Liquidity Drought Impact on Crypto Markets Explained

Liquidity Drought conditions are shaping the current state of crypto markets, according to macro investor Raoul Pal, who believes the recent downturn is driven by global liquidity pressures rather than problems specific to digital assets. As prices across the crypto sector declined sharply, many investors questioned whether internal weaknesses were to blame. Pal argues the opposite, stating that macroeconomic forces and tightening liquidity are the real drivers behind the market pullback.

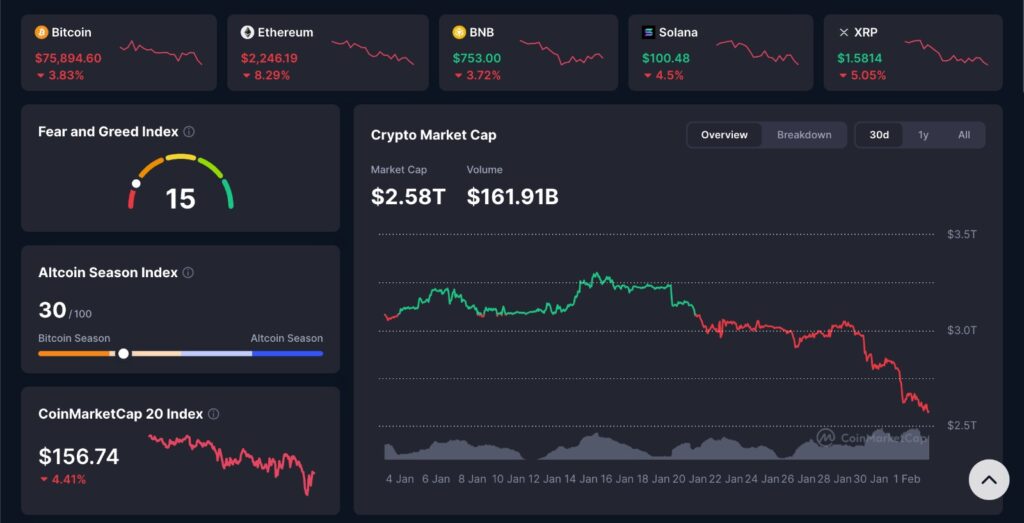

Viewed over the past month, the market cap chart highlights how quickly sentiment can shift when liquidity tightens. The decline is not marked by sharp capitulation spikes, but by a steady loss of upward momentum, suggesting reduced participation rather than panic selling. This kind of price action often reflects investors stepping aside and waiting, rather than actively exiting positions. In that context, the chart captures hesitation more than fear, showing how thin liquidity can quietly pressure valuations even in the absence of dramatic news.

Liquidity Drought and the Recent Crypto Decline

Over a short period, the crypto market lost hundreds of billions in total value, triggering fear and uncertainty among investors. While such moves often lead to speculation about industry-specific failures, Pal stresses that the selloff aligns closely with broader risk asset behavior. In his view, the Liquidity Drought affecting global markets has reduced available capital, forcing investors to pull back from higher-risk investments, including cryptocurrencies.

Bitcoin, in particular, has shown a strong correlation with other long-duration assets, such as technology and software stocks. These assets tend to suffer when liquidity tightens because they rely on future growth expectations. When access to capital shrinks, valuations across these sectors fall together, reinforcing the idea that crypto is responding to macro conditions rather than internal stress.

Asset Correlations During a Liquidity Drought

Pal highlights how Bitcoin has moved in sync with assets like SaaS stocks, which are highly sensitive to interest rates and liquidity. This correlation suggests that crypto is behaving as a macro asset rather than a niche market. When liquidity dries up, investors reduce exposure to assets perceived as riskier, leading to widespread declines across correlated markets.

Another factor contributing to this environment is the strength of gold. As investors sought safety, gold absorbed a significant share of available liquidity. This shift left less capital flowing into speculative assets, including cryptocurrencies, reinforcing the downward pressure caused by the Liquidity Drought.

U.S. Liquidity Conditions Behind the Pressure

According to Pal, the United States plays a central role in the current liquidity environment. Temporary government shutdowns and disruptions in Treasury cash management have contributed to reduced liquidity across financial markets. A key issue is the decline of the Federal Reserve’s reverse repo facility, which previously acted as a buffer by absorbing excess cash.

When the U.S. Treasury rebuilds its general account, liquidity is normally offset by funds leaving the reverse repo facility. However, with reverse repo balances largely depleted, Treasury actions now remove liquidity directly from the system. This creates a more pronounced Liquidity Drought, amplifying volatility in risk assets like crypto.

Why This Matters for Crypto Investors

Pal emphasizes that the current conditions are temporary rather than structural. He believes crypto fundamentals remain intact and that the market is reacting to short-term liquidity constraints. From this perspective, the downturn is not a sign of long-term weakness but a reflection of macroeconomic cycles.

He also points out that liquidity conditions tend to shift quickly once fiscal and monetary pressures ease. If liquidity begins flowing back into the system, risk assets could stabilize and recover. Pal maintains a positive long-term outlook, particularly looking toward 2026, when he expects liquidity dynamics to improve.

Editor’s View: Liquidity Drought and Investor Behavior

One aspect often missed during a Liquidity Drought is how investor behavior changes before prices fully reflect macro conditions. When liquidity tightens, participants do not just sell because of fundamentals, but because uncertainty reduces their willingness to hold volatility. Even long-term investors become more defensive, preferring clarity over conviction. This creates price moves that feel abrupt, not because information changed suddenly, but because risk tolerance quietly eroded over time.

Liquidity Drought Versus Monetary Policy Narratives

Some market participants have attributed the selloff to expectations of tighter monetary policy or changes in Federal Reserve leadership. The belief is that reduced rate cuts or slower easing could negatively impact risk assets. Pal disagrees with this explanation, arguing that policy narratives alone do not account for the magnitude of the market move.

Instead, he believes that central banks will ultimately revert to easing strategies once economic conditions demand it. In this scenario, liquidity, not rhetoric, becomes the dominant force driving asset prices. The Liquidity Drought, therefore, reflects a temporary mismatch in cash flows rather than a long-term shift in policy direction.

Banks and Future Liquidity Flow

Pal also suggests that banks will increasingly play a role in distributing liquidity as conditions normalize. Rather than relying solely on central bank tools, financial institutions may help restore liquidity through lending and market activity. This transition could gradually support risk assets, including crypto, once current pressures subside.

Looking Beyond the Liquidity Drought

Despite near-term volatility, Pal remains confident that the worst of the liquidity contraction may already be passing. With clearer visibility into government financing needs and monetary responses, markets may begin adjusting to a more stable environment. While price fluctuations are likely to continue, the broader trend could shift as liquidity constraints ease.

For crypto investors, understanding the Liquidity Drought framework offers valuable context. Rather than reacting to fear-driven narratives, recognizing the role of macro liquidity can help investors make more informed decisions. According to Pal, crypto is not broken. It is simply navigating the same liquidity cycle affecting all major risk assets.

As liquidity eventually returns, crypto markets may regain momentum, reinforcing the idea that macro forces, not internal failures, are shaping the current landscape.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe