Bitcoin Hashrate Falls Below 1 Zettahash

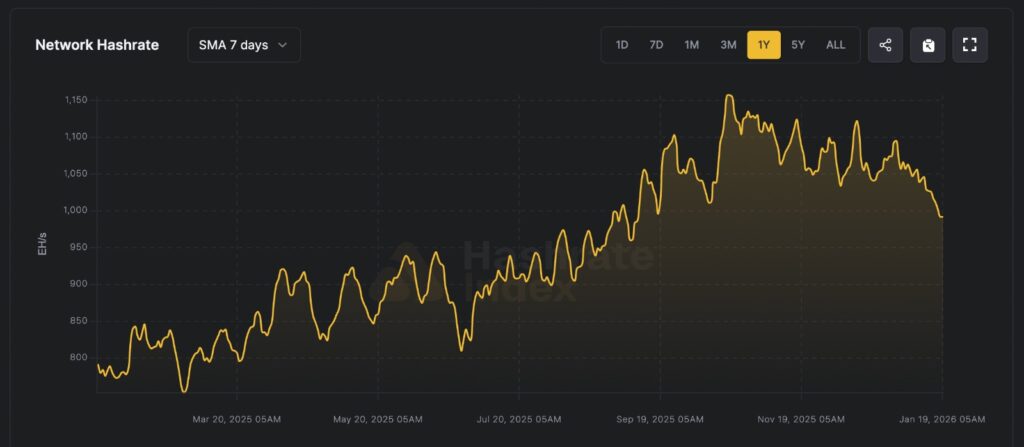

Bitcoin Hashrate has fallen below the 1 zettahash per second level, marking a notable change in the Bitcoin mining landscape after several months of sustained growth. This decline represents the first time in roughly four months that the network’s total computational power has dipped below this psychological milestone. While the decrease may appear significant at first glance, it reflects ongoing adjustments within the mining industry rather than a sudden loss of network strength.

The Bitcoin network reached and maintained levels above 1 zettahash per second during the latter part of 2025, demonstrating strong miner participation and high competition. However, recent data shows the seven-day moving average hashrate has dropped to just under 1 zettahash, representing a decline of approximately 15 percent from its October peak. This shift highlights how sensitive mining activity is to economic and operational factors.

Bitcoin Hashrate Trends and Recent Decline

Bitcoin Hashrate measures the total computational power miners contribute to processing transactions and securing the blockchain. A higher hashrate generally means stronger security and greater competition among miners. The recent decline does not erase the progress Bitcoin has made over the years, but it does signal a temporary cooling period for mining activity.

Throughout 2025, the hashrate climbed steadily as miners expanded operations and deployed more efficient hardware. Crossing the 1 zettahash threshold was widely viewed as a milestone for the network. Falling below that level now suggests that some miners have reduced or paused operations, especially those facing higher energy costs or lower profit margins.

Viewed over the past month, the Bitcoin hashrate chart highlights how the recent decline has unfolded gradually rather than through a sudden break. Short-term fluctuations appear within a relatively narrow range, suggesting miners are adjusting output incrementally instead of exiting en masse. This pattern often reflects operational fine-tuning, such as selective shutdowns or load balancing, rather than structural stress. In this context, the chart captures a period of consolidation where participation is being recalibrated, not abandoned.

Why Bitcoin Hashrate Matters

Bitcoin Hashrate is a key indicator of network health. It reflects how much computing power is being used to protect the blockchain against attacks and ensure transaction validity. Even with the current drop, Bitcoin’s hashrate remains historically high compared to previous years.

A strong hashrate makes it extremely difficult and costly for any malicious actor to control the network. Despite the recent decrease, Bitcoin remains highly secure, and the current hashrate level still represents immense computational strength.

Reasons Behind the Bitcoin Hashrate Drop

Mining Profitability Pressures

One major reason for the decline in Bitcoin Hashrate is reduced mining profitability. Mining revenue depends on factors such as Bitcoin’s price, transaction fees, block rewards, and energy costs. When profit margins shrink, less efficient miners may shut down equipment to avoid operating at a loss.

In recent months, some miners have faced tighter margins due to fluctuating market conditions and rising operational expenses. This has encouraged miners to reevaluate how and where they allocate their resources.

Shift Toward AI and High-Performance Computing

Another contributing factor is the growing interest among miners in artificial intelligence and high-performance computing workloads. Some mining companies have begun redirecting power and infrastructure toward AI-related services, which can offer more predictable or higher returns than Bitcoin mining under certain conditions.

This shift does not mean miners are abandoning Bitcoin altogether, but it does show that mining infrastructure is becoming more flexible and diversified. As resources move into other computing uses, the total Bitcoin hashrate can temporarily decline.

Mining Difficulty Adjustments

Bitcoin’s protocol automatically adjusts mining difficulty to maintain an average block time of around ten minutes. As the hashrate drops, difficulty adjustments tend to follow, making it easier for remaining miners to find blocks.

Since late 2025, the network has experienced several downward difficulty adjustments. These changes help balance the system by improving profitability for miners who remain active, potentially encouraging some operators to return if conditions improve.

Impact on the Bitcoin Network

Network Security Remains Strong

Despite the drop below 1 zettahash, Bitcoin’s security is not at risk. The current hashrate level is still far above historical averages and continues to provide strong protection against attacks. The cost and coordination required to compromise the network remain prohibitively high.

The decline should be viewed in context, as Bitcoin has experienced many periods of hashrate fluctuation throughout its history. Temporary decreases are a normal part of the mining cycle.

Changing Mining Industry Dynamics

The fall in Bitcoin Hashrate highlights broader changes within the mining industry. Miners are becoming more strategic, focusing on efficiency, energy optimization, and alternative revenue streams. This evolution reflects a maturing industry that responds quickly to market signals.

As miners adapt, competition may become more balanced, favoring those with access to low-cost energy and modern hardware. Smaller or less efficient operations may continue to scale back until profitability improves.

Editor’s View: Bitcoin Hashrate and Miner Psychology

When Bitcoin hashrate slips after reaching a major milestone, it often reflects more than economics alone. For many miners, psychological thresholds matter, and periods of peak competition can quietly encourage reassessment rather than expansion. Operators who scaled aggressively during record highs tend to pause once returns normalize, choosing stability over marginal gains. These moments reveal how mining decisions are shaped not just by charts, but by risk tolerance, operational fatigue, and the need to preserve capital in an industry where conditions can shift quickly.

What to Expect Next for Bitcoin Hashrate

Bitcoin Hashrate is likely to remain dynamic in the coming months. If mining profitability improves through price increases, lower difficulty, or reduced energy costs, miners may bring additional capacity back online. Conversely, continued pressure on margins could keep hashrate levels subdued.

The current dip below 1 zettahash should not be interpreted as a long-term trend without further confirmation. Instead, it represents a period of adjustment as miners respond to economic realities and emerging opportunities outside traditional Bitcoin mining.

In conclusion, Bitcoin Hashrate falling below 1 zettahash marks an important moment, but not a cause for alarm. The network remains secure, resilient, and supported by a massive amount of computational power. This shift reflects natural cycles within the mining ecosystem and underscores how closely mining activity is tied to profitability, technology, and broader market conditions.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL