Crypto Search Interest Hits Near Yearly Low

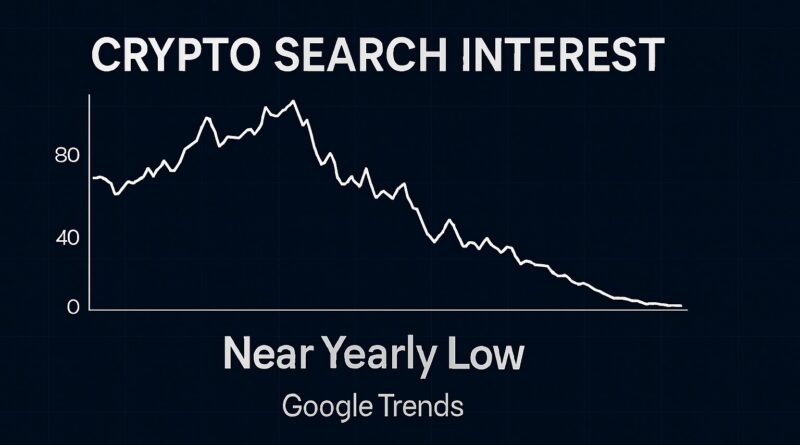

Crypto Search Interest has dropped close to its lowest point of the past year, highlighting a clear decline in public attention toward cryptocurrencies. Data from Google Trends shows that searches related to crypto are significantly lower than previous peaks, suggesting that many retail investors are stepping back as market conditions remain uncertain. This slowdown in interest reflects broader challenges facing the crypto market, including falling prices, reduced trading activity, and weakened sentiment.

At its peak earlier in the year, Crypto Search Interest surged as prices climbed and market optimism returned. During that period, global crypto market capitalization reached multi-trillion-dollar levels, and public curiosity followed closely. However, as prices corrected and volatility increased, search activity began to fade. The latest readings show search interest hovering just above the lowest levels recorded in the past twelve months.

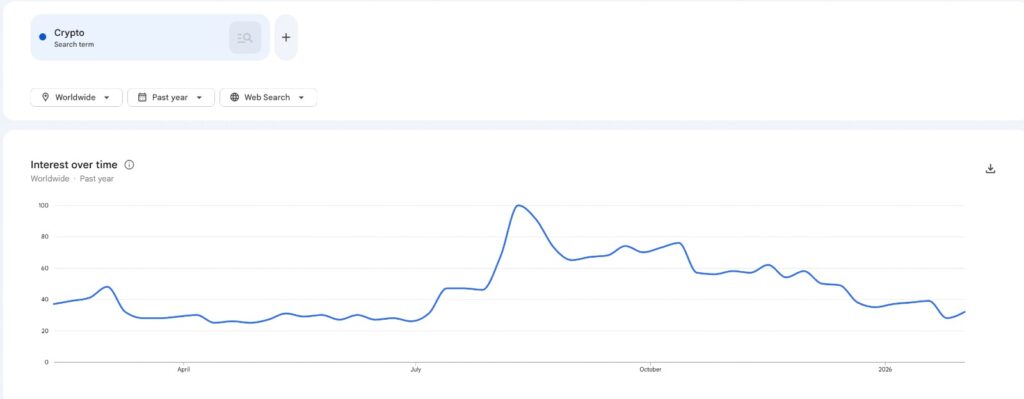

Crypto Search Interest and Google Trends Data

This Google Trends chart shows how search interest for the term “crypto” has fluctuated over the past year, with a clear spike during periods of heightened market activity followed by a steady decline. The sharp peak reflects moments when price movement drew broad public attention, while the extended downward slope highlights how interest faded as volatility increased and confidence weakened. What stands out is not just the drop itself, but how prolonged the lower levels have become, suggesting reduced day-to-day engagement rather than a short-lived reaction. Charts like this capture attention cycles, but they also reveal how quickly public focus can shift once momentum fades.

Crypto Search Interest is measured using Google Trends, which tracks how often users search for specific terms relative to their highest point over a selected time frame. On a scale from 0 to 100, current global readings for crypto searches sit around the low 30s. This is only slightly higher than the yearly low, indicating that interest remains subdued.

This trend is not limited to one region. While global search volume has declined steadily, several major markets show similar patterns. In many areas, interest fell sharply after market losses accelerated, suggesting that price action strongly influences public engagement. When markets struggle, fewer people actively seek information about crypto assets.

How Market Performance Affects Crypto Search Interest

There is a strong relationship between Crypto Search Interest and overall market performance. When prices rise and headlines turn optimistic, public curiosity increases. Conversely, during downturns, attention fades. Over recent months, the total value of the crypto market has fallen significantly, and search interest has moved lower alongside it.

This pattern suggests that retail investors are highly sensitive to market conditions. Many casual participants appear to lose interest when prices decline, choosing to wait on the sidelines rather than actively follow market developments. Lower search activity may also reflect reduced expectations for short-term gains.

Sentiment Signals Behind Crypto Search Interest

Crypto Search Interest also serves as a sentiment indicator. When search volume is low, it often aligns with fear or uncertainty across the market. Other sentiment measures have shown similar results, indicating that many investors currently feel cautious or pessimistic.

Periods of low interest can signal emotional exhaustion among retail traders. After prolonged volatility or losses, many individuals disengage entirely, leading to reduced searches and less online discussion. This behavior has been observed in previous market downturns as well.

Why Crypto Search Interest Matters

Crypto Search Interest plays an important role in understanding market psychology. Retail participation has historically driven significant portions of trading volume and momentum in crypto markets. When fewer people are searching for information, it often means fewer new participants are entering the space.

Lower interest can also affect liquidity and price movement. With less retail involvement, markets may experience slower recoveries and reduced buying pressure. At the same time, declining attention can reduce media coverage, which further limits exposure to new audiences.

Historical Patterns in Crypto Search Interest

Historically, Crypto Search Interest has followed a cycle similar to price movements. During bull markets, search activity tends to spike as new investors rush in. During bear markets, interest drops as enthusiasm fades. The current decline closely resembles previous downturns, where search volume remained low until clear signs of recovery emerged.

In past cycles, prolonged periods of low interest were often followed by renewed attention once prices stabilized or began to rise again. This suggests that search trends may lag behind price recovery, rather than lead it.

Regional Differences in Crypto Search Interest

While global Crypto Search Interest remains weak, some regional differences exist. In certain countries, search volume has shown small rebounds following sharp declines. These brief increases may reflect local news events, regulatory developments, or sudden market movements that temporarily attract attention.

However, these regional spikes have not been strong enough to reverse the overall downward trend. Most markets continue to show reduced engagement compared to earlier highs, indicating that the decline in interest is widespread rather than isolated.

Implications of Low Crypto Search Interest

Sustained low Crypto Search Interest has several implications for the broader market. First, it suggests that many retail investors are adopting a wait-and-see approach. Rather than actively researching or trading crypto assets, they may be waiting for stronger confirmation of a trend reversal.

Second, reduced interest can slow innovation and adoption in the short term. Projects and platforms often rely on strong public attention to drive user growth. When interest is low, growth may stagnate until confidence returns.

Finally, low search interest can influence market narratives. With fewer people searching for crypto topics, discussions may shift away from speculative opportunities toward risk management and long-term considerations.

Editor’s View: What Low Search Interest Really Signals

Low Crypto Search Interest does not necessarily mean people have stopped caring about crypto altogether. In many cases, it reflects a quieter phase where participants who remain are no longer searching basic information because they already understand the risks and mechanics. During uncertain markets, experienced users tend to observe rather than engage publicly, while newer participants delay entry altogether. This combination can make attention metrics look weaker than the underlying level of long-term interest actually is.

Can Crypto Search Interest Recover?

Whether Crypto Search Interest rebounds will largely depend on market conditions. Historically, renewed price momentum has been the strongest driver of increased public attention. If markets stabilize or begin to trend upward, search activity is likely to follow.

Macroeconomic factors, regulatory clarity, and major industry developments may also influence interest levels. Positive news or major breakthroughs can temporarily boost search volume, even during broader downturns.

For now, Crypto Search Interest remains near yearly lows, reflecting a cautious and disengaged retail audience. As long as uncertainty persists, public attention is likely to remain muted. However, as past cycles have shown, interest can return quickly once confidence is restored and market sentiment shifts.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe