Crypto Bull Market Drivers and Downtrend Explained

Crypto Bull Market discussions have dominated investor conversations throughout 2025, yet price action has failed to reflect the growing list of positive developments across the industry. Despite regulatory clarity, institutional involvement, and new investment products, the crypto market has continued to trend downward. This disconnect between fundamentals and price has left many investors confused about whether a true bull market is underway or still waiting to begin.

Crypto Bull Market Fundamentals Remain Strong

Regulatory Progress Supports the Crypto Bull Market

One of the strongest pillars supporting the Crypto Bull Market narrative is regulatory progress. Governments and regulators, especially in the United States, have taken steps toward clearer and more constructive crypto policies. This clarity has reduced uncertainty that previously kept large investors on the sidelines.

The approval and launch of crypto exchange traded funds has further strengthened market infrastructure. These products allow traditional investors to gain exposure to digital assets without dealing with custody or technical barriers. As a result, institutional participation has increased, bringing legitimacy and long term confidence to the market.

In addition, corporations and investment funds have continued adding crypto assets to their balance sheets. This steady accumulation signals belief in crypto’s long term value, even as short term prices remain volatile.

Structural Growth Across the Industry

Beyond regulation and investment products, the crypto ecosystem has experienced meaningful structural growth. Blockchain networks are handling more transactions, decentralized finance platforms continue evolving, and real world asset tokenization has expanded into areas like bonds and funds.

Infrastructure improvements such as faster settlement, better security, and improved scalability have laid a foundation for sustainable growth. These advancements suggest that the Crypto Bull Market thesis is not based on speculation alone, but on real development and adoption.

Industry leaders have described 2025 as a year of deep foundational work rather than explosive price growth. While this may be frustrating for traders, it often precedes longer lasting market cycles.

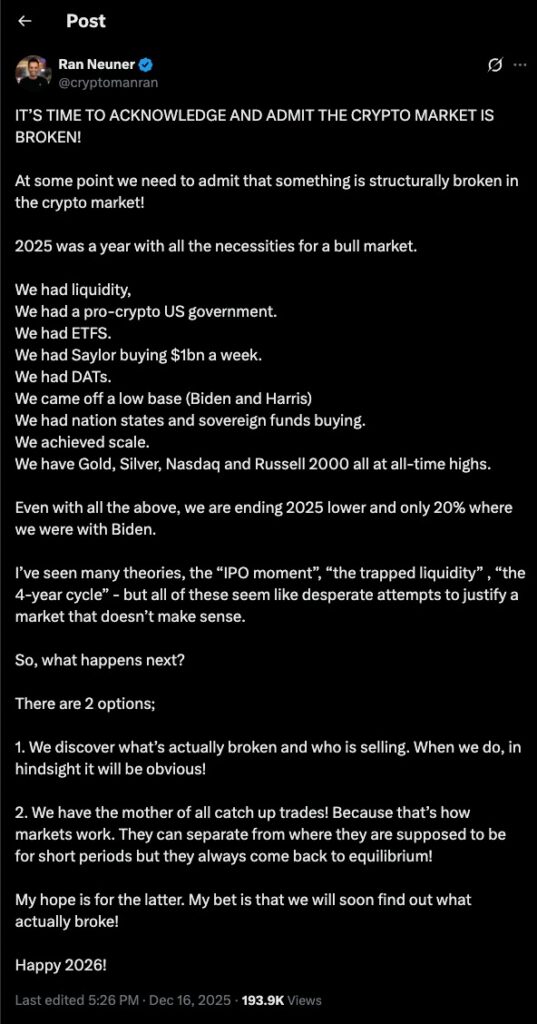

Why the Crypto Bull Market Has Not Reflected in Prices

Weak Retail Participation

A major reason prices have struggled is the absence of strong retail participation. In previous bull markets, retail investors played a key role in driving momentum and enthusiasm. In 2025, retail interest has remained muted, reducing buying pressure.

Without retail inflows, institutional demand alone has not been enough to push prices significantly higher. Retail traders typically amplify trends, and their absence can result in slower and more fragile price movement.

Leverage and Ongoing Liquidations

Another factor weighing on prices is excessive leverage. Many traders have used borrowed funds to increase exposure, making the market vulnerable to rapid liquidations when prices dip.

As prices decline, leveraged positions are forced to close, creating additional selling pressure. This cycle has repeated throughout the year, preventing sustained rallies and keeping prices under pressure.

Until the market clears excessive leverage and stabilizes, price recovery may remain limited regardless of strong fundamentals.

Bear Phase or Deep Correction

The frustration expressed here reflects a growing sentiment across the crypto industry. Despite liquidity, supportive political conditions, ETF approvals, institutional buying, and strong performance across traditional financial markets, crypto prices have failed to respond. The concern is not a lack of bullish ingredients, but rather an apparent disconnect between fundamentals and market behavior. This view suggests that either hidden structural selling pressure exists, or the market is experiencing an extended divergence that will eventually correct itself. In either case, the message highlights why many investors feel that current price action does not align with the broader progress made across the crypto ecosystem.

Some analysts believe the market entered a bear phase during the second half of 2025, while others see current conditions as a prolonged correction within a larger bull cycle. Regardless of classification, prices often lag behind fundamental improvements.

Markets can remain disconnected from underlying value for extended periods, especially when macroeconomic conditions are uncertain. This appears to be the case for the Crypto Bull Market today.

Why the Crypto Bull Market Narrative Still Holds

Long Term Adoption Continues

Despite falling prices, adoption metrics continue to improve. More institutions are exploring blockchain solutions, financial products are expanding, and crypto is becoming more integrated into traditional finance systems.

These trends suggest the industry is maturing rather than collapsing. Historically, periods of consolidation and frustration have often preceded major upward moves once sentiment and liquidity return.

Professional Sentiment Is Mixed, Not Broken

While retail enthusiasm is low, professional and institutional sentiment remains cautious but not fearful. Many long term investors view the current environment as a setup phase rather than a failure of the Crypto Bull Market thesis.

This divided sentiment indicates uncertainty rather than panic, which often characterizes market bottoms rather than peaks.

What Could Restart the Crypto Bull Market

Reduction in Selling Pressure

For prices to rise meaningfully, the market must absorb ongoing selling pressure. This includes the unwinding of leveraged positions and stabilization of technical indicators.

Once forced selling slows, prices can begin responding more directly to positive fundamentals.

Return of Retail Investors

Retail participation remains a key missing ingredient. Renewed interest from individual investors, driven by positive news or rising prices, could accelerate momentum quickly.

Retail inflows have historically fueled rapid expansions during bull markets, and their return could play a similar role again.

Macro and Industry Catalysts

Broader economic conditions also matter. Improved global risk appetite, supportive monetary policy, or major industry milestones could shift sentiment.

Events such as technological breakthroughs, scaling improvements, or adoption by major institutions could act as catalysts that align price action with fundamentals.

Conclusion

The Crypto Bull Market remains supported by strong regulatory progress, institutional adoption, and structural industry growth. However, price action has lagged due to weak retail participation, leverage driven selling, and uncertain market sentiment.

While frustration is understandable, history shows that markets often move only after long periods of consolidation. If selling pressure eases, retail interest returns, and catalysts emerge, the Crypto Bull Market could transition from theory to reality.

For now, the market reflects a pause rather than a collapse, with fundamentals quietly building beneath the surface.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe