Crypto ETP Outflows Slow as Selling Pressure Eases

Crypto ETP Outflows continued last week but at a much slower pace, signaling a possible shift in investor behavior after weeks of intense selling. Digital asset exchange-traded products recorded net outflows of $187 million, a sharp reduction compared to the multi-billion-dollar withdrawals seen earlier. This deceleration comes amid heightened market volatility and growing debate about whether selling pressure is beginning to fade.

While the market remains under stress, the slowdown in Crypto ETP Outflows suggests that some investors may be reassessing their positions rather than exiting crypto exposure entirely. Capital flow data is closely watched because it often reflects institutional sentiment before price trends become clear.

Crypto ETP Outflows Reflect Cooling Investor Panic

The most recent figures show that crypto ETPs experienced their third consecutive week of net outflows, yet the scale was dramatically lower than in previous weeks. Over the prior two weeks, investors withdrew more than $3 billion from these products. In contrast, last week’s $187 million represents a meaningful slowdown.

This shift indicates that the most aggressive selling may have already occurred. Large outflows often happen during periods of heightened fear, and when they begin to decline, it can signal that investors are becoming more cautious rather than reactive. Although total assets under management across crypto ETPs have fallen to their lowest level in months, the reduced pace of withdrawals is seen by analysts as a potentially stabilizing sign.

Bitcoin Drives Majority of Crypto ETP Outflows

Bitcoin-focused products accounted for the largest share of Crypto ETP Outflows during the week. Bitcoin ETPs saw net outflows of approximately $264 million, with spot Bitcoin ETFs responsible for most of the redemptions. This highlights ongoing caution toward Bitcoin as price volatility and macroeconomic uncertainty continue to weigh on sentiment.

Investors appear to be reducing exposure to Bitcoin specifically, rather than abandoning crypto investment products altogether. This distinction is important, as it suggests a rotation strategy rather than a broad rejection of the asset class.

Altcoins Attract Capital Despite Crypto ETP Outflows

Despite overall net outflows, several altcoin-based ETPs recorded notable inflows. XRP investment products led the group, attracting $63 million in new capital. Solana and Ether ETPs also posted positive inflows, though at more modest levels.

This pattern shows that some investors are selectively reallocating funds toward assets they perceive as offering better short-term or relative value. The presence of inflows during a week of net Crypto ETP Outflows supports the idea that capital is being repositioned within the crypto market rather than withdrawn completely.

Crypto ETP Outflows Occur Alongside Record Trading Volumes

One of the most striking developments was the surge in trading activity. Crypto ETP trading volumes reached a record $63.1 billion during the same week that outflows slowed. This combination of high turnover and reduced net withdrawals suggests active portfolio adjustments rather than widespread panic selling.

High trading volumes often indicate uncertainty, but they can also reflect investors taking advantage of price movements to rebalance or hedge exposure. In this context, record volumes paired with slowing Crypto ETP Outflows may indicate that investors are becoming more strategic in their decision-making.

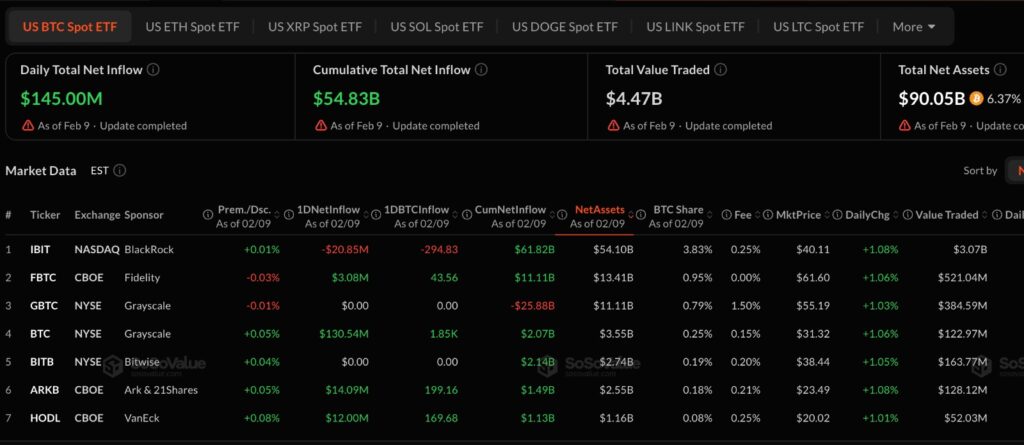

The snapshot of U.S. spot Bitcoin ETF activity highlights how uneven capital movement can be beneath headline flow numbers. Even on days when broader crypto ETP data points to outflows, individual funds continue to see sizable trading volume and selective inflows. This reflects how investors often adjust exposure incrementally, favoring liquidity and product structure over directional conviction. Screens like this capture behavior that weekly summaries can smooth over.

Regional Differences in Crypto ETP Outflows

Investment flows varied significantly by region. While the global picture remained negative, several countries saw net inflows into crypto ETPs. Germany, Switzerland, Canada, and Brazil all recorded positive investment activity, showing that sentiment is not uniform across markets.

These regional inflows suggest that confidence in regulated crypto products remains intact in certain jurisdictions, even as U.S.-based products experience heavier selling pressure. This divergence highlights how local market conditions and regulatory environments can influence investor behavior.

What Slowing Crypto ETP Outflows Could Mean

The recent moderation in Crypto ETP Outflows does not guarantee a market recovery, but it does offer valuable insight into changing sentiment. Slower outflows may indicate that investors are waiting for clearer signals rather than rushing to reduce exposure further.

At the same time, cumulative outflows over the past three weeks remain substantial, underscoring that caution still dominates the market. Bitcoin-linked products, in particular, continue to face pressure, while altcoins are benefiting from selective inflows.

Editor’s View:

Periods of slowing outflows often reflect exhaustion rather than optimism. After sustained volatility, many investors stop reacting to price moves and instead reassess whether further selling meaningfully changes their risk profile. This pause is less about confidence and more about uncertainty settling into patience. Flow data in these moments tends to capture hesitation, not conviction, which charts alone rarely explain.

Outlook for Crypto ETP Outflows

Looking ahead, the key question is whether this slowdown marks a temporary pause or the beginning of a more sustained stabilization. Continued monitoring of capital flows will be critical, as sustained reductions in Crypto ETP Outflows have historically preceded periods of consolidation or recovery.

For now, the data points to a market in transition. Investors are not rushing back in, but they are no longer exiting at the same pace. This shift suggests that confidence, while fragile, may be slowly rebuilding as participants search for balance amid ongoing uncertainty.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe