XRP ETF Inflows Explain Why Price Is Stuck

XRP ETF Inflows have surged to nearly one billion dollars over a sustained period, yet XRP’s market price has failed to respond in a meaningful way. This unusual disconnect between strong capital inflows and weak price action has sparked debate across the crypto market. Normally, consistent inflows into exchange-traded funds signal rising demand that pushes prices higher. However, XRP appears to be defying that pattern, remaining largely range-bound despite growing institutional interest.

Over the past several weeks, U.S.-listed spot XRP ETFs have recorded a long streak of positive net inflows. These inflows show that investors are actively allocating capital into regulated XRP investment products. On paper, this looks like a bullish development. Still, XRP has remained close to the same price levels, frustrating traders who expected a breakout.

Understanding this behavior requires a closer look at how XRP ETF Inflows work, how demand is being absorbed, and what is happening in the broader XRP market.

What XRP ETF Inflows Really Represent

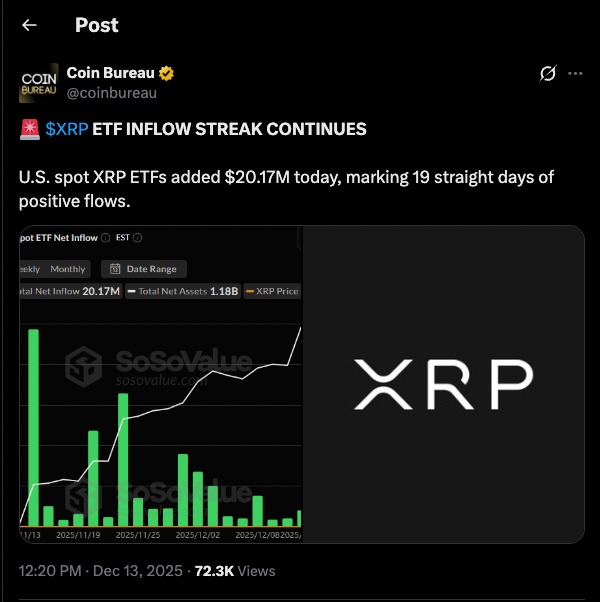

Recent data shared publicly highlights the consistency behind XRP ETF Inflows. A post from Coin Bureau confirms that U.S. spot XRP ETFs recorded an additional $20.17 million in net inflows in a single day, extending the streak to 19 consecutive days of positive flows. This reinforces the broader trend of sustained capital entering XRP-related investment products rather than short-lived spikes driven by speculation. Such consistency suggests deliberate accumulation rather than reactive trading, aligning with the view that ETF inflows reflect longer-term positioning instead of short-term momentum chasing.

XRP ETF Inflows represent net capital entering spot ETF products that track the price of XRP. Instead of buying XRP directly on crypto exchanges, investors gain exposure through traditional brokerage accounts. These ETFs are designed mainly for institutions, funds, and long-term investors who prefer regulated vehicles.

Recent data shows that multiple XRP ETFs have experienced daily inflows for nearly three consecutive weeks. Several issuers have contributed to this growth, with some ETFs attracting millions of dollars per day. Over time, these steady inflows have added up to almost one billion dollars in total assets.

This trend clearly signals interest, but interest alone does not always translate into immediate price action.

Why XRP ETF Inflows Are Not Moving the Price

Despite strong XRP ETF Inflows, several forces are preventing the price from rising.

Selling Pressure Outside ETFs

While ETFs are accumulating XRP, other parts of the market are selling. Traders in spot and derivatives markets continue to take profits or hedge positions. This selling activity effectively offsets ETF buying.

In particular, derivatives markets play a major role in XRP price discovery. Many traders use futures contracts to express bearish or neutral views. As long as this sell-side pressure exists, ETF inflows struggle to push prices higher.

ETFs Absorb Supply Slowly

ETF demand tends to be slow and methodical. Unlike retail traders who chase price momentum, ETF investors usually buy gradually. This means XRP is being absorbed quietly without causing sudden spikes in demand on open exchanges.

As a result, the market experiences accumulation rather than explosive movement.

Spot Market Versus Derivatives Market Dynamics

Another key reason XRP ETF Inflows have limited impact is the dominance of derivatives trading. XRP futures volumes often exceed spot volumes, meaning price direction is frequently dictated by leveraged positions rather than real-time buying of XRP tokens.

Open interest in XRP derivatives has also declined, signaling reduced speculative conviction. When fewer traders are placing strong directional bets, price tends to consolidate even if long-term accumulation is happening in the background.

This creates a situation where ETFs steadily buy XRP, but derivatives traders prevent momentum from building.

ETF Demand Is Long-Term, Not Short-Term

XRP ETF Inflows reflect a different type of investor behavior. Many ETF buyers are institutions, asset managers, or retirement accounts. These investors are not focused on short-term price swings. Instead, they are building positions for long-term exposure.

Because of this, ETF inflows do not generate the same urgency or emotional buying seen during retail-driven rallies. There is no rush to push prices higher, only steady accumulation.

Over time, this can actually stabilize XRP’s price rather than inflate it quickly.

Market Awareness Still Remains Limited

Another reason XRP ETF Inflows have not triggered a rally is limited awareness. Many retail investors are either unaware of XRP ETF products or unsure how to interpret their impact. Compared to Bitcoin ETFs, XRP ETFs are still relatively new and less discussed.

Additionally, some investors remain cautious due to regulatory history and broader crypto market uncertainty. This hesitation reduces follow-through buying from retail participants who usually amplify price moves.

What XRP ETF Inflows Mean for the Future

Although XRP ETF Inflows have not caused immediate price appreciation, they are not meaningless. Steady inflows reduce available circulating supply by moving XRP into long-term investment vehicles. Over time, this can strengthen price support and reduce downside volatility.

If market sentiment improves or selling pressure decreases, the accumulated ETF holdings could act as a foundation for a stronger move higher. In that sense, ETF inflows may be setting the stage for future growth rather than fueling instant gains.

Additionally, continued inflows suggest growing institutional confidence. As more financial advisors and portfolio managers include XRP ETFs, the investor base becomes broader and more stable.

Final Thoughts on XRP ETF Inflows

XRP ETF Inflows nearing one billion dollars represent a significant milestone for XRP as an investment asset. However, price action has remained muted due to offsetting selling pressure, derivatives market influence, and the long-term nature of ETF demand.

Rather than signaling failure, the lack of immediate price movement highlights how market structure matters more than raw capital flows. XRP is being accumulated quietly, not chased aggressively.

In the long run, sustained XRP ETF Inflows could prove to be a stabilizing force that supports future price growth once market conditions align.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe