MegaETH token sale oversubscribed 8.9x with $450M committed

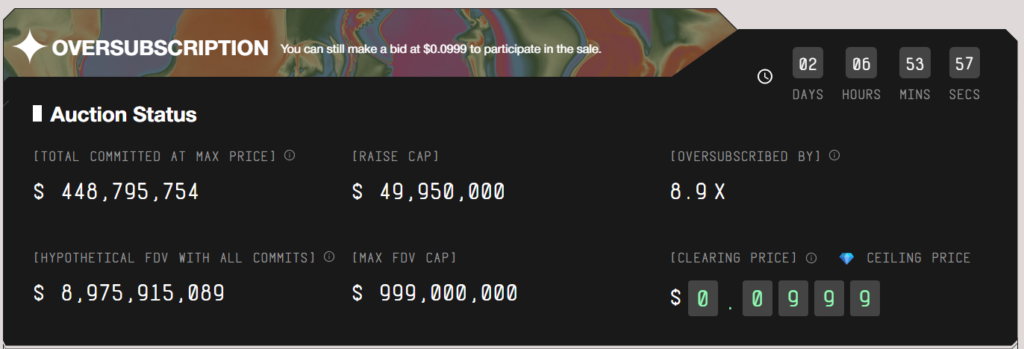

MegaETH token sale reached unprecedented levels of investor interest, becoming one of the most successful public offerings in the crypto space this year. The Ethereum layer 2 project’s token sale was oversubscribed by around 8.9 times, with total commitments exceeding $450 million. The event highlights the growing enthusiasm for blockchain scaling solutions and demonstrates the market’s appetite for Ethereum infrastructure.

MegaETH opened its token auction on Monday and has been oversubscribed by about $400 million from its cap. Source: MegaETH

Overview of the MegaETH token sale

The MegaETH token sale was designed to raise approximately $50 million but quickly exceeded all expectations. Within hours of launching, the public sale had received nearly nine times that amount in commitments. According to the project, the sale attracted a diverse group of investors from around the world, all eager to participate in the next stage of Ethereum’s evolution. The sheer demand forced the team to adjust its allocation plan and implement a special mechanism to ensure fair distribution among participants.

In total, MegaETH has a token supply of 10 billion MEGA tokens. Around 5 percent of this supply was made available through the public sale. Participants could contribute between roughly $2,650 and $186,000 each, depending on their verification status. To encourage long-term participation, buyers who agreed to a one-year lock-up received a 10 percent discount on token pricing. Because of the overwhelming demand, the team announced that allocations would not be processed on a first-come, first-served basis. Instead, the “special allocation mechanism” would consider user activity and lock-up preferences to ensure broader participation.

Why the MegaETH token sale drew such attention:

Growing demand for Ethereum scalability

The MegaETH token sale underscored how much interest currently exists in Ethereum scaling technologies. As the Ethereum mainnet continues to experience congestion and high transaction fees, developers and users are turning to layer 2 solutions that can offer higher speed and lower costs. MegaETH positions itself as an advanced Ethereum-compatible layer 2 network aimed at delivering significant performance improvements without compromising security. This focus on high throughput and reliability has made it especially appealing to investors seeking exposure to Ethereum’s expanding ecosystem.

Transparent and accessible sale structure

One factor contributing to the success of the MegaETH token sale was its transparent structure. Many previous token launches have been criticized for favoring institutional investors or private allocations, leaving little room for community participation. MegaETH’s team, however, opened its sale to the public while maintaining strict verification and contribution limits. This approach gave retail investors an opportunity to participate and created a perception of fairness and openness that helped fuel confidence and enthusiasm.

Community-centered approach

The team behind MegaETH emphasized that the project was built for the Ethereum community and designed to support long-term growth. Its decision to include lock-up incentives and an engagement-based allocation system reinforced the image of a community-first project. By rewarding participation rather than pure speed or size of investment, the sale gained credibility and built goodwill among early adopters. This inclusive philosophy likely contributed to the wave of support seen during the sale’s brief window.

Investor enthusiasm and its implications

The success of the MegaETH token sale demonstrates the continuing appetite for blockchain infrastructure projects with strong narratives around scalability and utility. It also signals that investor sentiment toward real, technology-focused projects remains strong, even in a cautious market environment. Raising over $450 million in commitments shows that substantial liquidity is still available for credible initiatives that address Ethereum’s bottlenecks.

At the same time, the rapid oversubscription also raised questions about the nature of investor demand. Analysts pointed out that the pace of participation suggested a degree of speculative momentum. With hundreds of wallets reportedly placing high bids within hours, some observers wondered whether excitement had outpaced realistic expectations. Despite those concerns, the sale’s completion reaffirmed MegaETH’s prominence in the current generation of Ethereum-based infrastructure projects.

Next steps after the MegaETH token sale

Following the close of the token sale, MegaETH plans to finalize allocations based on its established mechanism. Participants are expected to receive further details from the team about distribution timelines and token availability. Because the sale was so heavily oversubscribed, some participants may receive reduced allocations or refunds, depending on their contribution size and engagement status.

Going forward, MegaETH’s focus will shift toward developing its network, expanding its developer base, and preparing for broader ecosystem adoption. The funds raised will support technical development, network infrastructure, and long-term community initiatives. As an Ethereum layer 2, the project aims to deliver faster transaction speeds, reduced gas fees, and enhanced scalability for decentralized applications.

Lessons from the MegaETH token sale:

Demand for fair participation models

One clear takeaway from the MegaETH token sale is that fairness and transparency matter. The combination of verification steps, contribution limits, and engagement-based allocation made investors feel that the process was equitable. This could set a new standard for how public token sales are conducted in the future.

The balance between excitement and caution

While the outcome of the sale is impressive, it also serves as a reminder that enthusiasm should be balanced with realism. Oversubscription on this scale shows investor confidence, but it also places pressure on the project to deliver on its promises. The real success of MegaETH will depend not on the amount raised, but on whether the network achieves its technical goals and gains sustained adoption.

Broader impact on Ethereum’s ecosystem

The MegaETH token sale reflects the growing ecosystem of Ethereum layer 2 solutions, which now form a central part of the blockchain’s long-term scaling roadmap. Projects like MegaETH are vital to making Ethereum more efficient and accessible for users worldwide. If MegaETH succeeds, it could help reduce congestion, lower transaction costs, and improve user experiences across the network.

Conclusion

The MegaETH token sale stands out as a milestone in 2025’s blockchain fundraising landscape. With an oversubscription rate of 8.9 times and more than $450 million in total commitments, it ranks among the most successful offerings of the year. Its community-focused model, transparent structure, and commitment to fair access resonated with thousands of investors eager to participate in Ethereum’s next chapter. Still, the project’s long-term success will depend on execution and delivery. The excitement surrounding the MegaETH token sale has set high expectations, and the crypto community will be watching closely to see if it lives up to them.

Keep yourself updated with the latest crypto analysis with FYI Gazette

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin  Pepe

Pepe