MegaETH Refund Decision After Pre-deposit Chaos

MegaETH Refund became the center of attention after the project unexpectedly announced it would return the entire 500 million dollars collected during its troubled pre-deposit campaign. The decision came after a series of operational mistakes, communication failures, and community backlash that unfolded within hours of the campaign’s launch. The team ultimately admitted the rollout was mishandled and committed to issuing full refunds through a newly audited smart contract.

How the MegaETH Refund situation began

A pre-deposit campaign that spiraled out of control

The campaign was launched with the intention of allowing early users to preload collateral that would later convert 1:1 into the project’s stablecoin once the mainnet went live. The idea seemed simple, but the execution proved problematic. The original deposit cap was set at 250 million dollars, and this cap was filled in just over two minutes. Many users claimed they had no chance to participate before the limit closed.

As the rush intensified, the project’s website stalled and eventually went down. The platform remained inaccessible for roughly an hour as backend systems struggled under unexpected traffic levels. During this time, users were left confused, frustrated, and unsure whether their transactions had succeeded or failed.

A critical multisig mistake

One of the most damaging errors occurred behind the scenes. The team intended to configure their multisig wallet using a three-of-four signature requirement. Instead, they accidentally configured it as a four-of-four setup. This meant that any individual with the right access could execute the contract if all signatures were automatically available.

A user eventually discovered this misconfiguration and was able to trigger the execution earlier than planned. The premature execution occurred approximately half an hour before the intended time, which caused even more confusion and led the team to scramble in response.

Constant changes made the confusion worse

As the situation unfolded, the project team repeatedly changed the deposit cap. The limit was raised to one billion dollars, then lowered to four hundred million, and later adjusted again to five hundred million. Each adjustment caused more uncertainty, especially for users who were trying to understand whether their deposits were accepted or rejected. By the end of the chaotic period, around 500 million dollars had been locked into the contract.

Community distrust grew quickly

Many participants called the rollout disorganized, unprofessional, and unfair to retail users. Some described the event as a “clown show,” while others argued that the enormous demand showed strong interest in the project despite the obvious problems. Overall, community sentiment leaned negative, pushing the team to reconsider their approach.

Why the MegaETH Refund was announced

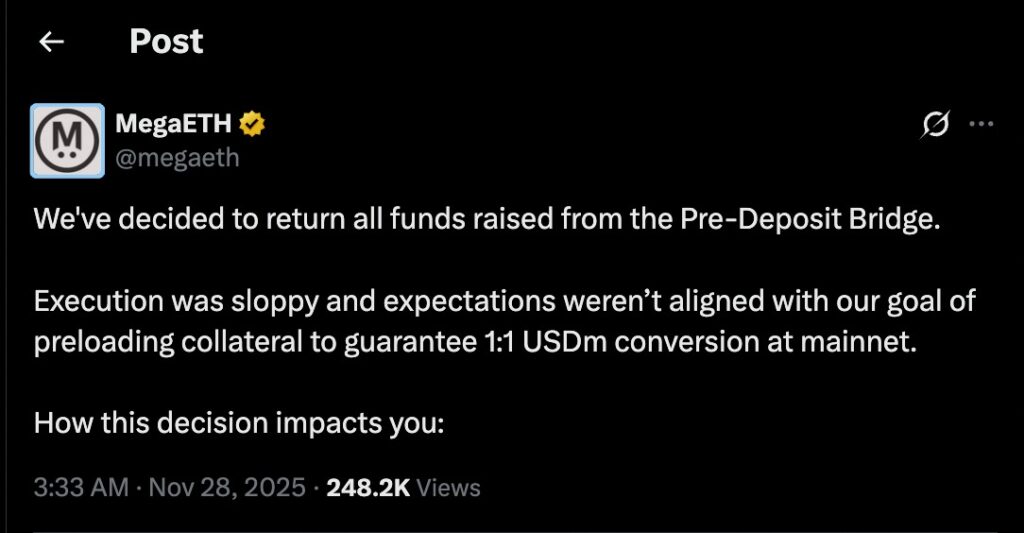

The announcement above marks the moment MegaETH publicly confirmed the decision to reverse the entire pre-deposit process. In the message, the team openly admitted that the execution of the campaign was mishandled and that expectations were not aligned with the intended goal of ensuring a smooth path to a 1:1 USDm conversion at mainnet. This direct acknowledgment set the tone for the refund plan and signaled a shift toward greater transparency after the chaotic rollout.

Compliance and legal risks became apparent

One of the most important reasons behind the refund decision was compliance. The team acknowledged that all future communication must follow strict compliance requirements, which suggests that the chaotic campaign may have raised regulatory concerns. Issues such as unclear disclosures, shifting deposit limits, and a poorly structured pre-deposit system could potentially draw regulatory attention, especially in a heavily scrutinized environment.

By choosing to refund all deposits and reset the entire process, the team appears to be taking a protective approach. Returning funds eliminates the risk of users claiming losses or arguing that they were misled. The team also avoids the appearance of conducting a non-compliant fundraising campaign.

Acknowledgment of operational failures

In a public message, the team admitted that the execution of the pre-deposit was sloppy and did not align with their intention of ensuring a smooth path toward the stablecoin launch. Publicly acknowledging such a large mistake is uncommon, but it demonstrates the severity of the errors and the team’s willingness to confront the issue.

Attempts to restore trust

The refund announcement also emphasized that contributions would not be forgotten. This suggests the project may reward early supporters later, even though the current deposits will be fully returned. The team stated that refunds would be processed through a new smart contract, which is currently undergoing an audit to ensure user safety.

What happens next for depositors and the project

The refund procedure

Once the new contract audit is complete, the refund process will begin. Users should receive their full deposits without deductions. This is intended to repair the damage caused during the campaign and prevent further fallout.

Mainnet timeline still uncertain

The original plan was to launch the project’s mainnet in December. While the team continues to aim for this target, uncertainty remains. Many community members question whether the group is ready to handle a full-scale launch after such significant operational missteps.

Rebuilding trust will take time

The chaotic rollout exposed serious gaps in internal processes, communication, and technical readiness. While issuing refunds is a positive step, it does not erase user concerns. Trust in crypto projects is delicate, and major errors like a misconfigured multisig raise serious questions about overall reliability and security.

Broader lessons from the MegaETH Refund event

Rushed launches are risky

The rapid failure of the pre-deposit campaign highlights how damaging rushed or poorly coordinated launches can be. Even strong demand cannot compensate for technical errors, system overloads, or unclear communication. Blockchain projects, especially those handling large sums, must prioritize stability, testing, and transparency.

Compliance matters more than ever

The reference to compliance in the team’s statement suggests that regulatory considerations played a large role in the refund decision. Crypto teams must navigate increasingly strict expectations around communication, user protection, and fundraising practices. The MegaETH refund could serve as a warning that even well-intentioned campaigns can face legal scrutiny if they are poorly executed.

Accountability can help, even when mistakes are large

By admitting mistakes, initiating refunds, and committing to audited processes, the team showed a level of accountability that is not always present in the industry. While this may not fully restore trust, it sets a constructive example for other projects facing similar issues.

Conclusion

MegaETH Refund became a defining moment for the project, showing how quickly a promising initiative can be derailed by execution errors. The refund of all 500 million dollars represents a complete reset meant to protect users and rebuild credibility. Whether the project succeeds from here will depend on its ability to learn from these mistakes, improve internal procedures, and regain trust from a shaken community.

Keep yourself updated with the latest crypto news with FYI Gazette

Read more about Memecoins with FYI Gazette

Keep yourself updated with the latest Altcoin News with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe