USDC policy update allows lawful firearm purchases

USDC policy changes introduced by Circle Internet Financial have sparked widespread discussion. The company behind the USD Coin (USDC) stablecoin has updated its terms to clarify that users can make lawful firearm purchases using USDC. The update, effective from late October 2025, aims to align Circle’s compliance rules with U.S. law and address criticism over financial discrimination in digital payments.

USDC policy explained

Circle’s revised user agreement now states that it reserves the right to “monitor, block, or prevent transactions” involving weapons or related accessories only if such transactions violate applicable law. This marks a key shift from earlier wording that broadly prohibited any weapon-related transactions, regardless of legality.

The updated language essentially means that lawful purchases are allowed, while illegal transactions remain prohibited. The company continues to emphasize its commitment to legal compliance, risk management, and transparency in how USDC is used worldwide.

Why Circle changed the USDC policy

The new USDC policy comes amid growing debate about whether financial institutions should restrict certain industries from using their services. For years, gun rights advocates and some lawmakers argued that blanket bans on firearm purchases using digital assets or payment platforms amounted to ideological discrimination.

Under the previous terms, Circle had banned “weapons of any kind” from USDC transactions, a policy that many saw as politically motivated rather than legally necessary. The revision now brings the company’s stance closer to the Second Amendment rights framework and general commerce laws in the United States.

Circle stated that the new wording ensures consistency with U.S. law, where owning and purchasing firearms remains legal when done according to federal and state regulations. By revising its policy, Circle demonstrates a neutral approach, focusing on compliance rather than ideology.

Reaction to the USDC policy change

Support from lawmakers

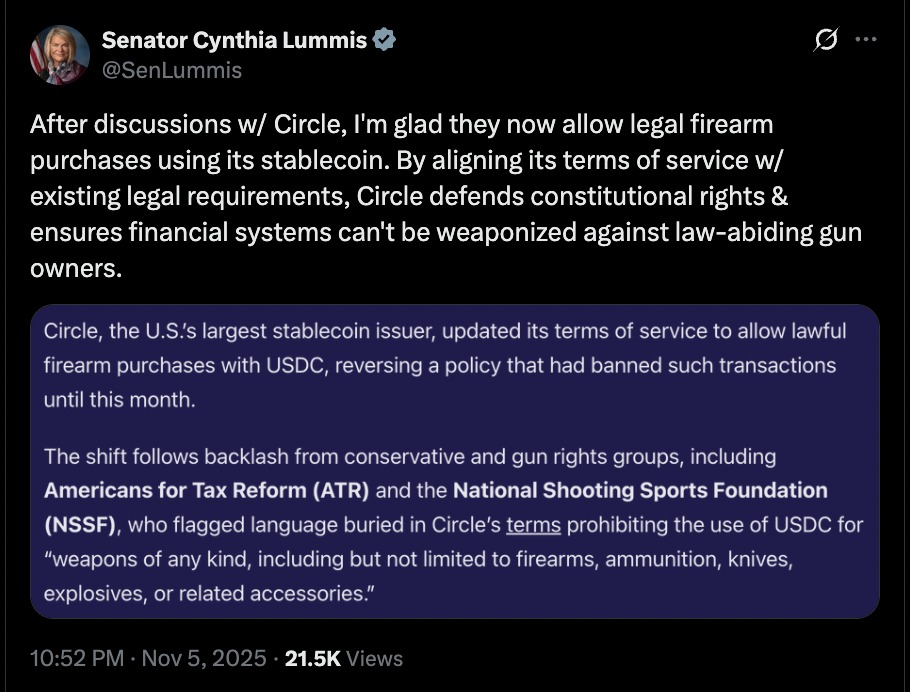

The policy shift received praise from several U.S. lawmakers. Senator Cynthia Lummis commended Circle for upholding lawful access to financial tools. She argued that stablecoin issuers should not be used to bypass or undermine constitutional rights. Similarly, Senator Bill Hagerty described the change as a “win for fairness,” saying it pushed back against efforts to use payment infrastructure for political pressure.

The post from Senator Cynthia Lummis highlights how the USDC policy change has drawn support from lawmakers who view it as a protection of constitutional and financial rights. Lummis emphasized that by aligning its terms of service with U.S. law, Circle ensures that financial platforms cannot be used to discriminate against lawful industries or individuals. Her statement also reinforces the broader narrative that digital asset companies are taking steps to balance compliance with fairness in access to financial systems.

Lawmakers emphasized that financial companies must avoid “Operation Chokepoint”-style practices, where banks or fintech firms cut off services to industries that are politically controversial but legal. Circle’s update is seen as an example of a company reaffirming neutrality in commerce.

Praise from the firearms industry

The National Shooting Sports Foundation (NSSF), which represents the U.S. firearms industry, applauded Circle’s decision. The group said the revision corrects a “misguided policy” that effectively punished law-abiding businesses. According to NSSF, the updated USDC policy recognizes that lawful commerce in firearms is no different from other legal transactions.

Industry experts noted that Circle acted swiftly once the issue gained public attention, suggesting the company aims to maintain trust and neutrality in its payment ecosystem.

Broader implications of the USDC policy

Stablecoin regulation and compliance

Circle’s update highlights an important balance for stablecoin issuers: ensuring compliance with laws while maintaining open access to legitimate users. The USDC policy still enforces all relevant anti-money laundering (AML) and counter-terrorism financing (CTF) measures. Every transaction must comply with federal and state laws, and Circle reserves the right to block illegal or suspicious activity.

This dual approach allows the company to satisfy regulators while maintaining the decentralized utility of USDC. It could serve as a model for other stablecoin issuers looking to navigate controversial use cases.

Impact on financial access

By revising its terms, Circle also positions USDC as a more inclusive payment tool. Some analysts argue that this step strengthens confidence in stablecoins as neutral digital assets, usable by anyone who follows the law. If private companies act as gatekeepers based on politics rather than legality, public trust in financial technology could erode.

With this policy shift, Circle may be reinforcing its commitment to open financial access and user autonomy, principles that are foundational to cryptocurrency’s appeal.

Potential ripple effect on other platforms

Observers expect other digital finance and crypto firms to review their own terms of service after the USDC policy update. Sectors like firearms, cannabis, or gambling often face restrictions from traditional banks, and crypto platforms may now reconsider whether such blanket bans are necessary or fair.

As digital assets continue entering mainstream payments, the question of who decides what is “acceptable” commerce will likely become more pressing. Circle’s move may encourage a wider discussion about the role of private companies in shaping access to money.

Circle’s official position

Circle’s public statements following the policy update reiterate that USDC remains a regulated stablecoin backed by U.S. dollars and subject to strict oversight. The company insists that its compliance standards remain intact and that lawful transactions will always be supported.

Circle maintains that it does not take positions on political issues but focuses on ensuring that its financial products comply with all applicable laws. The USDC policy update, therefore, reflects a practical adjustment rather than a political one.

The company also confirmed that it will continue working with regulators to ensure transparency and trust in the growing stablecoin market.

Final thoughts on the USDC policy update

The new USDC policy represents a meaningful step in the evolving relationship between digital currency providers, law, and individual rights. By clarifying that lawful firearm purchases are permitted, Circle is reinforcing both legal compliance and fairness in its user agreements.

The decision sends a message that stablecoin issuers can respect the law without imposing unnecessary restrictions on lawful users. It also shows that crypto companies are learning to balance regulatory demands with public expectations of neutrality and inclusion.

As stablecoins gain popularity, updates like this will help define how digital currencies operate within real-world legal systems. For users, the message is simple: if a transaction is lawful, it can be done with USDC. For the industry, it marks a clear shift toward responsible yet open financial innovation.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL