Gemini SEC Dismissal Brings Closure to Earn Lawsuit

Gemini SEC Dismissal marks a major turning point in one of the most high profile cryptocurrency enforcement cases in the United States, officially ending the Securities and Exchange Commission’s civil action against Gemini Trust Company. The dismissal brings final closure to the legal dispute surrounding the now defunct Gemini Earn program and reflects a broader shift in how crypto regulation is unfolding.

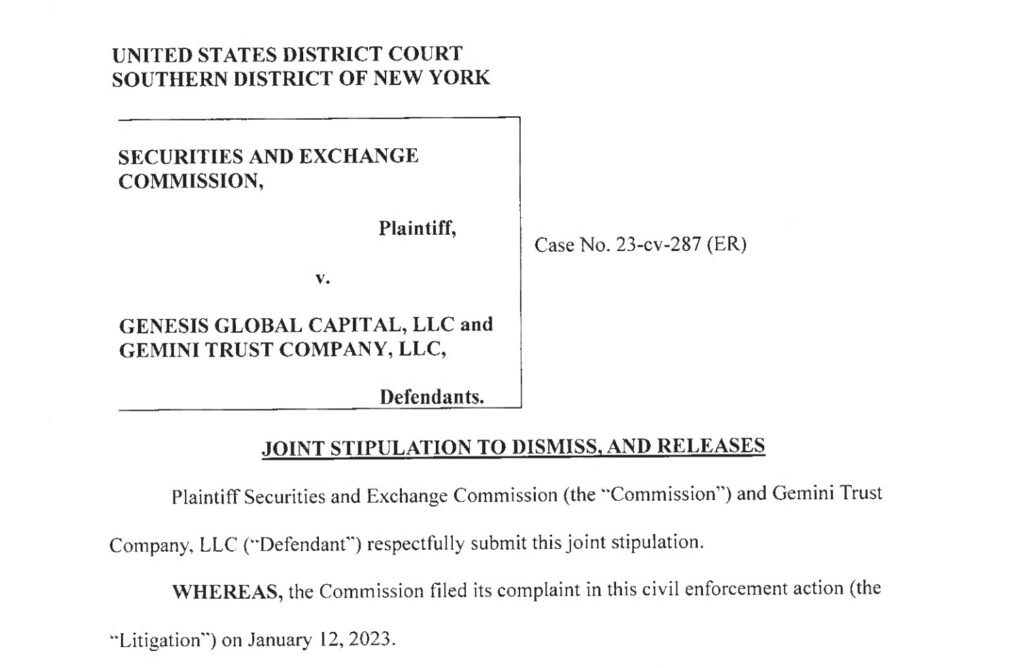

The SEC originally filed its lawsuit against Gemini Trust Company and Genesis Global Capital in January 2023. The agency alleged that the companies offered unregistered securities through Gemini Earn, a program that allowed customers to lend their crypto assets in exchange for interest. At the time, the case became symbolic of the SEC’s aggressive stance toward crypto lending and yield products.

Background of the Gemini SEC Dismissal

The Gemini Earn program was launched as a partnership between Gemini and Genesis Global Capital. Customers could deposit cryptocurrencies with Gemini, which were then lent to Genesis to generate returns. When Genesis halted withdrawals and later filed for bankruptcy in 2023, approximately $900 million in customer assets became locked.

The SEC argued that Gemini Earn constituted an unregistered securities offering, placing the program under federal securities laws. Gemini publicly disputed the claim, maintaining that the product did not meet the legal definition of a security and that the SEC had failed to provide clear guidance to crypto firms.

Despite the ongoing legal fight, bankruptcy proceedings continued separately, focusing on recovering funds for affected customers.

Why the Gemini SEC Dismissal Happened

The Gemini SEC Dismissal occurred after all Gemini Earn customers received full restitution of their assets. Through the Genesis bankruptcy process, investors recovered 100 percent of their crypto holdings in kind. This outcome played a central role in the SEC’s decision to dismiss the case with prejudice.

Gemini also agreed to contribute up to $40 million to help ensure customers were fully repaid. Genesis, for its part, had previously agreed to a separate settlement involving a $21 million civil penalty. The SEC emphasized that the dismissal was an exercise of its discretion and not a judgment on the legal merits of similar cases.

A dismissal with prejudice is significant because it prevents the SEC from bringing the same claims against Gemini again in the future.

The court filing underscores the procedural finality of the case rather than a negotiated settlement or partial withdrawal. By submitting a joint stipulation to dismiss with prejudice, both parties formally agreed to end the litigation without conditions for reinstatement. Documents like this rarely draw public attention, but they matter because they define what regulators can and cannot revisit in the future. In this instance, the filing quietly closes a chapter that once sat at the center of crypto enforcement debates.

Regulatory Context Behind the Gemini SEC Dismissal

The dismissal comes amid noticeable changes in the U.S. regulatory environment for cryptocurrencies. Since early 2025, several enforcement actions initiated under prior leadership have been paused, narrowed, or dropped entirely. This shift suggests a move toward reassessing how digital asset companies are regulated.

While the SEC has not abandoned enforcement altogether, the tone and strategy appear to be evolving. The Gemini case stands out because it was once considered a cornerstone of the agency’s crypto crackdown. Ending it signals that full investor recovery and cooperation can significantly influence enforcement outcomes.

Regulators have stressed that the dismissal does not set a blanket precedent for all crypto lending products. Each case, they say, will still be evaluated on its own facts and circumstances.

Impact of the Gemini SEC Dismissal on Investors

For investors affected by the Gemini Earn collapse, the dismissal represents long awaited closure. Many customers had feared substantial losses when Genesis entered bankruptcy. Recovering their assets in full helped restore confidence, even after months of uncertainty.

The case also reinforces the importance of asset segregation and transparency for crypto platforms offering yield products. Investors may become more cautious, favoring platforms with clearer risk disclosures and stronger protections.

From a broader market perspective, the dismissal may reduce perceived regulatory risk for some crypto companies, though it does not eliminate it entirely.

Industry Reaction to the Gemini SEC Dismissal

The crypto industry has largely welcomed the Gemini SEC Dismissal. Supporters view it as a sign that regulators are becoming more pragmatic and open to resolution rather than prolonged litigation. Some industry leaders argue that the case highlights the need for clearer crypto specific regulations instead of enforcement driven rulemaking.

Legal experts, however, caution against interpreting the dismissal as a free pass. They note that the outcome was heavily influenced by full investor restitution, something that may not be achievable in all cases. Compliance failures and investor harm could still lead to serious penalties in the future.

Editor’s View: Trust Is Rebuilt Quietly, Not in Courtrooms

One of the less visible outcomes of the Gemini SEC dismissal is how it reshapes user trust in subtle ways that enforcement headlines rarely capture. For many affected customers, confidence was not restored by legal arguments but by the slow, procedural return of assets through bankruptcy and settlement mechanics. That process reinforced a basic market lesson: credibility in crypto is often rebuilt operationally rather than rhetorically. Even when funds are ultimately recovered, the memory of illiquidity tends to linger longer than the legal outcome itself.

What the Gemini SEC Dismissal Means Going Forward

Looking ahead, the Gemini SEC Dismissal may influence how crypto firms approach both product design and regulatory engagement. Companies may prioritize customer protections and contingency planning to reduce enforcement risk.

The case also underscores the role of bankruptcy proceedings in resolving crypto disputes. Rather than relying solely on regulatory penalties, asset recovery through structured legal processes can play a decisive role in outcomes.

Ultimately, the dismissal marks the end of a defining chapter in U.S. crypto enforcement. It shows that cooperation, restitution, and shifting regulatory priorities can reshape even the most contentious legal battles.

As the digital asset industry continues to mature, the Gemini SEC Dismissal stands as a reminder that regulatory clarity remains essential for long term stability and trust.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe  Wrapped SOL

Wrapped SOL