Digital Yuan Crypto and Asia’s Market Shifts

Digital Yuan Crypto activity is becoming more visible across Asia as China and neighboring markets experiment with new digital finance strategies. Ahead of the Lunar New Year, Chinese banks introduced digital yuan red envelopes, known as hongbao, along with payment discounts to encourage consumer spending. The timing is significant because the Spring Festival period is traditionally one of China’s busiest retail seasons, making it an ideal environment for testing new financial tools.

Red envelopes are deeply rooted in Chinese culture and are widely used during Lunar New Year celebrations. They represent gifts of money meant to convey good fortune and prosperity. Over time, this tradition has gradually moved into digital formats, first through mobile payment platforms and now through the digital yuan. By linking Digital Yuan Crypto usage to familiar customs, financial institutions aim to make adoption feel natural rather than experimental.

Digital Yuan Crypto and Interest Bearing Wallets

The 2026 Lunar New Year stands out because it is the first holiday season after authorities allowed digital yuan wallet balances to earn interest. This change alters how users may view and use the currency. Instead of functioning purely as a payment method, digital yuan wallets now provide an incentive for holding funds, which can influence how consumers manage their balances.

Reports from local media suggest that the new interest bearing feature has encouraged many users to maintain larger wallet balances ahead of the holidays. This reflects a broader pattern in China’s digital currency strategy, where authorities continuously adjust features to improve engagement and practical utility. Interest mechanisms can make digital wallets more attractive while still preserving centralized oversight.

Before the end of 2025, the People’s Bank of China also introduced a structural shift in how the digital yuan operates. The currency moved away from a digital cash model toward one treated as digital deposits. Under this system, wallet balances are recorded as liabilities of commercial banks. This technical adjustment strengthens the banking sector’s role and changes how the CBDC is classified within the financial system.

Stablecoin Yield Debates and Digital Yuan Crypto Comparisons

While China expanded Digital Yuan Crypto functionality, debates over similar features unfolded in other regions. In the United States, disagreements surrounding stablecoin regulation created friction between industry participants and policymakers. Coinbase, among other major players, withdrew support for a proposed crypto market structure bill due to conflicts over stablecoin provisions.

One key issue involves whether stablecoins should be allowed to offer yield. Banking groups have argued for banning interest bearing stablecoins, warning that such products could blur distinctions between bank deposits and digital assets. From a regulatory perspective, interest paying tokens may raise concerns about oversight, risk management, and consumer protection.

The crypto industry has pushed back against these restrictions, claiming that prohibiting yield features could weaken the competitiveness of dollar backed stablecoins. Comparisons are often made with developments such as Digital Yuan Crypto wallets that now offer interest. Critics argue that limiting functionality may place certain digital assets at a disadvantage compared with international alternatives.

Despite these comparisons, the digital yuan operates under a very different framework. It is distributed through designated commercial banks and functions within China’s tightly managed financial system. The currency is not freely transferable across borders and does not circulate within open cryptocurrency markets. These constraints ensure regulatory control but also limit global accessibility.

Mainland China and Hong Kong Policy Differences

China’s domestic policies toward cryptocurrencies remain strict. Mainland authorities have banned key crypto activities, including trading and mining. This contrasts with Hong Kong, which maintains a separate regulatory framework that allows licensed digital asset operations. The divergence highlights how different jurisdictions within greater China pursue distinct financial strategies.

Hong Kong is expected to approve its first group of stablecoin licenses during the first quarter of 2026. Such approvals would further establish the city as a regulated hub for digital assets. The separation between mainland restrictions and Hong Kong’s licensing regime illustrates varying approaches to innovation, risk management, and market participation.

South Korea’s Exchange Acquisition Momentum

Elsewhere in Asia, South Korean financial and technology firms have intensified efforts to expand into cryptocurrency markets. Toss, one of the country’s largest fintech platforms, is reportedly reviewing the acquisition of an overseas crypto exchange through its US subsidiary. Industry sources indicate that Toss may be exploring platforms focused on institutional trading.

Toss operates an internet only bank and retail brokerage services through its finance application. The company previously reported a cumulative user base of 30 million, representing a large portion of South Korea’s population. Its interest in overseas acquisitions differs from the recent domestic consolidation trend among Korean institutions.

Several major firms have targeted licensed local exchanges. Mirae Asset agreed to acquire Korbit in a deal valued at nearly 100 million dollars. Naver Financial has also pursued a transaction involving Dunamu, the operator of Upbit, one of South Korea’s largest exchanges. Ownership limits and regulatory considerations may influence how such deals proceed.

Global players have been linked to this acquisition wave as well. Binance has been associated with Gopax, while Coinbase has been mentioned in connection with potential moves involving Coinone. These developments reflect strong institutional demand for regulated exchange infrastructure rather than new platform launches.

Japan’s Expanding Digital Asset Strategy

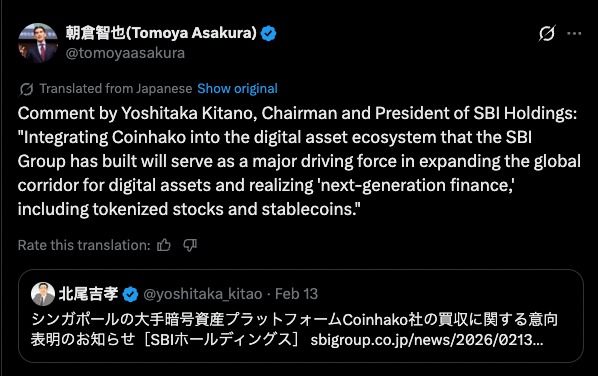

Japan has also seen increased activity from established financial groups. SBI Holdings announced plans to acquire a majority stake in Singapore based digital asset platform Coinhako.

The statement highlights how large financial groups increasingly frame exchange acquisitions as infrastructure expansion rather than speculative positioning. Emphasis on tokenized equities and stablecoins suggests a focus on future financial rails rather than short term trading activity. Such language reflects how institutions often justify crypto exposure through integration narratives tied to broader capital market evolution. It also signals that regulated platforms are being viewed as strategic gateways rather than standalone businesses.

The proposed transaction includes both a capital injection and share purchases from existing stakeholders. The move signals continued Japanese interest in regulated crypto service providers across Asia.

As institutional participation grows, many financial groups appear to prefer acquiring licensed exchanges instead of building proprietary trading platforms. This approach reduces regulatory uncertainty and accelerates entry into digital asset markets.

Editor’s View: Adoption Is Often Behavioral Before Technical

Financial adoption rarely begins with a deep understanding of infrastructure or monetary design. Users typically respond first to convenience, incentives, and social familiarity rather than policy mechanics. In the case of Digital Yuan Crypto initiatives, cultural framing and seasonal campaigns may influence engagement more effectively than technical upgrades alone. This pattern is common across financial technologies, where behavioral comfort often precedes structural comprehension.

Blockchain and China’s Energy Market Reforms

China’s policy direction also emphasizes the distinction between cryptocurrencies and blockchain technology. The State Council has outlined plans to develop a unified national electricity market, with expanded spot market operations and deeper interregional trading mechanisms. These reforms aim to improve pricing efficiency and reflect multiple dimensions of electricity value.

As part of the initiative, regulators intend to introduce blockchain technology to support a national green electricity certification system. Blockchain based verification can enhance traceability and ensure the credibility of renewable energy data. The goal is to strengthen certification processes and integrate environmental attributes into carbon accounting systems.

This policy framing positions blockchain as strategic infrastructure rather than speculative finance. While China has restricted cryptocurrency activities, blockchain technology remains aligned with national priorities involving transparency, verification, and digital modernization. Together, these developments show how Digital Yuan Crypto evolution and blockchain adoption continue to shape Asia’s financial and technological landscape.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe