, and that enthusiasm is cooling after months of heavy speculation. The slowdown is not limited to one or two coins; the shift is happening across the board.

Weekly Performance

A deeper review of weekly performance reinforces the idea that the Memecoin Market is facing widespread pressure. All top memecoins by market capitalization recorded double-digit losses over the past week. These losses ranged from approximately 9.9 percent to nearly 30 percent, depending on the token. Among them, Dogecoin posted a drop of more than 10 percent and traded near the 0.16 dollar range. Pepe, Pudgy Penguins, and Bonk each experienced declines of more than 18 percent during the same period. Even Shiba Inu, which held up slightly better, still followed the downward pattern. These declines highlight that the weakness is not isolated; it is sector-wide and systematic.

Market Sentiment

One of the core reasons behind the downward shift in the Memecoin Market is declining sentiment across the cryptocurrency industry. Memecoins rely heavily on hype, social media attention, quick speculation, and viral community behavior. Because they typically lack strong utility or deep development roadmaps, they tend to be more sensitive to drops in investor confidence. When the overall crypto market becomes cautious, memecoins are often the first to show signs of stress. This makes them very reactive to shifts in sentiment, and the current decline reflects that sensitivity clearly.

Trading Behavior

Changes in trading patterns have also contributed to the slump. Recent data shows that sell pressure has risen sharply in many memecoins, while buy interest has fallen. In some cases, sell volume has reached more than one million dollars, while buy volume has come in at about half that amount. This imbalance demonstrates that many traders are choosing to exit their positions instead of accumulating. One example is Fartcoin, which became the most accumulated coin among certain traders despite having fallen more than 90 percent from its all-time high. On the opposite end, Useless Coin saw the highest level of selling activity within a 24-hour window and suffered a one-day drop of about 21 percent. These examples illustrate how speculative capital is shifting away from high-risk meme-based assets.

Sector Stability

With ongoing losses, traders are questioning how stable the Memecoin Market really is. Unlike sectors built on utility, memecoins often depend on trends and community-driven excitement. When enthusiasm begins to fade, the market tends to follow. The recent declines suggest that the once-strong speculative cycle may be entering a cooling phase. For now, the instability is encouraging investors to take a more cautious approach. However, this does not necessarily mean the sector is finished. It simply signals that the intense wave of hype may be easing off.

Possibility of a Recovery

Despite the current downturn, it is too early to say that the Memecoin Market has no chance of recovery. Historically, memecoins have rebounded during broader market upswings. Their performance often tracks overall crypto sentiment rather than developments within the individual projects. If general market confidence improves and traders regain their appetite for high-risk assets, memecoins could experience another surge. A renewed wave of buying activity, increased social buzz, or a major catalyst in the crypto market could help lift the sector higher again. The path forward will depend heavily on overall market conditions rather than token-specific progress.

What Investors Should Watch

For those watching the Memecoin Market, several key points stand out. First, capital is flowing out of the sector. Second, trading activity is falling, which shows reduced interest from both new and existing traders. Third, heavy sell pressure indicates that many investors may be locking in profits or minimizing risk. Finally, the market’s reliance on sentiment makes it more vulnerable during uncertain times. These signals suggest caution, but they do not rule out improvement. A shift in broader market momentum could reinvigorate interest in meme-driven tokens.

Conclusion

The Memecoin Market is showing clear signs of cooling. Market cap has dropped, trading volume has weakened, and weekly performance across top tokens has been consistently negative. The decline appears to be tied to reduced investor enthusiasm, increased selling activity, and shifting market sentiment rather than problems with specific tokens. While the current trend suggests a slowdown, history shows that the sector can rebound under the right conditions. For now, the memecoin space is no longer leading the market, but it remains an area to watch closely as broader trends evolve.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe