Popcat Attack Exposes Major Hyperliquid Vulnerability

Popcat Attack is the phrase now circulating across the crypto world after a dramatic event on the Hyperliquid derivatives platform led to nearly five million dollars in losses. The incident involved an unusual form of market manipulation that did not aim for profit but appeared focused on destabilizing the platform’s liquidity protections. The event has since become a reference point in discussions about transparency, risk exposure and the limits of automated safeguards in decentralized finance.

How the Popcat Attack started

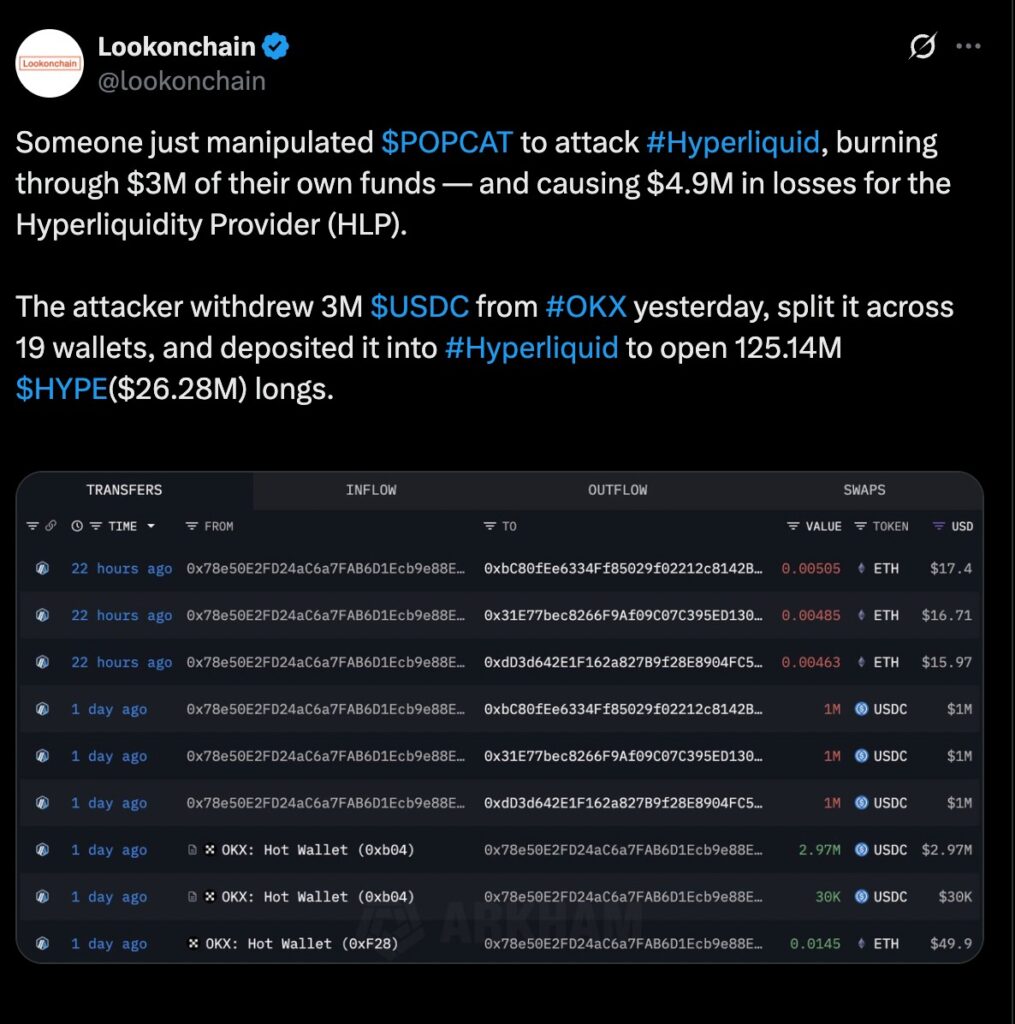

The Popcat Attack began when a single trader withdrew three million dollars in USDC from OKX and divided it across nineteen different wallets. According to the original reporting, this step made it harder to detect coordinated trading behavior and laid the foundation for a large leveraged position on Hyperliquid. With the funds distributed, the trader opened more than twenty-six million dollars worth of long positions on the POPCAT token through Hyperliquid’s perpetual contracts. These oversized positions relied heavily on leverage and were concentrated on an asset known for volatility.

Once the positions were placed, the trader created a twenty-million-dollar buy wall around the price of twenty-one cents. A buy wall is a well-known tactic, often used to create the appearance of strong demand. In this case, the effect was to give the market a sense of stability and upward pressure. However, the buy wall was never designed to stay. Shortly after placing it, the trader canceled the entire wall, causing a sudden absence of support. This abrupt removal allowed the price to collapse quickly and forced a wave of liquidations.

Liquidity damage from the Popcat Attack

The platform’s Hyperliquid Liquidity Provider vault, often referred to as the HLP vault, absorbed most of the damage. When the POPCAT price crashed, the leveraged long positions unwound, and the automated liquidation process pushed the losses into the liquidity vault. By the time the crash stabilized, the vault had lost approximately four point nine million dollars.

What made the Popcat Attack even more unusual was that the attacker received no profit from the maneuver. With their three-million-dollar collateral wiped out, the event was a net loss for the trader as well. This detail led many observers to conclude that the purpose was not financial gain but something closer to stress testing, sabotage or even an extreme form of speculation with no expectation of return.

Why the Popcat Attack stands out

The Popcat Attack quickly drew attention because it blended market manipulation, high leverage and deliberate self-sacrifice. Most crypto exploits attempt to drain funds or trick a protocol, but this attack simply engineered a scenario where everyone lost. Several analysts described it as one of the more reckless forms of trading behavior seen in recent years. On social platforms, some called it performance art, while others referred to it as a form of chaotic experimentation made possible by unrestricted leverage.

Another point that stood out was the use of numerous wallets. While using multiple wallets is common in crypto, coordinating them to open synchronized positions helped mask the strategy and amplified the eventual chain reaction. This tactic highlighted an existing challenge in decentralized systems: identifying harmful coordination without violating user privacy or autonomy.

Hyperliquid’s response to the Popcat Attack

As the liquidation cascade unfolded, Hyperliquid temporarily paused specific deposits and withdrawals. In particular, it activated an EmergencyLock function connected to its Arbitrum bridge. This step helped halt movement on the chain and prevented additional liquidity risks from entering the system. The pause lasted for roughly an hour before operations resumed. Although temporary, the halt raised questions among users about how responsive and resilient the platform is during extreme events.

Hyperliquid did not immediately publish a full technical breakdown, but community channels and on-chain data confirmed the activation of the emergency mechanism. Many users appreciated the quick action, while others argued that such measures reflected deeper structural weaknesses that needed attention.

Lessons DeFi platforms can draw from the Popcat Attack

The Popcat Attack serves as a reminder that leverage on low-liquidity or speculative tokens comes with significant risk. Even when a platform has automated systems to manage liquidations, a determined user willing to burn millions can disrupt the balance. For decentralized exchanges and derivative platforms, this means developing clearer limits on position sizes, especially for assets with shallow liquidity and extreme volatility.

Another clear lesson is the need for improved detection of multi-wallet coordination. Although decentralization allows users to manage funds freely, platforms can still establish behavioral flags that identify suspiciously aligned activity without directly identifying users. Designing such tools will be a difficult challenge but may become necessary as DeFi matures.

What traders should take from the Popcat Attack

For individual traders, the Popcat Attack is a case study in understanding how community-funded liquidity vaults operate. Many users assume such vaults behave like traditional liquidity pools, but the event demonstrated that they can absorb major losses when used to stabilize leveraged positions. Traders should be aware that large, unexpected market moves can hit shared vaults harder than isolated accounts.

Users should also recognize that even established platforms can experience disruptions. In a decentralized environment, safeguards may not always function as expected under stress, and the presence of high-risk assets can magnify those disruptions.

The ongoing impact of the Popcat Attack on DeFi

The Popcat Attack will likely influence how DeFi platforms shape their risk controls in the coming months. The fact that someone willingly destroyed personal capital to destabilize a system suggests a new category of threat: loss-driven attacks that do not rely on hacking but instead manipulate market structure. Platforms may need updated rules for leverage, token listings and vault architecture to protect themselves from similar scenarios.

For Hyperliquid, the recovery process will involve rebuilding user confidence and demonstrating that new safeguards can withstand extreme situations. For the broader DeFi landscape, the event has already reignited discussions about transparency, protection for liquidity providers and balancing user freedom with responsible guardrails.

In the end, the Popcat Attack stands as a dramatic reminder of how volatility, leverage and coordinated action can reshape markets quickly. The question now is how platforms adapt and whether future safeguards can keep pace with the increasingly creative strategies emerging in decentralized finance.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe