Ethereum Sell Off Fears After Massive Whale Move

Ethereum Sell Off fears intensified after a long dormant crypto whale transferred a staggering amount of ETH to Binance, triggering widespread discussion across the market. Large movements from early holders often attract attention because they can signal potential selling activity. In this case, the transaction involved hundreds of thousands of ETH worth hundreds of millions of dollars, making it one of the most talked about on chain events in recent days. Traders and analysts immediately began debating whether this move could lead to increased selling pressure or whether it simply reflected portfolio management decisions.

Understanding the Ethereum Sell Off Narrative

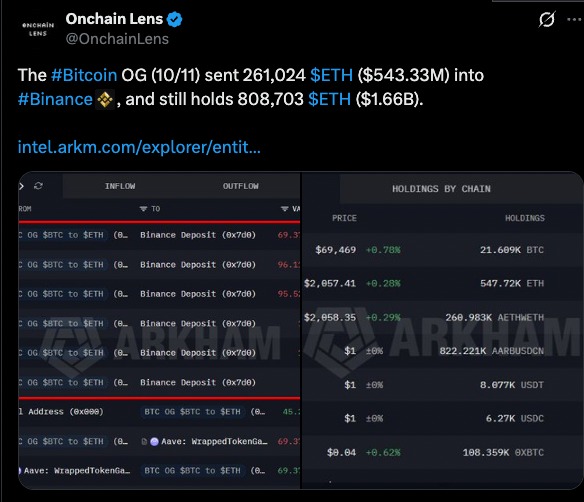

The core of the concern revolves around a wallet associated with an early crypto investor, often described as a Bitcoin OG. This address had remained largely inactive for years, holding substantial Ethereum reserves through multiple bull and bear cycles. Suddenly, more than 261000 ETH was moved to Binance, an action that historically raises speculation. Deposits to centralized exchanges are commonly interpreted as preparation for selling because assets must typically be transferred there before trades can be executed.

The transaction highlighted above quickly became a focal point for market participants because of both its size and origin. Movements from long-standing holders tend to carry disproportionate psychological weight, even when no immediate selling activity follows. Traders often interpret such transfers as signals of intent, reflecting how strongly behavior is inferred from wallet history rather than confirmed actions. This dynamic helps explain why large deposits frequently influence sentiment before they affect price.

Despite the dramatic nature of the transfer, the investor did not liquidate their entire holdings. A significant balance of ETH remains in the wallet, amounting to hundreds of thousands of tokens. This detail is important because it suggests the move may not represent a complete exit. Instead, it could indicate partial profit taking, risk reduction, or strategic repositioning. Nevertheless, the sheer size of the transfer is enough to unsettle markets already dealing with fragile sentiment.

Ethereum Price Conditions at the Time

Market context is crucial when evaluating potential Ethereum Sell Off signals. At the time of the transaction, Ethereum was trading near the lower end of its recent range. Although prices had recorded a small daily gain, the broader trend over the previous weeks remained negative. Ethereum had experienced a steep monthly decline, reflecting persistent bearish pressure and weaker investor confidence.

Large holders moving assets during periods of subdued pricing can have psychological effects on the market. Traders may interpret such actions as a lack of confidence from experienced investors. This can amplify volatility as participants rush to adjust positions. Even if no immediate selling follows, the perception alone can influence short term price dynamics.

Technical Signals and Market Momentum

Technical indicators offer additional perspective on Ethereum Sell Off concerns. Metrics such as the Relative Strength Index have remained relatively low, indicating that buying momentum has not yet fully recovered. Similarly, trend based indicators have shown limited signs of sustained bullish strength. Short lived upward movements have appeared, but they have not translated into decisive reversals.

When technical signals remain weak, markets become more sensitive to large transactions. A major deposit to an exchange can carry more weight when overall momentum is fragile. Traders often combine on chain data with chart analysis to assess whether selling pressure is likely to intensify. In this environment, caution tends to dominate decision making.

ETF Flows and Investor Sentiment

Institutional behavior also plays a role in shaping Ethereum Sell Off narratives. Recent data from Ethereum linked investment products revealed mixed flows. While some inflows were recorded, they were overshadowed by larger outflows in the surrounding period. This imbalance suggests that certain investors may be reducing exposure rather than aggressively accumulating.

ETF flows are closely watched because they reflect broader investment trends. Sustained outflows can contribute to negative sentiment, particularly when paired with declining prices. Although short term variations are common, the pattern of larger withdrawals adds another layer of uncertainty to the market outlook.

Open Interest and Trader Participation

Another noteworthy factor is the decline in open interest across Ethereum derivatives markets. Open interest represents the total number of outstanding futures and options contracts. A downward trend in this metric often indicates reduced trader engagement. Fewer active positions can imply declining confidence or a preference for staying on the sidelines.

Lower open interest can have practical implications. It may reduce liquidity and increase sensitivity to large trades. In combination with bearish price action and whale movements, this trend reinforces the cautious tone surrounding Ethereum. Markets with diminished participation are more prone to sharp reactions when significant events occur.

Interpreting the Whale Movement Carefully

While the Ethereum Sell Off narrative has gained traction, it is important to avoid oversimplification. Not every exchange deposit results in immediate selling. Large investors frequently move assets for reasons unrelated to liquidation. These may include custody changes, collateral management, or diversification strategies.

The continued presence of substantial ETH holdings in the whale wallet supports this more nuanced interpretation. It indicates that the investor still maintains a strong position in Ethereum. However, markets often respond to possibilities rather than certainties. The uncertainty itself can shape behavior, influencing both price movements and sentiment.

Editor’s View: Market Psychology Behind Whale Moves

Large transfers by early holders tend to provoke stronger reactions than routine market signals because participants assign meaning to the actor, not just the action. When a long-term investor moves funds, traders often read it as informed behavior, even without evidence of intent. This reflex reveals how much market sentiment is driven by perception rather than confirmed activity. In many cases, volatility emerges not from selling itself, but from how other participants reposition around the possibility of it.

What Market Participants Are Watching

Traders monitoring Ethereum Sell Off risks are focusing on several indicators. Exchange inflow patterns are being examined for signs of sustained deposits from large holders. Technical levels are being tracked to identify potential support or breakdown zones. Derivatives data is being analyzed for changes in leverage and positioning.

A stabilization in open interest and more balanced fund flows could ease concerns. Conversely, additional large deposits or renewed weakness in price structure could intensify bearish expectations. In highly reactive markets, multiple signals often interact to produce outcomes rather than any single event acting alone.

Conclusion

Ethereum Sell Off fears triggered by the massive whale transfer highlight the delicate balance between data interpretation and market psychology. The transaction itself is undeniable, but its ultimate implications remain uncertain. Technical indicators, ETF flows, and derivatives activity all contribute to the broader picture, which currently leans cautious.

Whether this episode leads to significant selling pressure or fades as a routine portfolio adjustment will depend on subsequent developments. For now, the event serves as a reminder of how influential large holders can be in shaping narratives and expectations within the cryptocurrency ecosystem.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe