Bitcoin price fills CME gap as $240M sell-off halts $104K rally

Bitcoin price continues to captivate traders as it fills another weekend CME futures gap, only to face a sudden reversal triggered by a $240 million market dump. The event highlights a recurring pattern in Bitcoin’s short-term movements while exposing growing caution among derivatives traders amid hopes for a longer-term rebound.

Bitcoin price completes CME gap amid resistance near $107,500

Bitcoin price surged to fresh November highs near $107,500 before facing stiff resistance that bulls failed to overcome. Data from Cointelegraph Markets Pro and TradingView indicated that BTC/USD soon reversed, dropping sharply after touching those local highs.

In doing so, Bitcoin successfully filled its weekend “gap” in the CME Group’s Bitcoin futures market at around $104,000. These CME gaps occur when Bitcoin’s spot price moves significantly while futures markets are closed—typically over weekends. Historically, such gaps often act as magnets for future price movements, making them reliable short-term targets.

Trader Daan Crypto Trades commented on X (formerly Twitter), “Another gap closed within the first few trading days of the week. This has become an incredibly reliable and predictable pattern by now.” He noted that while many expect the pattern to eventually lose consistency, it has remained statistically strong for over four years.

Bitcoin price faces pressure from whale sell-offs

Despite completing the CME gap, Bitcoin’s rebound was short-lived. Market data showed that large holders—often referred to as whales—sold heavily into the $104,000 price region.

Trading analyst Skew observed renewed short interest accompanying these sales. “Some size sold into $104K price area & renewed short interest,” he wrote. “Pivotal price point here.”

This whale-driven sell-off, reportedly worth about $240 million, dampened bullish momentum and prevented Bitcoin from regaining its push toward $104,000 and beyond. Order-book data revealed growing sell-side liquidity clusters, confirming that significant profit-taking was taking place after the rally to $107,500.

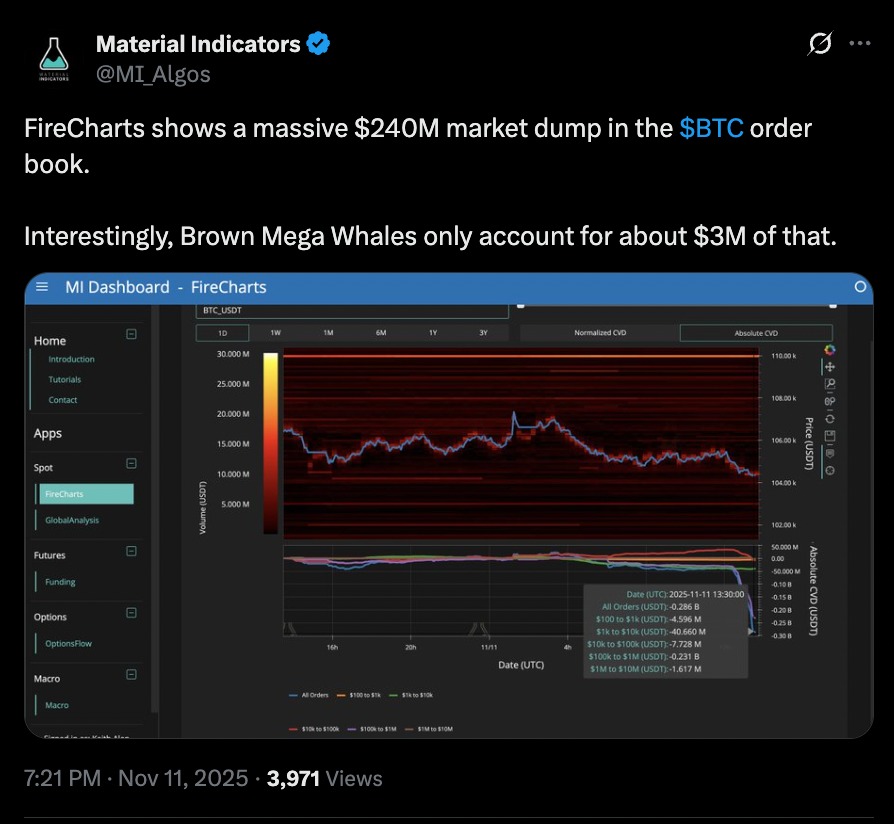

The on-chain analytics platform Material Indicators confirmed the $240 million market dump in its FireCharts data visualization tool. According to the post, the selling pressure was widely distributed across trader groups, with “Brown Mega Whales” contributing roughly $3 million of the total. The chart illustrated a steep drop in cumulative volume delta (CVD), highlighting how rapid sell orders overwhelmed the order book. This sudden liquidity event underscored the fragility of short-term price levels and the dominant role large market participants continue to play in shaping Bitcoin’s near-term volatility.

As a result, Bitcoin price retraced further, unsettling bullish traders and prompting speculation about the next support zones. Some analysts highlighted potential support below $100,000, an area that could attract buyers if selling pressure continues.

Bitcoin price finds footing near $100,000

At the time of writing, Bitcoin price hovered near the $100,000 mark—a psychological level watched closely by both retail and institutional traders. While volatility persisted, many market observers saw the correction as a natural phase following an extended uptrend.

Data from on-chain analytics provider CryptoQuant showed that derivatives traders were increasingly reducing their exposure to risk. This was evident from the notable decline in open interest (OI), which fell by more than 11% in just one week.

CryptoQuant’s contributor GugaOnChain noted, “The 11.32% drop in OI over 7 days is a sign that the market is eliminating speculative risk, which has historically been a precursor to recovery.” He added that although short-term volatility might continue, such deleveraging often forms a more stable base for future growth.

This sentiment echoed across trading circles: the reduction in leveraged positions can pave the way for a healthier rally, as it removes excess speculation and provides stronger support for long-term accumulation.

CME gaps continue to guide Bitcoin traders

CME gaps have become an integral part of Bitcoin price analysis. When the CME Bitcoin futures market closes over weekends, any major price move in spot markets leaves a “gap” between Friday’s close and Monday’s open. Traders monitor these unfilled levels closely because Bitcoin frequently revisits them soon after markets reopen.

In this instance, the gap around $104,000 formed over the weekend and was quickly filled during Tuesday’s trading session. For many market participants, this further reinforced confidence in the reliability of CME gap-filling behavior—a phenomenon that has persisted for years despite growing awareness.

Daan Crypto Trades emphasized that while one might expect the pattern to weaken as more traders exploit it, the consistency of these events suggests structural behavior tied to futures market mechanics rather than mere coincidence.

Derivatives data hints at Bitcoin market reset

The recent shift in derivatives metrics extends beyond open interest. Funding rates—fees paid between traders in perpetual futures to maintain market balance—also declined, signaling reduced speculative activity. When funding rates cool alongside falling open interest, it typically indicates that over-leveraged long positions have been flushed out, creating conditions for a more sustainable price floor.

CryptoQuant’s report referred to this process as “market deleveraging,” noting that it often precedes renewed upward momentum. “While volatility may persist in the short term, the metric suggests that the market is consolidating on a more stable base,” the report stated. “This sets the stage for a subsequent rally and confirms the thesis that the current region represents a buying opportunity for long-term investors.”

Such patterns have appeared repeatedly during past Bitcoin cycles—large liquidations and whale-driven sell-offs that temporarily suppress prices, only to be followed by renewed accumulation and eventual rallies.

Traders weigh next moves as volatility returns

Despite the recent correction, optimism remains among experienced traders. Many interpret the ongoing consolidation as a reset phase that will strengthen Bitcoin’s long-term structure. The repeated behavior of filling CME gaps, reducing leveraged exposure, and stabilizing near round-number support zones suggests that Bitcoin remains within a broader bullish framework.

Still, caution persists. The $100,000 level now serves as a crucial battleground. If Bitcoin price manages to hold above this region and build sustained demand, analysts expect renewed attempts to reclaim $104,000 and eventually $107,500. Conversely, a decisive break below $100,000 could open the door to deeper corrections.

Whale behavior will likely play a major role in the next direction. Large on-chain transactions often foreshadow shifts in momentum. If whales resume accumulation rather than distribution, the market could quickly rebound.

Outlook: Bitcoin price prepares for potential rebound

In summary, Bitcoin price filled its CME gap at $104,000 but failed to sustain higher levels due to a $240 million whale sell-off. Derivatives data, however, indicates that speculative risk is declining, hinting at healthier market conditions.

Analysts see the recent drop as a temporary shakeout rather than the start of a prolonged downturn. As the market consolidates around $100,000, traders will be watching for renewed buying pressure and confirmation of long-term bullish support.

If history is any guide, the combination of CME gap completion, market deleveraging, and resilient on-chain fundamentals could once again set the stage for Bitcoin’s next upward phase.

Keep yourself updated with the latest crypto news with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe