Bitmine ETH Holdings Surpass 4M After $40M Buy

Bitmine ETH Holdings reached a major milestone as the company crossed more than four million Ether following its most recent $40 million purchase. The latest acquisition highlights Bitmine’s aggressive accumulation strategy and reinforces its long-term commitment to Ethereum as a core treasury asset.

The company has steadily increased its ETH position over recent months, making it one of the most notable corporate holders of Ethereum. With the most recent purchase, Bitmine continues to execute a strategy centered on building scale while maintaining confidence in Ethereum’s future growth and utility.

Why Bitmine ETH Holdings Are Significant

Bitmine’s Ethereum treasury now exceeds four million ETH, a figure that places the company among the largest known corporate ETH holders. This milestone reflects both the scale of Bitmine’s investment strategy and the pace at which the company has been accumulating digital assets.

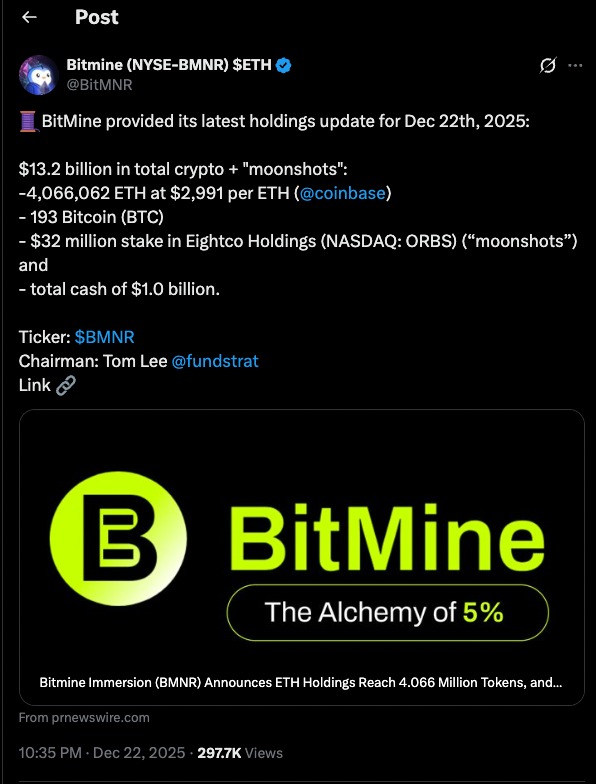

The update shared by Bitmine on social media provides additional clarity on the scale of its crypto treasury. According to the company, its total digital asset and related holdings now stand at approximately $13.2 billion, with more than 4.06 million ETH held at an average price of $2,991 per token. The disclosure also highlights complementary holdings, including Bitcoin, a strategic equity stake categorized as a “moonshot” investment, and roughly $1 billion in cash. This breakdown reinforces the central role Ethereum plays in Bitmine’s balance sheet while also illustrating a diversified approach to treasury management.

The recent $40 million purchase added over 13,000 ETH to Bitmine’s balance sheet. Over the course of a single week, the company acquired nearly 100,000 ETH, demonstrating an unusually rapid accumulation compared to typical corporate crypto strategies.

Crossing the four million ETH mark is significant not only because of the sheer size of the holdings, but also because it brings Bitmine substantially closer to its stated long-term objective of owning 5% of Ethereum’s circulating supply.

Bitmine ETH Holdings and the 5% Supply Goal

A Clear Long-Term Target

Bitmine has publicly stated its intention to accumulate 5% of Ethereum’s total circulating supply. With more than four million ETH now under its control, the company has already completed a large portion of that goal.

According to company leadership, reaching this level of holdings in just over five months represents rapid progress. The pace of accumulation suggests that Bitmine is prioritizing early positioning rather than waiting for extended market pullbacks or price corrections.

This strategy reflects confidence in Ethereum’s long-term value rather than short-term price movements. By steadily acquiring ETH, Bitmine is positioning itself to benefit from both price appreciation and ecosystem growth.

Market Conditions Supporting Bitmine ETH Holdings

Ethereum Price Recovery

Bitmine’s latest milestone comes as Ethereum prices have rebounded above the $3,000 level. This recovery has helped push the company’s ETH treasury back into overall profitability after periods of market weakness earlier in the year.

The timing of the rebound highlights the inherent volatility of crypto markets, but it also demonstrates how large-scale holders like Bitmine can benefit when prices recover after consolidation phases.

Impact on Company Stock

Bitmine’s strategy has also drawn attention from equity market participants. The company’s stock performance has reflected investor interest in its Ethereum-focused treasury approach, with ETH accumulation becoming a central part of its investment narrative.

As a publicly traded company, Bitmine’s valuation is increasingly influenced by Ethereum price movements, making its stock performance closely tied to the broader crypto market.

Strategic Role of Bitmine ETH Holdings

Corporate Treasury Diversification

While Ethereum is the dominant asset on Bitmine’s balance sheet, the company also maintains holdings in Bitcoin, cash reserves, and other financial assets. This approach allows Bitmine to balance exposure while maintaining a strong focus on ETH.

The size of Bitmine ETH Holdings means Ethereum now plays a central role in the company’s financial identity. Unlike firms that treat crypto as a secondary asset, Bitmine has placed Ethereum at the core of its corporate strategy.

Positioning Among Institutional Holders

Bitmine’s growing ETH treasury highlights a broader trend of increasing institutional interest in Ethereum. As more companies explore digital assets beyond Bitcoin, Ethereum continues to attract attention due to its role in smart contracts, decentralized finance, and staking.

Large-scale accumulation by companies like Bitmine sends a signal of long-term confidence in Ethereum’s ecosystem and use cases.

Staking Plans and Future Utility

Expanding Beyond Holding ETH

Bitmine has announced plans to begin staking its Ethereum holdings through a dedicated validator network expected to launch in early 2026. This move represents a shift from simple asset accumulation to active participation in the Ethereum network.

By staking ETH, Bitmine aims to generate yield on its holdings, adding a new revenue component while supporting network security and decentralization.

Long-Term Value Creation

Staking allows Bitmine to extract additional value from its ETH treasury beyond price appreciation alone. This strategy aligns with Ethereum’s proof-of-stake model and reflects a deeper engagement with the blockchain’s infrastructure.

If successfully implemented, staking could significantly enhance the overall returns generated by Bitmine ETH Holdings over time.

Broader Market Implications

Institutional Confidence in Ethereum

Bitmine’s aggressive ETH accumulation highlights growing institutional confidence in Ethereum as a long-term asset. Large purchases at scale suggest belief in Ethereum’s continued relevance despite market volatility.

This trend may influence how other corporations approach digital asset treasuries, potentially accelerating institutional adoption of Ethereum.

Supply Concentration Considerations

While Bitmine’s holdings represent a meaningful share of ETH supply, they still account for only a fraction of the total circulating tokens. However, continued accumulation raises questions about supply concentration and the role of large holders in crypto markets.

These concerns remain largely theoretical unless significant changes in holding behavior occur, such as large-scale selling or shifts in strategy.

What’s Next for Bitmine ETH Holdings

With its holdings now surpassing four million ETH, Bitmine appears committed to continuing its accumulation strategy. The company remains focused on reaching its 5% supply target while preparing to activate staking operations in the future.

As Ethereum evolves and market conditions change, Bitmine’s success will depend on disciplined execution, market timing, and its ability to generate long-term value from its expanding ETH treasury.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe